On Friday, the latest U.S. employment data were released, with the unemployment rate standing at 4,3%while the non-farm payrolls (NFP) surprised on the downside with just 22,000 jobs createdagainst the 75,000 expected and the 79,000 for the previous month. As Diego García del Río points out, this clearly weak data has reinforced expectations that the Fed may cut rates in the remainder of the year. The next major catalyst will come this Thursday with the inflation data (CPI)a figure close to 2% would virtually guarantee a cut at next week's Fed meeting, something the market has been discounting for weeks.

ANALYSIS OF SPX FINANCIAL OPTIONS ACCORDING TO DIEGO GARCÍA DEL RÍO

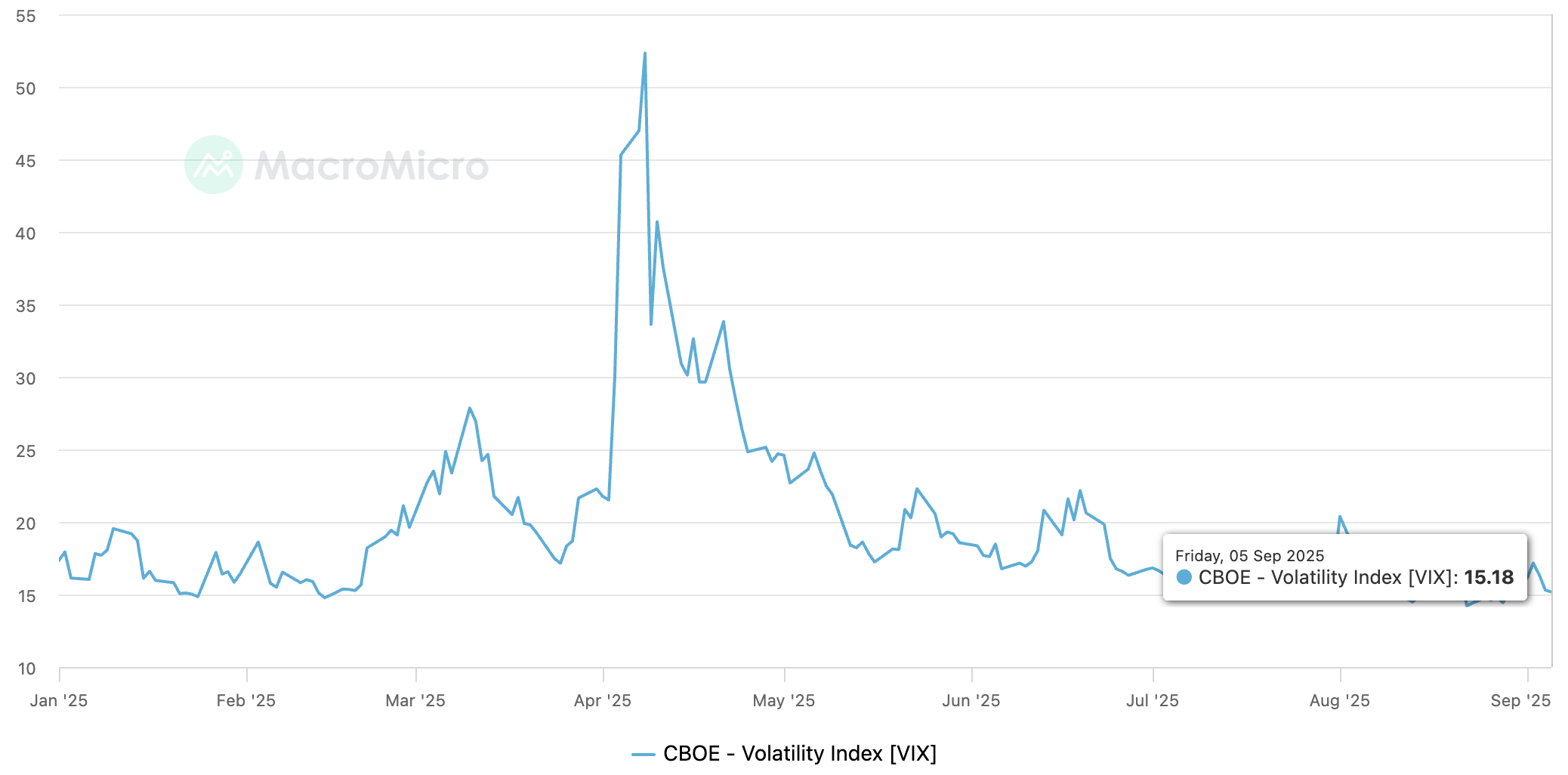

After the main event risks dissipated, the market breathed a sigh of relief. VIX around 15%. Diego García del Río's analysis highlights that this environment has given oxygen to risk assets, even though the risk/benefit balance is perceived as less attractive at these levels. In options, the gamma turns very negative below 6,455 pointswhich amplifies the likelihood of sharp movements if the index pierces that zone. Meanwhile, the implied volatility for the coming week remains at lows: the ATM as of September 19 just above 10%, in front of a realized volatility of 9% in the last month. This differential reflects confidence in stability, although it leaves room for abrupt rallies if an unexpected shock arises.

