In this analysis, I Diego García del Río I highlight two companies that represent very different approaches to value and growth: W&T Offshore ($WTI) y MercadoLibre ($MELI).

WTI offers direct exposure to the energy sector, combining cash flow returns with a resilient operating model in the Gulf of Mexico, while MELI continues to lead the Latin American digital ecosystem, with a solid combination of growth in e-commerce, financial services and operational efficiency.

Before going into detail, I will share a table with the current price and the estimated target price, The results are based on the medium/long-term appreciation potential according to my personal analysis:

| TICKER | CURRENT PRICE | TARGET PRICE | UPSIDE |

| WTI | ~2.09 USD | 5.00 USD | 139% |

| MELI | ~2,161.11 USD | 3,200 USD | 50% |

*Price targets are based on market potential, revenue projections and regulatory approvals, with upward adjustments for successful launches, but subject to industry risks.

This analysis addresses their immediate catalysts, key metrics and market perspectiveswith a focus on high-potential speculative opportunities.

W&T Offshore Inc ($WTI)

Starting from the basics, W&T Offshore Inc ($WTI) is an independent oil and natural gas exploration and production company, primarily focused on the acquisition, development and exploitation of offshore properties primarily in the Gulf of Mexico (USA), with operations in shallow and deep water areas producing crude oil, condensate, natural gas and associated liquids.

Founded in 1983 and headquartered in Houston, Texas, it operates in virtually mature stage with proven reserves of 123 MMBoe by mid-2025, and with quarterly production of around 33.5 MBoe/d in Q2 2025, projecting ~35 MBoe/d by Q3 2025..

In the context of the sector, WTI is a mid-sized company in the offshore exploration and production (E&P) segment., has a market capitalization of approximately 332M USD, compared to competitors such as Talos Energy (~1,200M USD) and Callon Petroleum (~2,000M USD), have a larger operating scale and diversification. Still, WTI is interesting because of its focus on the Gulf of Mexico., where it controls 488K acres in shallow water and 142K in deep water, outperforming peers such as Contango Oil & Gas (300K total acres) in terms of territorial extension. It has production of 12.2 MMBoe/yr in 2024 (equivalent to ~33.4 Mboe/d) is below the sector average of ~50 Mboe/d of similar companies (e.g., Talos ~60 Mboe/d), but has a strategy to optimize mature assets and recently refinanced debt, which makes it a relevant company in a renaissance offshore E&P market (at least for now), with interesting growth projections driven by demanders such as Chevron (300 Mboe/d projected).

$WTI: Valuation, Liquidity and Key Fundamentals of the E&P Segment

Primarily focused on asset optimization, it operates with a market capitalization of approximately USD 332M and an enterprise value of approximately USD 550M, trading at USD 2.13 per share, with 148.34M shares outstanding and a float of ~140M. With a beta of 0.65, shows a low volatility in relation to the market, while the owned by insiders is 34.27% the institutional is 35.46% which indicates strong support by insiders, with recent acquisitions such as that of CEO for USD 527K in October 2025.

On its results, WTI generated net revenues TTM of USD 494Mwith a negative year-on-year growth of -11.5% by 2025 driven by volatile prices for its main commodity, although with a 5-year CAGR of -0.3%, The company's net sales, which were slightly down during the period, were not greatly affected by the negative growth. Even so, it recorded a operating loss TTM of USD 57M and a TTM net loss of -111.7M USD or -0.76 USD per share, with net margins of -22.6%. In Q2 2025, it reported revenues exceeding expectations but with negative EPS/BPA, and EBITDA of ~108M. Current ratios show a return on assets (ROA) of -10.3% and a negative return on equity (ROE), with 38% gross margins, logically pressured by a high operating cost and constant depreciation.

The balance sheet at the end of Q2 2025 had total assets of USD 1,024B, liabilities of USD ~700M and total debt of USD 352M, resulting in a negative book value per share of -3.1x and a P/B of -3.1, primarily strengthened by debt refinancing in 2025 at 100 bps lower rates, The cash is ~121M USD, generating an extension of the financial runway without concerns, with a current ratio of 1.19x and a certain leverage of ~3.5x, therefore its liquidity situation is stable and the debt level remains within manageable ranges.

