It is important to mention how all this happens, its origin and motive, in order to be able to clearly determine what is going on. Otherwise, all of the following are mere speculations and the difference between a sane person and a paranoid becomes very narrow.

Government shutdown in the United States

A U.S. government shutdown occurs when Congress and the White House fail to pass federal budgets and a stopgap funding resolution on time. This is precisely what happened last night, as the deadline expired without agreement. The trigger was the lack of consensus between Republicans and Democrats on spending items and budget prioritieswhich blocked approval in both houses of Congress.

In this scenario, a significant portion of the public administration is left without operating resourcesand only the essential servicesnational security, air traffic control and debt service.

For the financial marketsthe most relevant aspect is the suspension of the publication of key macroeconomic indicators (GDP, inflation, employment, trade balance). The absence of these references increases the uncertainty in the formation of expectations and makes the job of the Federal Reserve and institutional investors more difficult by forcing them to operate with less visibility on the economic cycle.

Closure also implies that hundreds of thousands of federal employees furloughed without pay (furloughs), while others must continue to work without pay until funding is approved. In the 2018-2019 shutdown, the longest in history, over 800,000 federal workers were affected.

From a macroeconomic point of view, a shutdown generates a one-off contraction in private consumption and a transient slowdown in activityThe impact on GDP is limited, however, given that the U.S. economy is highly leveraged to the U.S. economy, which is highly leveraged to the U.S. economy. However, the aggregate impact on GDP is limited, given that the U.S. economy is highly leveraged on the private sector dynamismin the corporate profitability and the profit-generating capacity of its businessesThe country's real engine of structural growth is the United States, which is the country's real engine of structural growth.

As I explain, Diego García del RíoIn the case of the latter, these types of episodes generate more noise in the market than long-term effects.

Below is a table with the main macroeconomic data whose publication will remain suspended until the government shutdown is lifted.

| Suspended (Not Published) | Still Being Issued (Yes Available) |

|---|---|

| Claims for unemployment benefits (Labor Dept.) | ADP Employment Report |

| Nonfarm payroll (BLS) | S&P Global and ISM indices |

| Consumer Price Index (CPI) and Producer Price Index (PPI) - BLS | MBA mortgage applications |

| Retail sales, factory orders, housing starts, trade data (Census/BEA) | Challenger layoff report |

| Employment Trends Index (Conference Board) | Redbook retail sales |

| GDP data (BEA) | NFIB optimism index |

| New home sales and building permits (Census Bureau) | Federal Reserve Reports (Consumer Credit, Industrial Production, FOMC Minutes) |

| Export and import data (Census/Commerce) | Some Treasury reports (e.g. Monthly Budget Statement, TIC flows, as available) |

Historical Background and Reaction on Wall Street

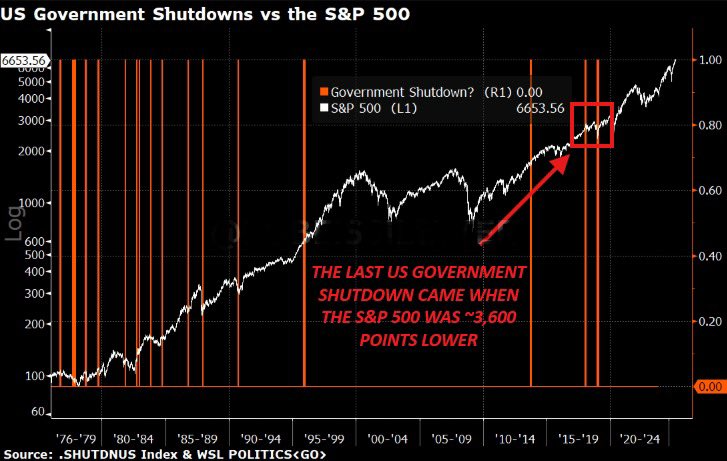

This is not the first time it has happened in the United States and, in all likelihood, it will not be the last. Government shutdowns are not a novelty and its impact on the markets has been heterogeneous. In many cases, they should be analyzed with caution, as they coincided with other more significant events that had a more direct influence on market dynamics.

