Remember these words, in the investment world, analytical skills are critical, but risk management is what truly determines survival.

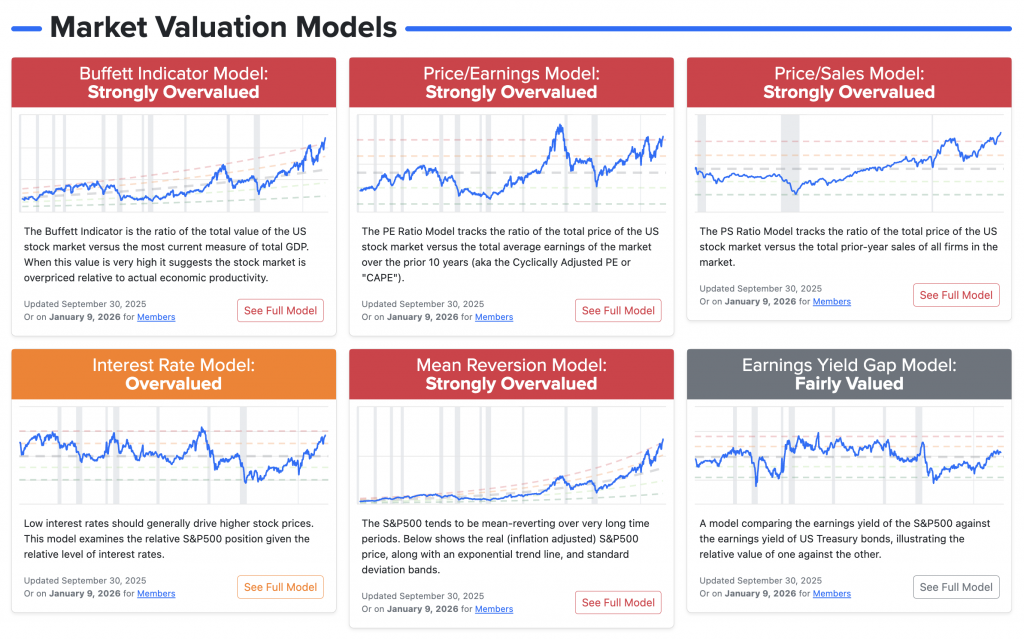

A few months ago, I published an analysis of the market where I exposed my vision at that time, about the euphoria of AI and the excessive leverage of the market, you can read it again here. My thesis was clear, substantiated and in its depth, bearish, yet anyone who understands this world knows perfectly well that the market has a habit of defying the most sophisticated models and remaining irrational longer than one can remain solvent, and that is unless it is adequately hedged (or not).

In this analysis I want to review the macroeconomic thesis that I mentioned in the previous paragraph, where it did not materialize as I expected, why the market held up, and although today, it continues to lurch and the situation intensified, the picture seems to have changed, and more importantly, how I have remained in profit, without fully exposing myself.

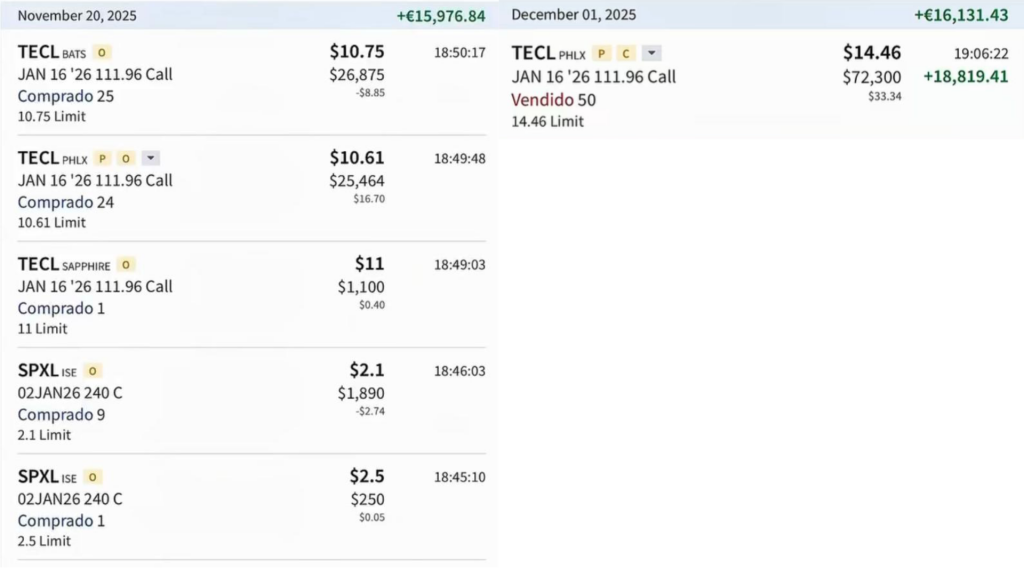

One of the strategies I previously discussed was tactical hedging using leveraged ETFs, such as Direxion Daily Technology Bull 3X Shares ($TECL). This strategy allowed me to generate profits in a scenario that ran counter to the main macro view (my view). As long as the market did not fall to the magnitude I expected, which it ultimately did not, I was able to capture profitability while maintaining controlled risk management and avoiding full exposure.