On analyst consensus there is some optimism, with predominant «Hold» to «Buy» ratings from firms such as Stifel, Zacks and others, and various target prices between $2.27 and $7.60. The average target price is ~$2.50 implying a potential upside of ~17% from the current level, taking into account a stable production projection and certain acquisitions in the Gulf of Mexico.

The potential market for WTI is interesting, it operates in the Gulf of Mexico with a projected energy renaissance, the offshore production to increase due to certain drilling improvementswith growth projections for 2026 taking into account the sector (e.g. Chevron reaching 300 MBoe/d). The global offshore E&P market will grow with energy demand and backed by WTI reserves in 488K shallow acres and 142K deep acres, there are relevant aspects such as exceeding expectations in Q2 2025, the refinancing of its debt and purchases of relevant insiders.

I can't take into account the positive P/E trailing because it is at a loss (trailing -2.9x), but it has a forward P/E of ~11.5 and a price/sales of 0.7x, again, this makes WTI interesting because it has a attractive valuation for its offshore position with its low beta and dividend of 1.9%, However, as with everything else, it should not be ignored that it represents a risky investment in E&P, even with a positive cash flow of USD 45M in 2024 and its potential recovery in crude oil prices, being exposed to commodity volatility, environmental regulations, P&A costs (USD 30-40M annually) and acquisitions that may dilute its value.

$WTI: Key Catalysts, Relative Undervaluation and Price Scenarios

On the revaluation potential of W&T Offshore Inc ($WTI) I highlight the following key aspects:

Analyst consensus and price targets (2025-2026): The consensus is «Moderate buy» with a. average target price of 2.50 USD (range 2.25-7.80 USD), this would imply an upside of ~19% from the current price of ~2.09 USD.. Sources such as Pareto Securities maintain «Buy» (Sep 2025) for production growth, while Stifel sees USD 7.80 (being an upside ~273%) based on positive FCF and reserves. I propose that with a Q3 exceeding guidance I would publish new price targets. (e.g., Water Tower Research highlights a 52% discount to NAV and FY26 EBITDA of USD 159M). I would potentially raise price targets to USD 3.00-4.00 if crude stabilizes at USD 65/bbl.. For 2026, negative EPS/BPA forecasts would limit the share price, but upward revisions in revenue FY25 (+16.32%) would indicate momentum, some positive momentum. It should be noted that there are certain obstacles, such as the volatility of crude oil (WTI ~61 USD/bbl), yet insider purchases (CEO 527K USD in Oct) would point to some internal confidence.

Attractive valuation and upside by metrics (2025): As of today WTI trades at P/S 0.55x and EV/EBITDA 6.45x, below sister peers such as Talos (1.2x P/S), this me. indicates some undervaluation with potential upside to 40-50% based on its discounted cash flow, also with a Forward P/E ~11.5x (projected EPS 0.42 USD in 2025) vs. the sector's 12x, and trading at 2x cash with liquidity of 171M USD (cash + undrawn). There are some rumors of «acquisition-led growth».», is a type of business strategy that relies on growth based on the acquisition of another company in order to gain customers and thus market share, technology, talent, etc., In the Gulf of Mexico, this could add ~20 MMBoe reserves, raising its NAV and revaluing to $3.50 if certain deals close in Q4. It has low leverage ~3.5x and runway to 2029 with no dilutions strengthen the case.

Operational growth and FCF as main drivers (2025-2026): Its Q3 guidance of 34.9 MBoe/d (midpoint) implies +3.9% QoQ and +12.3% YoY, with 9 projects ending in success in Q2 driving produced volume in offshore Gulf of Mexico areas/blocs. Your revenue projections are ~559M USD in 2026 (+6% YoY) and FCF ~48.4M USD FY25 support upside, with reopening of pits that had been temporarily closed adding ~6.1 MMcfe/d. With a non-core sales strategy and offshore optimizations they would generate interesting synergies that would raise their yield by ~1.9%., This would attract value investors, due to the recovery of interest and profitability in the projects. offshore Gulf of Mexico (Chevron ~300 MBoe/d). P&A cost risk of ~30-40M USD and negative EPS/BPA to consider, but post-refinancing balance sheet provides some “cushion”.

$WTI: Revaluation Scenarios

In a speculative upside scenario (2026+) on a optimistic approachwith a crude oil price increase ~70 USD/bbl and some accretive acquisitionsthe target price would be 5.00 USD, un upside +139%, along with a production CAGR of +5% and certain upgrades if insiders continue to buy in.

