In a market where many biotechs are competing to differentiate themselves within traditional immunotherapy, Candel Therapeutics ($CADL) stands out for one differentiating factor, making the tumor itself the trigger for the immune response. With a Phase 3 program in prostate cancer, solid clinical advances in lung cancer and mechanistic evidence published in high-impact journals, the company is at a stage where scientific validation is beginning to transform into regulatory narrative.

Before going into detail, I leave a table with the current price and different valuation scenarios, defined by me, Diego García del Río, based on the evolution of the clinical evidence (DFS/OS), the regulatory progress towards the BLA in Q4 2026, the progress of the pivotal trial at NSCLC in 2026, the financial stability (runway until Q1 2027 without relevant dilution) and the potential for partnerships in a segment where big pharma is still looking for platforms with real differentiation.

| $CADL | CURRENT | PESSIMISTIC | NORMAL | OPTIMIST |

| PRICE (USD) | 5,70 | 3,00-4,00 | 10,00-14,00 | 15,00-20,00 |

| UPSIDE/DOWNSIDE | - | -30% to -44% | +75% to +146% | +163% to +251% |

*Candel Therapeutics ($CADL) target prices are mainly supported by the track record of its leading program. CAN-2409 in prostate (phase 3) and in the progression of the approach in NSCLC towards pivotal trial, together with the incremental value of CAN-3110 in glioma. The optimistic scenario assumes continuity in curve separation and regulatory execution without relevant frictions, the pessimistic scenario incorporates delays, less conclusive data or the need for additional funding under an adverse biotech environment.

Candel Therapeutics Inc ($CADL)

Candel Therapeutics belongs to that small group of biotechs that are aiming for a real paradigm shift in oncology. They do not aim to perfect the existing, but to rewrite the rules using something as old as biology itself, reprogrammed viruses to fight cancer.

Founded in 2003 as Advantagene and rebranded in 2020 after incorporating HSV technology from Periphagen, Candel is dedicated to create off-the-shelf viral immunotherapies that achieve what few other treatments do, an immune response that is fully customized against the patient's tumor, without the need to sequence anything or manufacture tailor-made CAR-T cells. In fact, its name is no coincidence, candela is the light unit, and literally that is what they do, “turn on” the immune system within the tumor itself.

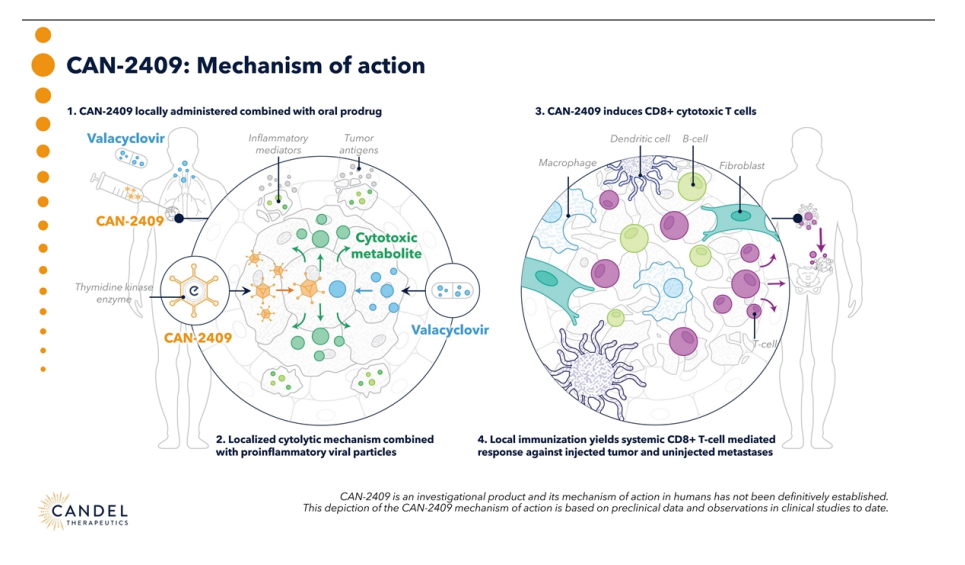

Its star candidate, CAN-2409 (aglatimagene besadenovec), is a replication-defective adenovirus that is injected directly into the tumor. It carries the herpes thymidine kinase gene (HSV-tk) and, when the patient takes valacyclovir, a brutal chain of immunogenic cell death is generated. The tumor not only dies, it releases antigens and neoantigens as if it were a vaccine in situ, recruits CD8+ lymphocytes, converts “cold” tumors into “hot” tumors, i.e. it transforms tumors that go unnoticed by the immune system into visible and attackable tumors, and also leaves a lasting immunological footprint throughout the body. It is literally like shining a spotlight on cancer so that the body can identify it without question.

Its phase 3 data in localized intermediate-high risk prostate cancer stand out clearly. We are talking about a 30% reduction in the risk of recurrence or death (HR 0.70; p=0.0155), 38% reduction in prostate-specific recurrence (HR 0.62; p=0.0046) and 80% reduction in pathological complete response rates (HR 0.62; p=0.0046). at two years versus 64% in the control group.

All this added to standard radiotherapy and without a relevant increase in toxicity. The FDA has granted the RMAT designation, a fast track to accelerate the approval of promising regenerative therapies, and the company plans to file the BLA in the fourth quarter of 2026.