BASIC THESIS: “THE BROKEN EQUILIBRIUM”.”

In October 2025 I published the article “The broken equilibrium: how AI euphoria and leverage have pushed the market over the edge”. I am not going to discuss it in depth here, as you can read it and build your own opinion on it. Anyway, I am going to discuss its synthesis, because in that analysis I identified several critical patterns that explain the market's behavior at that time:

SYSTEMIC LEVERAGE AND CTAS.

My main concern was not with the discretionary investor, but with price-blind programmatic flows. Quantitative analysts' models indicated that CTAs (Commodity Trading Advisors) and Vol Control Funds were positioned with equity exposure near all-time highs.

I identified an asymmetry, which certainly inspired danger. These funds operate under strict trend-following and target volatility rules. If the S&P 500 had convincingly broken the 50-day moving average (DMA50) or key support levels (such as 5,700 at the time), the algorithms would have triggered automatic sell orders («sell stops») estimated in the range of $30,000-50,000M in a week. This mechanical flow of forced selling had the potential to create a negative feedback loop, where selling generates volatility, and volatility forces risk parity funds to deleverage further, regardless of fundamentals.

GAMMA NEGATIVE

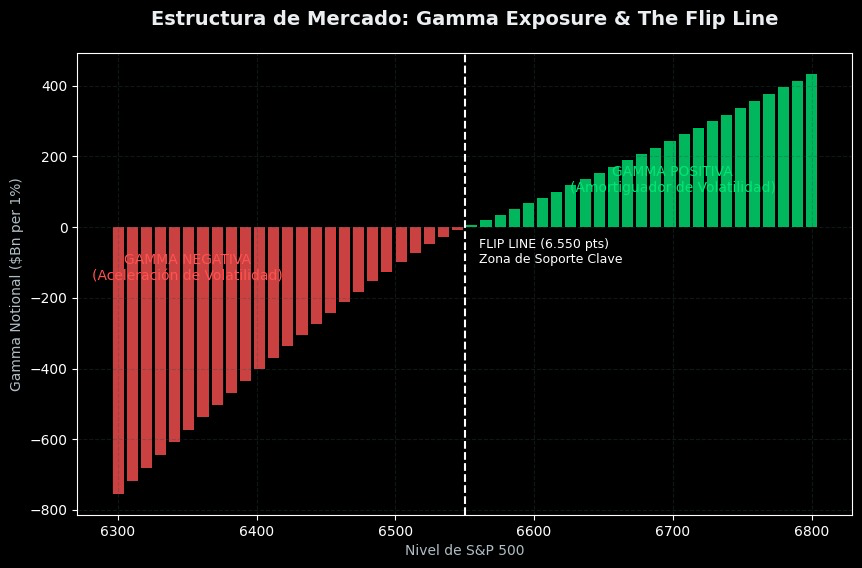

The structure of the options market showed clear technical fragility. Market makers had entered Negative Gamma territory.

In this situation, in a Positive Gamma regime, market makers act as volatility dampers, buying as the market falls and selling as it rises to maintain their neutral delta. However, as the «Flip Line» (or Zero Gamma level) is crossed downward, the dynamic reverses and becomes opposite, market makers are forced to sell positions as the market falls to cover the rising delta of the puts they have sold, with the objective of hedging their positions so as not to be exposed to market directionality. This creates a liquidity gap in the bid and acts as an accelerant of the declines. I calculated that, for every 1% of additional downside, market makers would have to unload billions in notional delta, amplifying any initial correction initiated by fundamentals.

POLITICAL CATALYST: TARIFF RHETORIC AND THE USD

Beyond the technical structure, the macro environment was threatened by a relevant political catalyst, Trump's explicit threat to impose 100% tariffs on nations seeking to “de-dollarize” (BRICS bloc).