And the next catalysts are just around the corner. According to Diego García del Río, the focus will be first on the inflation data (CPI)followed by the Fed meeting and of the triple September quarterly maturityan event that usually concentrates strong position adjustments. For a significant correction to occur, with forced sales of systematic funds, a simple one-off spike in the VIX towards 20 would not be enough. A sustained and consistent increase in realized volatility, strong enough to discomfort both volatility sellers and buyers on the dips, would be necessary.

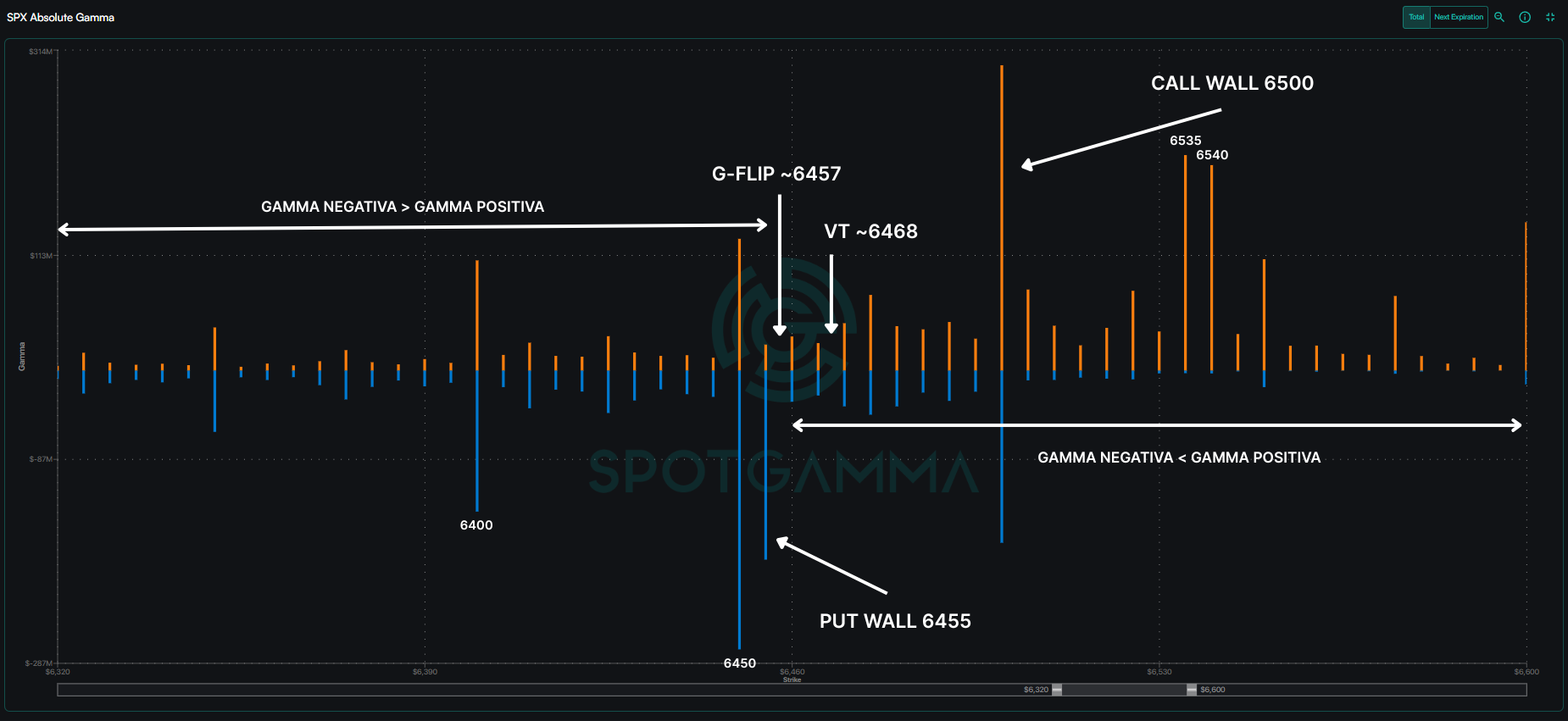

SPX REFERENCE LEVELS ACCORDING TO DIEGO GARCÍA DEL RÍO

According to Diego García del Río, in the short term, the SPX gamma reference levels draw a clear map of supports and resistances that are worth watching in detail.

The G-Flip, located at ~6.457above this level they tend to act as market stabilizers, while below this level their hedges tend to amplify movements, generating sharper swings.

For its part, the Call Wall at 6,500 concentrates the largest volume of open call options and acts as an important institutional resistance, since as the index approaches this level, dealers adjust positions that limit the ability to breakout to the upside.

On the other hand, the Put Wall at 6,455 represents the market's major defensive support; as long as the SPX remains above it, hedge flow helps support prices, but a clear piercing could trigger forced selling and accelerate downward pressure.

In addition to all this, the Volatility Trigger at ~6.468If the index trades above, implied volatility usually compresses and the market gains stability; if it falls below, it opens the door to a volatility spike and faster declines.

Overall, Diego García del Río warns that the range of 6,450 to 6,500 points is configured as a consolidation zone, where option flows keep the market in balance while waiting for a major catalyst that can break the inertia and define the next trend.

Although the market retreated slightly, the volatility remained under pressure in maturitiesThis is a positive sign for equities. Still, with the limited upside potential and compressed volatilityHowever, it is important not to lose sight of the fact that complacency can be quickly reversed if the next catalysts surprise to the upside.