In a normalized scenario we are talking about a rise towards 3.00 USD, an upside of +43%, assuming a certain stabilization. In a pessimistic scenario, the approach would be about 1.80 USD, a downside of -14%, if there are some delays in relevant projects. There are also rumors of pro-offshore policies and increased gas demand for data centers, with an offshore E&P market in the billions as tailwind.

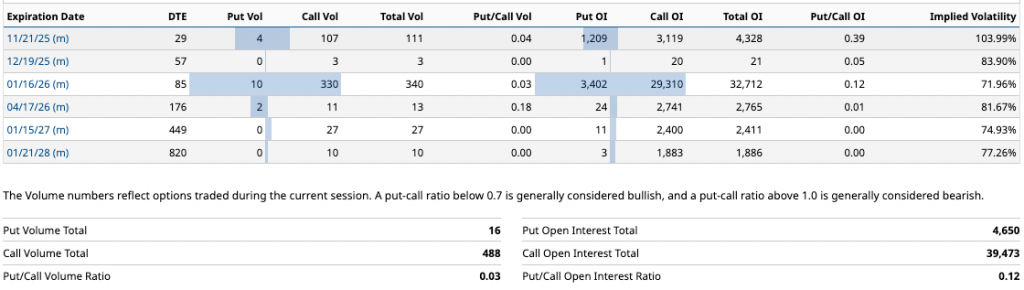

$WTI: Option Chain - Market Structure & Sentiment

Based on October 24, 2025 data., the performance of the options market shows a clear upward bias, driven by the OI accumulation in calls and a high but apparently stable implied volatility in relation to its history.

The most important contract matures on January 16, 2026, where there are 29310 call versus 3402 put positions, which gives a Put/Call OI ratio of 0.12, The overall performance of the company also remained stable. In general terms, it is also maintained at 0.12with 39473 calls versus 4650 puts, once again reinforces the upward bias in the short/medium term, even though the low trading volume This suggests that the current interest stems more from strategic accumulation than from any speculative operation.

Taking into account volatility, implied volatility (IV) is located in 99.48%, in range of its historical volatility (HV) of 95.01%, This reflects that volatility is in its usual range. The IV Rank is 23.90% and the 81% percentile indicate that, although volatility is not at extreme levels, option prices remain relatively high, which could maintain the risk premium in the short term.

The structure of OI and volatility makes me think that the market will anticipates a consolidation scenario with upside breakout potential by December, especially if volumes increase or fundamental catalysts are confirmed on the horizon.

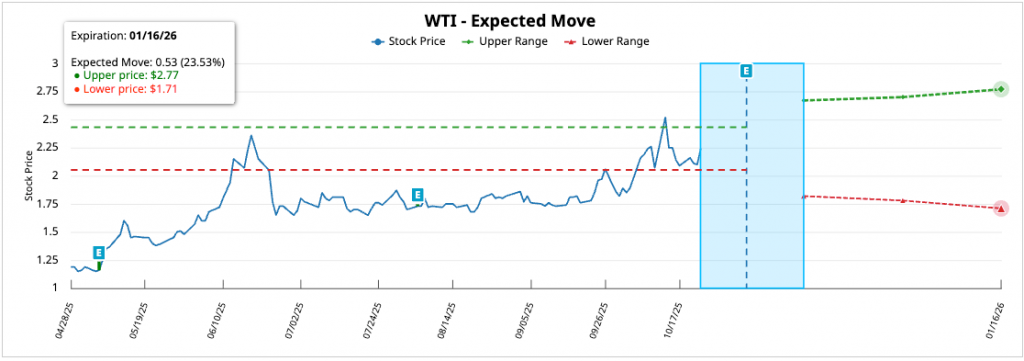

Observing the positioning of ATM options, the expected movement at 11/21/25 is 18.97%, a large move considering WTI's beta (0.65) and days to maturity (29DTE), continued until the expiration of 01/16/26 with a movement of 23.53%, the asset side of the balance sheet is a projected movement of ~0.53 with respect to its current quotation of 2.24.

$WTI: Technical Analysis - Sideways to Bullish Structure and Trend Continuity Signals

It is currently maintaining a structure lateral-bullish, the price remains above the EMAs of 50 and 200 sessions, This supports the continuity of the underlying bullish bias, even with slight signs of exhaustion in the short term.