From an asset allocation perspective, this introduced a clear and immediate risk of stagflation. Tariffs of that caliber act not just as a consumption tax, but as a supply shock, with the capacity to strengthen the DXY (dollar index), drain global dollar liquidity and put pressure on both emerging markets and S&P 500 multinationals with high international revenue exposure.

The market began to discount a “trade war 2.0” scenario that was significantly more aggressive than the one experienced in 2018, which justified a significant widening of the equity risk premium and a defensive rotation that, in its initial phase, seemed to anticipate the start of a larger correction.

WHY DID THE TRANSITION MODEL FAIL?

My analysis pointed to an impending “regime transition”. The move from an environment of low volatility and moderate correlations to one of expansive volatility and correlation close to one, in which assets tend to fall equally. Even so, the market's evolution certainly invalidated that signal. The error lay not in the input data, but in the weighting of the forces in the opposite direction. I simply underestimated the magnitude of three structural pillars that acted as a real check dam:

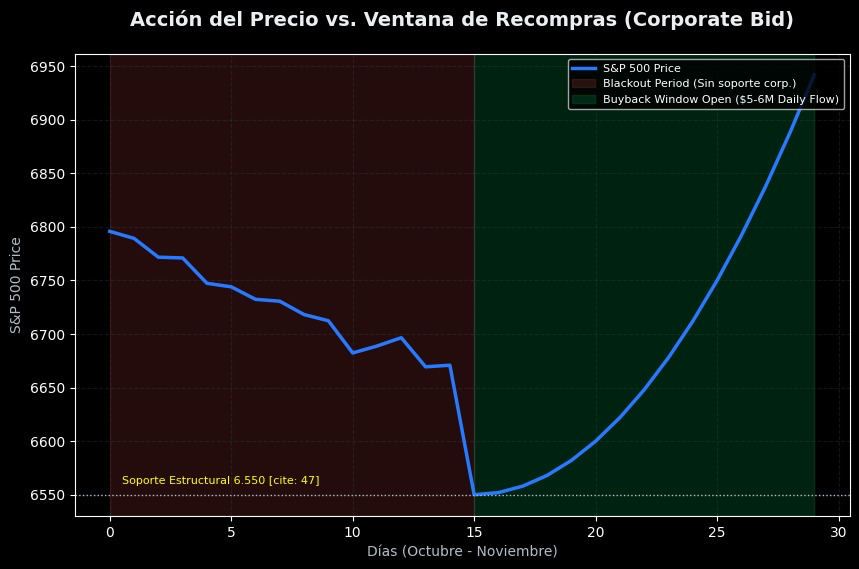

CORPORATE BID RESILIENCE AND VOLATILITY SUPPRESSION

While I waited for my analysis to take place, I ignored the fact that the largest marginal buyer in the market is not price sensitive, which is the corporations themselves.

The end of the earnings blackout period coincided with key technical levels, reactivating the S&P 500 share buyback tables. This flow, mainly estimated at around $$5-6M per day, acted as a real structural floor under the market.

On top of that, the short volatility complex, funds that systematically sell volatility to generate yield, simply did not capitulate. On the contrary, it took advantage of VIX rallies to sell options aggressively, compressing implied volatility and forcing the market into a regime of artificial calm.

THE IA AS A MACRO DECOUPLING FACTOR (THE SECULAR SHIELD)

My macroeconomic analysis was bearish for the general economy (cycle), but the market decided that Artificial Intelligence is not a cyclical trade, but a secular one.

There was a bifurcation of flows, where money flowed out of rate-sensitive sectors or traditional economic growth, but did not go into liquidity, but instead rotated violently into technology and semiconductors.

The narrative is that CAPEX in AI is existential for Big Tech and will continue regardless of whether there is a recession or not. This belief created inelastic demand in the index's most heavily weighted components, masking the weakness of the «market average» (breadth).

TECHNICAL REBOUND FROM 6,550 AND THE RETURN OF POSITIVE GAMMA

The 6,550 level was not only a psychological support, it was literally the trench where the flow war was decided. By holding that level, the cascade of liquidations by the CTAs that the market feared was avoided.

Still, the most important thing happened in the derivatives market. As the price rebounded from that floor, the flows associated with Vanna and Charm, the combined effect of the temporary decay and changes in implied volatility, forced market makers to buy back short hedges. This triggered a circle, where the recovery in prices progressively returned market makers to a Positive Gamma regime.

Instead of amplifying the bearish moves, they resumed their role as market stabilizers, selling the upside and buying the downside. The result was a compression of the daily range and a systematic destruction of volatility, just the ingredient that the bearish thesis needed to develop.

