During the last few sessions, the main indices have shown signs of exhaustion in upper tranches, accompanied by a progressive contraction of institutional momentum and a rebound in short-term implied volatility levels. In this context, the price structure of the S&P 500 and of the Nasdaq 100 reflects a contained distribution phase, with accumulated technical divergences and an increase in the volume of puts purchased in the very short (7 DTE), medium (60 DTE) and long term (776 DTE).

In this situation, and maintaining the rest of the strategies that I currently maintain, I perform a tactical entry through call options on the SPXS (Direxion Daily S&P 500 Bear 3X Shares) leveraged inverse ETF..

The objective is to capture a corrective move of the S&P 500 using the inherent convexity of the product, which replicates with multiplier x3 the daily movements of the index.

Position structure

The position is a Long Call strategy where we are directly exposed to an increase in the value of the leveraged short index on the SPX:

- Underlying: SPXS (Direxion Daily S&P 500 Bear 3X Shares)

- Contract: Call 40 - Expiration January 16, 2026

- Directionality: Bullish on SPXS → Implied bearish on S&P 500

- Time horizon: 76 DTE

- Operationally rational: Controlled exposure to the risk of a prolonged correction, with the potential for exponential appreciation in the face of declines in the underlying index.

The choice of a Call 40 with ~76 days to maturity allows to capture an eventual corrective movement of the S&P 500 without assuming the daily erosion inherent to the leveraged ETF, while benefiting from a delta-adjusted elasticity greater than 0.40, This amplifies the positive sensitivity of the premium to increases in implied volatility and declines in the index.

Context and justification of the operation: Why this Short Operation?

To take into account my decision to open a short position against the market, one must review the market situation, structural factors that, taken together, reflect a progressive deterioration in credit conditions and a loss of traction on the catalysts that had sustained the final leg of the rally.

All of the above is in addition to a long list of signs that reinforcing the scenario of a correction in equities.

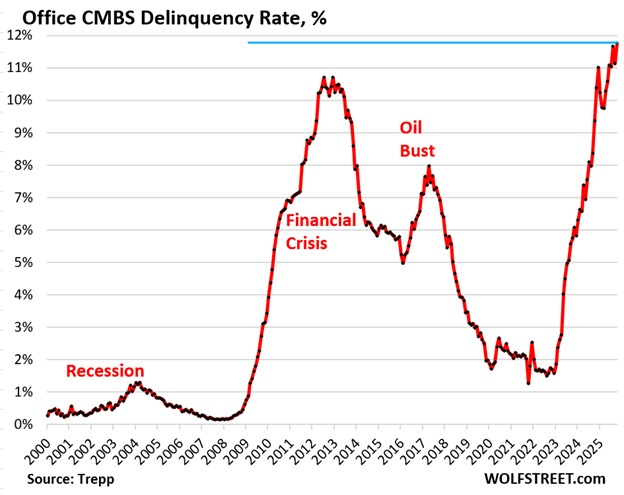

The starting point is in the U.S. commercial real estate market, where the delinquency rate on commercial mortgage-backed securities (CMBS) has returned to levels not seen since the 2008 crisis. In October, delinquencies on office CMBS increased 63 basis points, up to a record of 11,80%, exceeding the peak of 10.70% recorded after the Great Financial Crisis. As of October 2022, the cumulative increase amounts to 10 percentage points, The escalation illustrates the fragility of the sector.

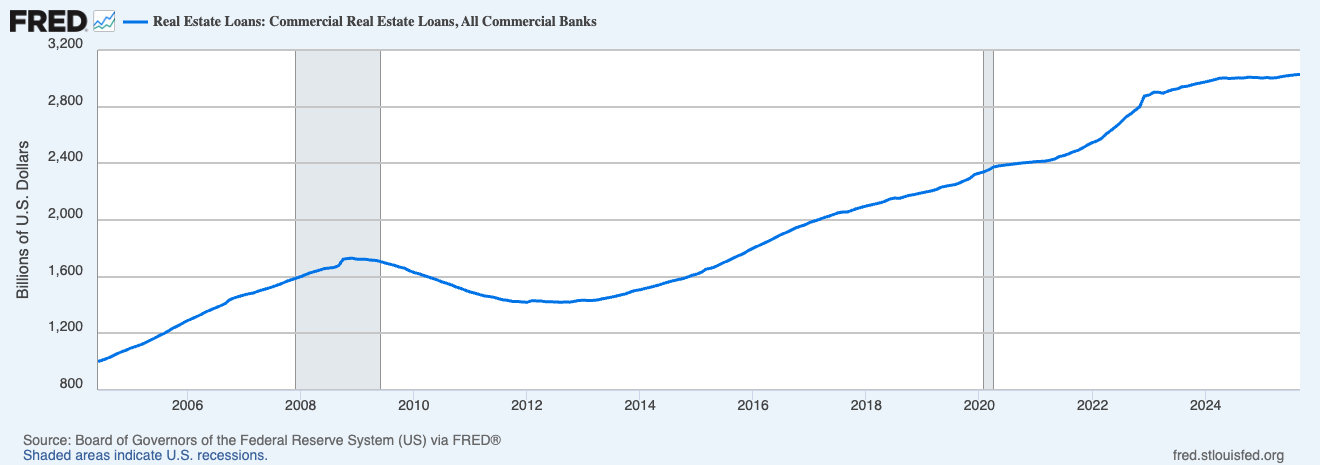

The tension is not limited to the office segment, the Multifamily CMBS also rebounded 53 basis pointsreaching a 7.10%, the highest level since 2015, while the general delinquency of CMBS is already at 7.46%, the most in at least four years. All this is occurring while the commercial banks maintain record exposure to real estate loans, creating a drag risk on its balance sheet if the trend continues or accelerates.