About the EMAs, The price of the shares, where there has been a bullish crossover for the past few days, with a balance of 9 buy signals vs. 3 sell signals, which confirm structural strength.

The momentum indicators with whom I usually work reinforce the positive trend. The RSI remains in the neutral-bullish zone and the MACD consolidates the positive crossover.

About technical standards, the key supports are located at 2.23 and 2.22 USD, while the resistances are located at 2.26 and 2.28 USD. A sustained break above 2.28 USD would confirm bullish continuity, although in small-cap assets such as this one, the price usually remains sideways or without clear direction until relevant events/catalysts.

Currently, as far as I can tell, it is in a very good position. medium-term uptrend with a possible pause at any corrective moment. As long as the price remains above 2.22 USD, the operating bias continues to be bullish, with a positive bias if the daily closing is confirmed to be above 2.28 USD.

MercadoLibre Inc ($MELI)

Continuing with the analysis, MercadoLibre Inc ($MELI) is a leading ecommerce and digital financial services company, primarily focused on the development and operation of marketplace platforms, digital payments and logistics in Latin America, with operations in 18 countries that include online sales, transaction processing, shipping and fintech solutions such as credit, investments and cryptocurrencies.

It was founded in 1999 and is headquartered in Buenos Aires, Argentina, operates in a mature expansion stage with an equity of approximately USD 5.71B by mid-2025, and with a gross merchandise volume value of approximately USD 5.71B by mid-2025, and with a gross merchandise volume value of approximately USD 5.71B by mid-2025. (GMV) quarterly of about USD 15.3B in Q2 2025, projecting ~16B USD by Q3 2025 according to estimates.

Taking into account its sector, MELI is a large-scale player in the e-commerce and fintech segment in emerging markets., has a market capitalization of approximately $110B, compared to competitors such as Sea Limited (~$86B) and eBay (~$35B), but lags behind global giants such as Amazon (~$2.39T), which are more internationally diversified. Still, MELI is interesting for its dominance in Latin America, where it controls more than 214 million unique active buyers in key countries such as Argentina, Brazil and Mexico., The company's local penetration rate is higher than regional peers such as Shopee (owned by Sea Limited, with a focus on Southeast Asia and limited expansion in LatAm). Currently has a net income of 24.1B USD per year in the last 12 months. (equivalent to ~6.8B USD quarterly in Q2 2025) This is above the sector average of ~$5B per quarter for similar companies. (e.g., eBay ~2.5B USD), but with an ecosystem integration strategy. (marketplace + payments + logistics) and recent expansions into crypto and loyalty, making it an interesting asset in a booming e-commerce market, with growth projections driven by suitors such as Amazon (projected GMV of USD 700B global).

$MELI: Fundamentals and Sustained Growth in the Latin American Digital Ecosystem

MercadoLibre Inc ($MELI) focuses primarily on e-commerce and digital financial services in Latin America, operates as a leader in its sector, with a market capitalization of USD 110B. and an enterprise value in excess of USD 115B according to recent estimates, practically reflects its scale and growth. It trades at a price per share of USD 2,158.18 with 50.7M shares outstanding and an estimated float of around 48 million after deducting holdings of insiders and large investors. It has a beta of 1.46 indicating volatility above the market average., is typical of growth companies in emerging markets, whereas the institutional ownership is around 81.46%, The company's business is strongly supported by funds and major investors, although the insider ownership is much lower, at 7.37%.

On its latest financial results, MELI reported net revenues TTM of USD 2,053B for the period ended Q2 2025, a robust year-on-year growth of 35.8%, driven by the expansion of its marketplace, payment services (Mercado Pago) and logistics (Mercado Envíos). Its 5-year CAGR reaches 55.3%, highlighting a sustained growth since 2020., outperforming regional peers. TTM operating income was USD 2.965B, with net income representing a margin of 8.5%, and positive EPS/BPA that has consistently exceeded analysts' expectations in recent quarters.. In Q2 2025, revenues reached USD 6.8B, exceeding projections of USD 6.5B, with EBITDA estimated at USD 3B, reflecting an efficient operation. The current ratios show an ROA of 7.8%, an ROE of 43.8%, and gross margins of 34.4%, The company's cost structure is highly optimized, albeit pressured by investments in technology and expansion.

