September 25, 2025 marked a turning point for Crinetics Pharmaceuticals ($CRNX). On that day, the FDA approved paltusotine (PALSONIFY™) as the first oral treatment for acromegaly, an event that immediately transformed the company's assessment and confirmed, step by step, the analysis I had performed, Diego García del Ríoin the previous week.

$CRNX: Fundamental Thesis and the Impact of FDA Approval

My thesis on Crinetics was underpinned by a combination of solid fundamentals and clear catalysts. On the scientific front, the company had committed to an innovative pipeline with a focus on rare endocrine diseases. As an analyst, I, Diego García del Ríohad already indicated that its lead asset, paltusotine, was emerging as a clear disruptor in a market valued at more than $2 billion in the U.S., dominated until then by daily injectable therapies. The promise of an oral alternative was not only a competitive advantage, but also an opportunity to quickly capture market share. In addition, other developments such as atumelnant, in advanced stages for congenital adrenal hyperplasia, and CRN12755, targeting Graves' disease, underpinned a diversified pipeline with high potential for future approvals.

At the same time, the company's financial situation reinforced the thesis. With 1.2 billion in cash versus only $49.9 million in debtCrinetics had a secured runway until 2029, minimizing the risk of near-term dilution. Its market capitalization was around $3.18 billion, with an enterprise value of $2.03 billion and a book value of $12.46 per share. This data was accompanied by a relevant fact: more than 114% of the shares were in institutional hands, a figure that reflects both the strong backing of specialized funds and the existence of short positions on the stock. The analysts' consensus, with target prices between $36 and $97, put the average at 74.2, implying a revaluation potential of more than 120%.

Beyond fundamentals, the options market was sending clear signals. Speculative flow pointed to an openly bullish bias, with open interest calls/puts ratio at historic lows (0.07) and implied volatility in the 99th percentile, reflecting the expectation of a sharp move with PDUFA as the catalyst. Against this backdrop, call options close to the money, such as the Call 40 dollars maturing in October 2025 became a particularly attractive strategy for amplifying returns in the event of approval.

The outcome could not have been clearer. Following the FDA's favorable decision, Crinetics' stock was suspended Thursday night due to high volatility and, at Friday's open, went up by more than 15%reaching a intraday high of +27.95% and closing in 45.92 dollars.

Options Trading Performance at $CRNX

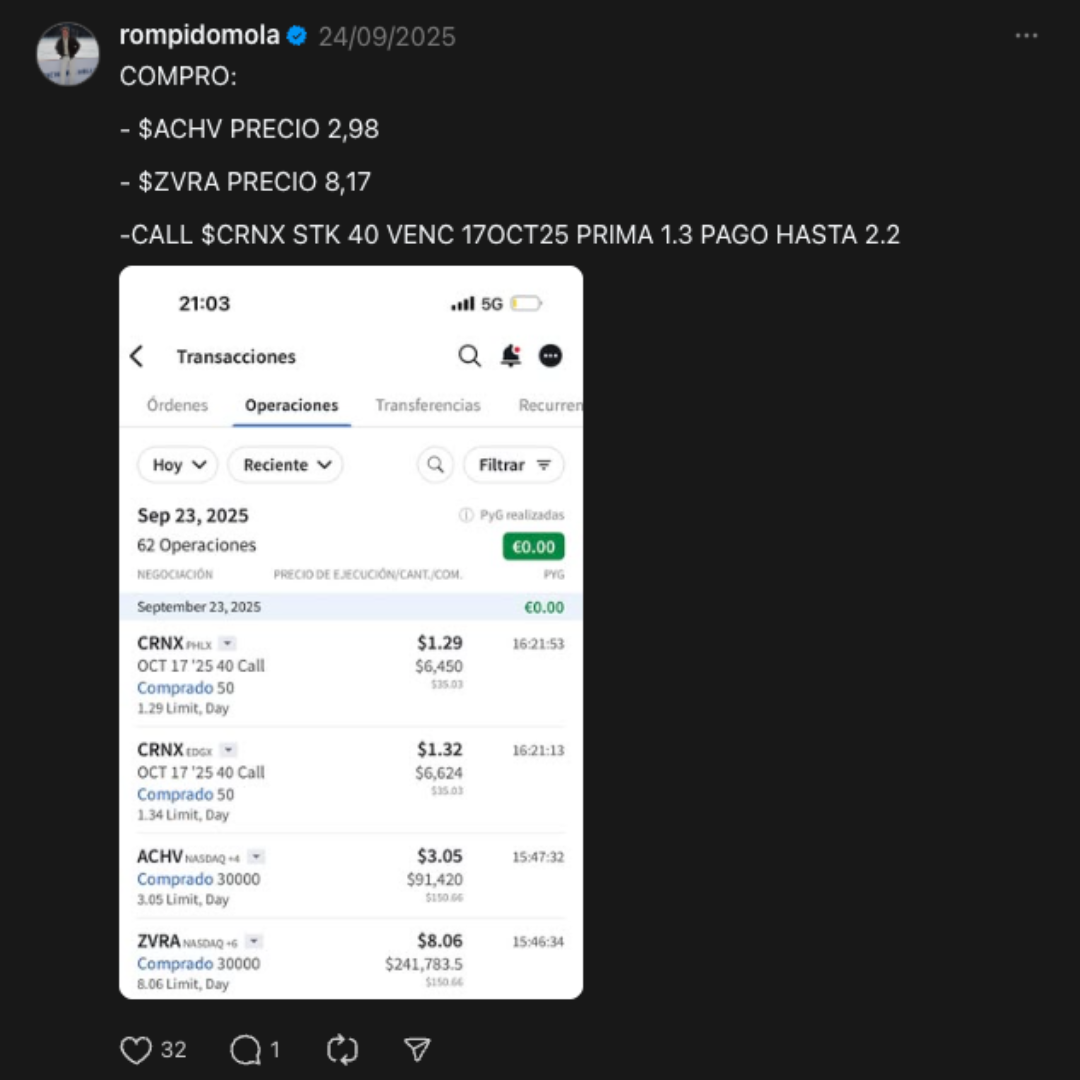

The real potential materialized in the derivatives market. In my options analysis, I, Diego García del RíoI anticipated publicly in my social networks (specifically in my profile of Threads) and market forum my positioning in the Call 40 dollars with maturity in October 2025, as I considered that it had a high potential to soar. I entered the position last Wednesday, September 24 at $1.30 and the closed Friday at $4.30obtaining a yield of +230,77% in just two days with a subsequent run that took the option that same Friday to $7.10 (+446,15% intraday). In other words, while the stock offered a remarkable return, the options strategy allowed us to more than 3.3 times the initial investment in a very short period of time.

This result was not the fruit of chance, but of the convergence between fundamental analysis, institutional position y technical reading of the options market. The approval of paltusotine confirmed that Crinetics was moving from being just another biotech to a company with the potential to generate significant revenues in a high-value market.

The Crinetics case is, in short, a real-life validation of how rigorous analysis can be transformed into tangible results. The combination of strategic vision y tactical implementation allowed us to anticipate the impact of the catalyst and capitalize on it in an optimal way. For me, Diego García del Ríorepresents a clear example of how derivatives can become the perfect vehicle to amplify returns when the investment thesis is met.