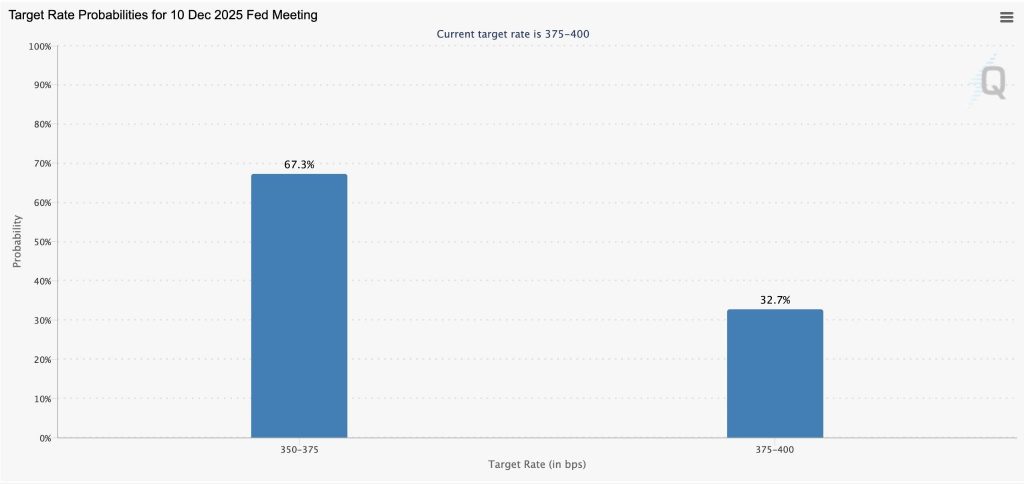

On top of all this, there is the more restrictive message from Jerome Powell, who pointed out that a rate cut in December “is far from a done deal”.”. The change in tone neutralizes part of the easing narrative that had sustained risk assets in recent weeks and reinforces the scenario of high rates for a longer period of time, The real estate credit is showing signs of stress.

On the other hand, Goldman Sachs points out that the hedge funds are balancing their long positions in individual stocks with increasing shorts in indices and ETFs., This behavior confirms the loss of directional conviction in global equities.

According to its latest report, the hedge funds were net buyers of global equities for the second consecutive month (+0.4 standard deviations on a year-over-year basis), driven by sustained purchases in individual values, partially offset by an increase in short sales of macro products.

The individual actions were net purchased for the sixth consecutive month (+0.7 standard deviations), with a proportion 3 to 1 between long and short, concentrated in technology, industrials, materials, and consumer discretionary, while utilities, basic consumption and real estate were the best-selling sectors.

The macro products (indexes and ETFs combined) were net sellers for the fourth consecutive month (-0.3 standard deviations), with a ratio of short 1.3 to 1 vs. purchases. The notional volume of shorts in macro commodities reached highest level in the last year, with a monthly increase of +10.10% in U.S.-listed ETFs., led by short positions in small and large cap equities, as well as in corporate bonds, partially offset by hedges in ETFs of health and technology.

The short positions in ETFs now represent 13.30% of total shorts in U.S. equities (excluding index products), compared to 11,70% in September, standing at 11,70% in September. 96th percentile over the last year and in the 48th percentile of the last five.

This institutional repositioning proposes that the funds have begun to hedge long exposures with systematic index sales., a strategy that often precedes tightening phases in equities when credit conditions deteriorate.

All this, in the environment combines defaults at record highs, inverted curve and reduced monetary support, a triad that historically anticipates correction phases in equities. The deterioration of commercial credit not only affects real estate and regional banking, it also erodes institutional confidence and increases the demand for hedging through the CMBX indexes, where spreads are widening significantly.

The short operation is justified not as a tactical move, but as a defensive position in the face of structural deterioration:

- The Fed maintains tightening bias, which puts pressure on valuation multiples.

- The real estate credit market acts as a vector of systemic risk.

- The CMBS derivative spreads and the rise of the VIX above 22 are signs of incipient stress.

- The hedge funds begin to rotate into macro hedging strategies, balancing long exposures with short exposures in indexes.

- And the risk of financial contagion is amplified as delinquency exceeds the 1 % threshold.

The long positions lose asymmetry and hedging becomes the only rational form of risk management The economic scenario in which rate cuts are no longer an immediate catalyst and the economy is beginning to reflect the consequences of two years of restrictive monetary policy.