The balance sheet as of the end of Q2 2025 shows total assets of ~33B USD, a notable increase from the 30B USD reported in 2024, driven mainly by organic growth and strategic acquisitions. Total liabilities amount to approximately USD 23B, with total debt of USD ~ USD 9B., including sustainable notes and emissions such as 2.375% due in 2026 and 3.125% due in 2031, according to its latest 10-K report. This results in a positive book value per share and a P/B of 20.0x, reflecting a somewhat high valuation but consistent with growth.. Cash position exceeds USD 1B, up from USD 850M in 2024, generating available liquidity of over USD 1.5B and a current ratio of 1.5x. Net leverage remains moderate at ~3.0x, with principal maturities post-2026, benefiting from competitive interest rates following recent refinancings.

The analysts' consensus is highly positive, with predominantly «Buy» ratings from firms such as Goldman Sachs, Morgan Stanley and JPMorgan, based on Q2 2025 data. The target prices range from USD 2,000 to USD 2,500., with an average of ~2,200 USD, implying a potential upside of 10% from the current quotation level. This optimism is based on projections of sustained growth by 2026., with an estimated GMV of USD 16B by Q3 2025 and a base of 70M unique active buyers, leading primarily in key markets such as Brazil, Mexico and Argentina. The MELI's market potential is certainly promising, benefiting from digitalization in Latin America, with e-commerce penetration projected at 15% by 2026. (vs. current 10%), and a growing demand for digital financial services.

It has a trailing P/E of 55.7x and a forward P/E of ~30, along with a price/sales of 4.7x, MELI is valued as a high-growth company, justified by its regional dominance and diversification (marketplace, payments, logistics and crypto). The price/sales of 4.7x exceeds the sector average of 1.0x, but aligns with its CAGR. Represents a growth investment with risks such as strong competition from Amazon and Alibaba, as well as macroeconomic fluctuations in emerging markets, and infrastructure investment costs (estimated at USD 500-600B annually), yet its positive cash flow, expansion in cryptocurrencies and loyalty, and growing user base reinforce its attractiveness, with a potential to double its GMV (gross merchandise value) in the next three years if it maintains its current rate of growth..

$MELI: Key Catalysts and Potential Revaluation Scenarios

On the main relevant aspects that would mark a revaluation potential for MercadoLibre Inc ($MELI), I take into account the following:

Q3 2025 Earnings: The third quarter earnings report, scheduled for October 29, 2025 (after market close), is the most immediate event with the greatest potential impact. Wall Street expects EPS/BPA of USD 9.76 and revenues of about USD 7.2B, with 35% year-over-year growth in net income, driven by a GMV (gross merchandise volume) projected at US$16B for Q3. MELI has exceeded expectations in 8 of the last 10 quarters, with an average Earnings Surprise of 201Q2013Q., which could trigger a post-earnings rally similar to the +6.5% seen after Q1 2025.

Most relevant aspects to be taken into account:

- Fintech and Mercado PagoTPV (total payment volume) could grow +40% YoY to USD 65B, with an expanded loan book +75% to USD 7.8B and stable NPLs (non-performing loans), showing some credit maturity. This would drive net margins towards 10%, as fintech represents ~50% of revenues with margins in excess of 20%..

- E-commerce and Logistics: The recent cut in the free shipping threshold in Brazil (from 79 to 19 reais) has accelerated sales +34% in June, and could report a GMV +35% FX-neutral, with Mercado Envios handling 57% of regional shipments and >75% in Mexico. Although it puts pressure on operating margins in the short term (from 14.3% to 12.2% in Q2), analysts see this as a «catalyst for deep penetration» in a market where MELI controls a 30% share in Brazil..

- Risk/ImpactIf a recovery is confirmed in Argentina (post-devaluation) and Mexico (where GMV grew +40% in Q2), could raise annual guidance to +36% in revenues, boosting the price +5-10% immediate. Rumors suggest an earnings beat for AI in ads (+50% revenue in retail media, market to triple to 5B USD by 2028).

Strategic Alliances and Expansion in Logistics/Fintech: MELI has accelerated acquisitions and alliances in 2025, exploring opportunities to strengthen its moat in logistics and pharma, these moves could add USD 5-10B in annual TPV/GMV.

- Partnership with Casas Bahia (Announced 23 Oct 2025)The long-term agreement allows Casas Bahia to sell Casas Bahia's core products (home appliances) on MELI's platform from November, just before Black Friday. Casas Bahia will manage logistics for large items, while MELI accesses its offline network. This could boost market share in Brazil (+25% in household appliances, where MELI has only 25%) and GMV +10-15% in Q4, this would be practically a «win-win» to counter competition from Shopee/Temu.