In 1995-1996, under the presidency of Bill Clintontwo closures occurred, the longest being of 21 daysThe President is in a confrontation with the Republicans over public spending. The S&P 500 ended the period with a slight increase of 0.1%.

In 2013, with Barack Obamathe Obamacare funding stalemate lasted for 16 days. In the previous days, the S&P 500 fell by around -4%but during the closing he managed to recover a +3% in a short time.

The longest closure in history was under Donald Trumpbetween 2018 and 2019, and was prolonged to 35 days over the border wall funding dispute. The S&P 500 advanced a solid +11%, although more influenced by the rebound following the December 2018 decline than the close itself.

The conclusion, like me, Diego García del RíoI see it, it is clear: The closings have not led to severe or prolonged declines, and the market has tended to quickly regain lost ground..

Estimated Wall Street Impact Scenarios

The analysis projects different effects of a government shutdown depending on its duration:

Short closure (< 2 weeks): most likely scenario. It would involve a moderate drop of 1-3% on the markets and a increase of the VIX by 2-4 points. The impact would be limited and reversible in the short term.

Medium closure (3-4 weeks): could lead to decreases in 3-6% on the S&P 500 and an increase of 5-8 points on the VIX. The main risk in this case is the delay in the release of key macroeconomic data (GDP, inflation and employment), which would add noise to the Fed's decisions and increase uncertainty in the markets.

Long closure (> 4 weeks): less likely scenario. An estimated drop of the 7-12% on the marketsa VIX rallied more than 10 points and additional risks: deterioration in economic growth, decline in consumer confidence and even a possible sovereign credit rating downgrade.

In the latter scenario, the closing would coincide with the Federal Reserve monetary policy decision scheduled for October. This could lead the Fed to consider the shutdown as an additional factor in its interest rate decision. Currently, the market is discounting with more than 80% of probability of a 25 basis point decline in Octoberwith expectations of at least an additional decrease for the remainder of the year.

The next meeting of the Federal Reserve is effectively within 4 weeks. With this "data freeze"the Fed misses critical benchmarks such as employment, inflation and GDPwhich tends to make her more cautious and dovish on average during past shutdowns, relying more heavily on private indicators and in market signals.

As I discuss in my reports, these types of scenarios require distinguishing between short-term noise and background dynamics.

What History Says: Fast Falls, Strong Recoveries

Although a government shutdown seems alarming, and extreme scenarios reinforce this, the history shows a consistent pattern. The historic average duration of a closure is just 8 daysand in the 86% of the cases the S&P 500 was higher 12 months laterwith an average gain of +12,7%.

In the short term, the volatility tends to increaseThe market has always recovered to its previous levels since 1995. By now, investors are already discounting this pattern: the gold accumulates +45% in 2025the highest ever, setting record highs almost every week. dollar experiences its worst performance since 1973and short positions on the VIX are at their highest levels since 2022, implying that any spike in volatility could trigger a massive short squeeze.

It should be noted that a government shutdown does not alter underlying trend. Reviewing historical experience, the accumulation of speculative positions against volatility does make the system more fragile in the short term. A unexpected major event -whether it is a geopolitical escalation, an unfavorable macro data (we will not be able to know it because of the current situation) or the delay in the official statistics- could act as a trigger and amplify market movements beyond what the fundamentals would justify.

Where We Are: The Current Perspective

In the middle of government shutdown and with the start of October 2025investors as well as the market remain focused on the Federal Reserve meeting on October 29where a high probability of a lowering of interest rates. The situation adds short-term uncertaintybut it should not alter the underlying trendsince the The U.S. economy has always depended on the performance and profits of private companies.rather than the public sector.

As an analyst, I, Diego García del RíoI believe that this episode should be interpreted as more of a transient market noise than as a structural change. The key will continue to be in the corporate earningsin the evolution of the Fed monetary policy and in the private sector resilience as the main driver of the U.S. economy.