THE STRATEGY: RIGHT TAIL HEDGING

“Being right” is secondary to “making money”. Even with a bearish conviction, risk management requires contemplating alternative scenarios.

If the market did not correct, it implied that the AI narrative remained fully operational and that leadership would continue to focus on technology. Holding an overly defensive or net short portfolio in that context would have been capital inefficient.

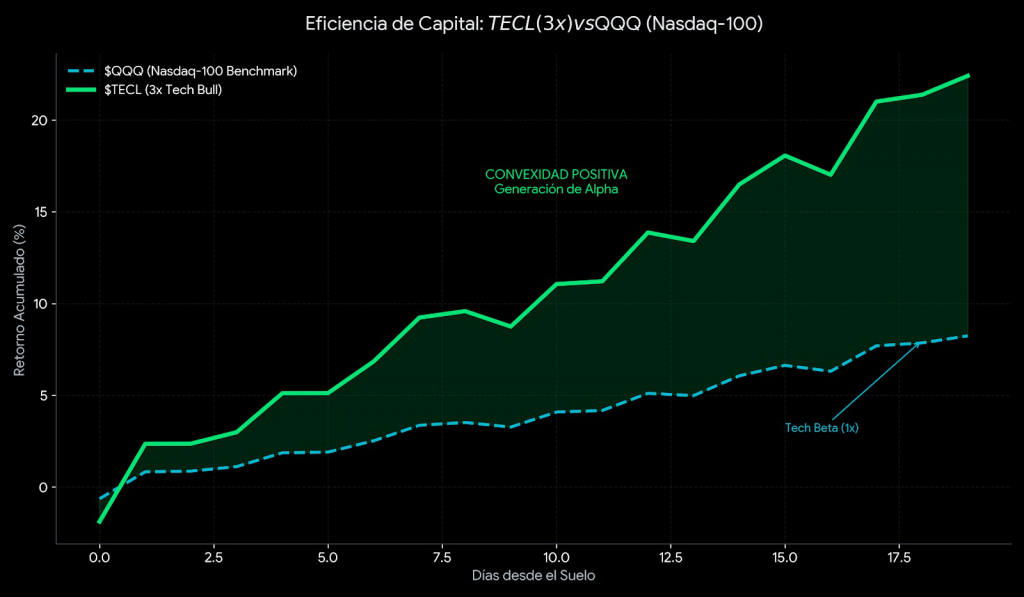

To preserve asymmetry and tactical flexibility, I implemented a positive convexity hedge using a 3x leveraged ETF on the technology sector ($TECL), which allowed participation in a scenario adverse to the main thesis without compromising the overall structure of the portfolio. Its leveraged nature meant that the cost of exposure was much lower, thus optimizing capital efficiency, thereby maximizing the maximum loss.

The strategy itself is not new, I have used it at other times and it is a recurring part of my operational framework. You can see how it works in detail in the article: “Hedging with Options on Indexed and Leveraged ETFs against Short Futures Positioning Strategy”, where I explain the logic, the objectives and their practical application.

Why TECL: The Efficiency of Capital

The primary choice of a 3x leveraged instrument was not merely speculative, but strictly mathematical.

While waiting for a correction that did not materialize, the main risk was the opportunity cost of staying out of the market. Maintaining an excessively defensive exposure meant giving up a significant part of the potential return if the market continued to rise. For this reason, I needed an instrument that, in a bullish scenario, would generate a convex and significant response with a reduced use of capital.

The use of a 3x leveraged position allowed me to allocate a limited percentage of NAV to this hedge, where two clear scenarios existed:

- Scenario 1: Market Correction.

In this case, losses in $TECL were limited and, simultaneously, better entry points were generated for the portfolio's structural positions. - Scenario 2: Bullish continuation.

If the market continued to rise, $TECL amplified the move, allowing me to capture significantly higher returns while the rest of the portfolio also appreciated.

This asymmetry made it possible to hedge the opportunity cost risk and directional deviation risk with a superior capital efficiency to the direct purchase of call options, also avoiding the negative impact of theta decay in a sideways market environment.

The result: Profit in contradiction

The market did not break. Technology once again led flows. While some of the bearish market positioning was forced to reduce exposure, the position in $TECL was no longer a hedge but a net alpha generator.

The leveraged exposure I was in allowed me to capture the intensity of the rebound with a multiplier of three, generating a positive flow that not only offset the opportunity cost, but added incremental profitability to my portfolio. The key was not to correctly anticipate every move in the market, but to building a portfolio structure capable of monetizing divergent scenarios without compromising my overall risk profile.