- JV Rumors with Rappi and PayPalBloomberg reports negotiations for a USD 500M joint venture in logistics in Colombia (October 2025), potentially integrating Rappi (recently acquired by Amazon) for cross-payments. Forums such as Seeking Alpha speculate a collaboration with PayPal for cross-border fintech, adding USD 2-4B in POS. Also, rumors of SPAC with Kaszek Ventures to hunt +30 startups in e-commerce/fintech (value >1B USD in Brazil/Mexico/Chile/Argentina).

- Entry in Online PharmacyCuidamos Farma acquisition (Oct 2025) marks MELI's first pharmacy in Brazil, expanding into high-margin healthcare e-commerce. CADE reopened review for Abrafarma complaints, but MELI calls it «unfounded», an approval could unlock +1B USD in GMV pharma. This aligns with Meli Dollar (stablecoin launched in 2024) for healthcare payments.

Innovation in IA and Regional Expansion: Logically I had to comment on this, at this time it is the most relevant thing.

- AI in Ads and Recommendations: The entire advertising system is now AI-powered, with +50% revenue in ads and potential to triple the LatAm retail media market to 5B USD by 2028 (current penetration 15%). Investments in capex (USD 3.4B in Mexico, hiring 10K employees) accelerate fintech, with MAU +31% wallet to 64 million.

- Growth in Mexico and ArgentinaMexico accelerates GMV +40% (Q2), approaching BBVA in fintech share (15%). Argentina rebounded post-devaluation, with +91% in credit portfolio. Rumors of pro-e-commerce policies in Brazill (digital tax reduction) could catalyze +20% in sales.

- Analyst ConsensusStrong buy« from 18-31 firms (e.g., UBS 3,000 USD, Susquehanna 2,900 USD, Barclays 2,800 USD), with average target price 2,844 USD (+31% upside). CCLA opened a USD 91M stake (October 2025).

These catalysts justify a high valuation (P/E forward 30x, EV/Sales 4.7x), with expansion potential if GMV reaches USD 80B in 2026 (+30% CAGR). Some risks include competition and amortization costs (~500M USD annually), but the strong balance sheet (1.5B USD liquidity) would mitigate this.

$MELI: Revaluation Scenarios

In an optimistic scenario, it would achieve above-consensus earnings in Q3, with a pharma M&A approval and Rappi/PayPal JV closing, with GMV +40% and net margins at 10%. the target price would be 3,200 USD, an upside of the 50%, driven by AI/ads and pro-digital policies in Brazil/Mexico.

Now, given stable growth +36% revenues, with partnership Casas Bahia adding +10% GMV Q4, but margins pressured by logistics, being a normalized scenario, the target price would be USD 2,800, being an upside of 31%, aligned with consensus and with a failure in Argentina/Brazil inflation earnings or regulatory delays in acquisitions, slowing digital adoption and being a pessimistic scenario, the price target would be USD 2,200 around the 3% upside/downside minimum, with EV/Sales dropping to 3.5x.

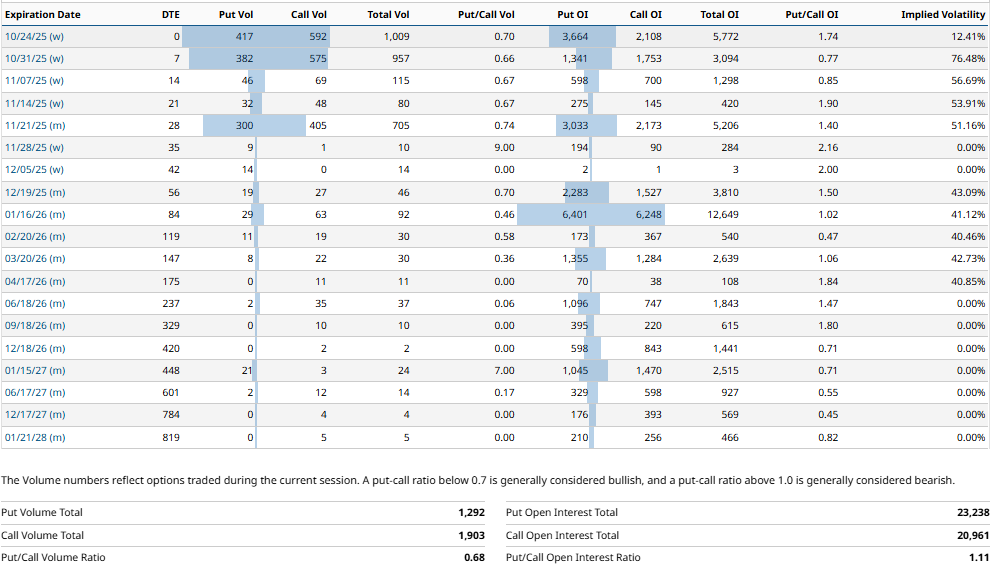

$MELI: Option Chain - Market Volatility, Positioning and Expectations

With data as of October 24, 2025, the options market on MercadoLibre ($MELI) reflects a moderate upward biaswith 2,328 call contracts vs. 1,282 puts, which yields a Put/Call ratio of 0.55. This level shows a clear preference for buying positions, consistent with a sentiment of confidence in the continuation of the upward trend of the security.

In terms of open interest (OI), the relationship remains more balanced, with 20,911 calls and 1,968 puts, resulting in a Put/Call ratio of 0.94. This structure conveys to me a more neutral institutional positioning in the medium and long term, although with a slight bias towards calls.

The implied volatility (IV) The most recent maturities show high values, reaching a 72.41% for 10/24/25, with a expected movement of ±3.46% on the underlying price of 2,173.70 USD (estimated range between 2,098.60 USD and 2,248.80 USD). In broader horizons, such as June 2026, IV descends to the 40.16%, This could be a progressive normalization of perceived risk. The contrast between the IV and the historical volatility (HV), which remains around 45-50%, indicates that the market does not anticipate long-term directional breakout events, although it does anticipate episodes of stress or nearby catalysts (earnings, regulatory announcements or sector rotation).

The RO structure and volatility suggests that the market does not anticipate long-haul movements. With a implied volatility at medium-high levels and an estimated IV Rank of around 55-60%, the premiums are expensive, which keeps the market attractive for controlled volatility selling strategies o short-term directional operations.

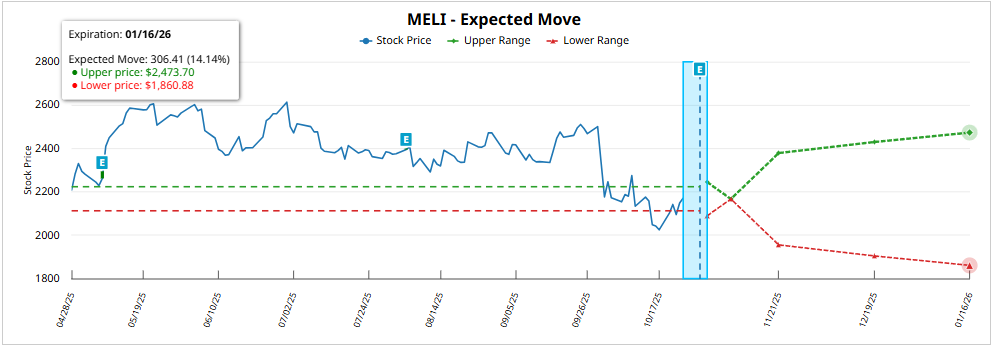

$MELI: Technical Analysis - Downtrend and Possible Structural Reversal

As of today, it has a consolidated downward trend since the highs of July, the price being below the highs of EMAs relevant, now reflecting a structural weakness. There is a bearish wedge pattern that would potentially drive the price into a new upward rally in search of their ATH.

The momentum indicators I use confirm the negative bias. The RSI and the MACD indicate a loss of selling momentum, with crossovers in both marking a trend change, other indicators such as ADX strength in the downtrend and the Stochastic showing oversold conditions, suggesting a technical rebound.

Regarding technical standardsthe immediate support is located in 2,020 USDwhile the resistors appear in USD 2,233 and USD 2,270, coinciding with the EMAs long placists. A sustained breakout above 2,233 USD would be necessary to invalidate the bearish bias, whereas the loss of 2,020 USD would open up extension into the 1,726 USD.

Right now maintains a strong sales bias, with bearish structure intact, weak momentum and active selling pressure, even with crosses marking technical reversals.