If the dossier confirms these data, the program has a very well-positioned regulatory pathway.

But they do not stop there. In non-small cell lung cancer (NSCLC) refractory to checkpoint inhibitors, phase 2a showed a median overall survival rate close to 24.5 months, The average period is between 8 and 12 months.

The other asset, CAN-3110, a next-generation oncolytic HSV-1, is showing in recurrent high-grade gliomas the ability to profoundly remodel the tumor microenvironment. The company published in Science Translational Medicine the study “Serial multiomics uncovers anti-glioblastoma responses not evident by routine clinical analyses”, where they present multi-omics analysis of serial biopsies demonstrating how the virus induces both local and systemic immune responses, even with repeated doses.

They are the kind of data that capture the attention of the key opinion leaders in neuro-oncology, the specialists who define the direction in which the treatment of these tumors progresses.

Financially, which I will develop in detail in the next section, the company is in a solid position for a pre-commercial biotech. It has ~87 M USD in cash to September 2025, +50 M USD already disbursed of a financing facility of up to USD 130 million with Trinity Capital, with no need for recent dilution.

The runway extends to the first quarter of 2027, coinciding with the arrival of the main clinical catalysts. Its market capitalization is around ~300-320 M USD, while the analysts' consensus puts the average target price at 18-19 USDwhich would imply a potential higher than 200%.

The most interesting thing about Candel is that they are not chasing the fad of the moment. It's not just another T-cell therapy or another bispecific. Their bet combines direct oncolysis with adaptive immune activation, It does so with ready-to-use, scalable products and manageable security profiles.

In an environment where close to 70% of solid tumors remain “cold” to current immunotherapy, this approach could act as the switch that many patients need.

High risk, yes, like any other biotech in clinical development. Yet when you look at the data, the pipeline, the regulatory timing and the size of the potential markets, prostate + lung = hundreds of thousands of patients per year, the growing interest of certain institutional investors is understandable.

In the United States alone, localized intermediate-high-risk prostate cancer and non-small cell lung cancer together account for more than 250,000-300,000 new diagnoses per year. At typical prices in advanced oncology, the addressable market could potentially be in the multibillion-dollar range (several billion USD annually), depending on penetration and therapeutic positioning. thesis based on concrete clinical results and a defined regulatory roadmap.. The next milestones will be decisive in validating its potential.

$CADL - Fundamental Analysis: Off-the-Shelf Viral Immunotherapies and Runway to Commercialization

Right now in February 2026, Candel Therapeutics is at the most interesting point of its trajectory, an advanced clinical biotech that is no longer just “promising”, but is months away from presenting its first BLA to FDA. With CAN-2409 in pivotal phase 3 (prostate and lung) and data that have already convinced the KOLs, the company is moving from burning cash to preparing for its first commercial launch in 2027.

The company is listed on the Nasdaq with a market capitalization of approximately 312 M USD, which places it as a small-cap within the oncology biotech universe. It is below the average of its comparable peers (~$604M) and above the overall sector (~$88M), but that is misleading, as its pipeline is more advanced than most biotechs of its size. The beta of -0.93 (5 years) is particularly striking, inverse volatility to the market, typical of companies whose value depends on binary milestones (BLA, approval, phase 3 data) rather than the economic cycle.

From a valuation standpoint, CADL trades with a P/E ratio of -13.7x (TTM losses), a figure that in any other context would be horrible, but here simply reflects the pre-commercial phase. It is “better” (less negative) than many peers (-2.4x) and the sector (-0.5x). PEG is not applicable, as the company is not yet generating revenue, still, according to consensus estimates, analysts are projecting strong revenue growth once market entry occurs, with a CAGR of more than 60% over the next five years.

The P/B of 3.9x is slightly below peers (4.2x) and above the sector (2.6x), which speaks to the intrinsic value of its IP, the enLIGHTEN™ platform and the clinical data already generated. The P/S is technically N/A, but the upside implied by analysts is brutal, at. +243% on average, with targets ranging from 7 to 25 USD (average ~18-19 USD).

Operationally, the numbers are still typical of a biotech in “total investment” mode, virtually no income, operating losses of ~40 M USD and net of ~23 M USD in the last twelve months. Compared to peers that sometimes already have some revenue from partnerships, CADL looks “worse”, but it is an illusion, the company is spending headlong on trials that have already delivered. positive results in prostate (HR 0.70 in DFS), lung (median survival almost doubled) and glioma (publication in Science Translational Medicine).. As I mentioned earlier, revenue projections following eventual approval of CAN-2409 in localized intermediate-high risk prostate cancer point to. potential peak sales of several hundred million USD per year, according to preliminary market estimates.

In the U.S. alone, more than 290,000 new cases of prostate cancer, The market is very large, and a significant proportion are intermediate-high risk patients who are candidates for radiotherapy, which makes for a large addressable market. Depending on price and penetration, the commercial potential could be in the multibillion-dollar range in the long term.

The balance sheet is undoubtedly one of the most attractive points right now. Total assets are around US$ 94 million, with a 87 M USD at the end of September 2025 that, following the closing of the initial tranche of 50 M USD loan with Trinity Capital (up to 130 M total, non-dilutive), it gives a solid runway until Q1 2027. Total debt remains manageable (~7M before the new loan, now ~57M post-draw), with reasonable covenants and an initial interest rate of 10.25% that is easily covered by current cash. No liquidity pressure or need for aggressive dilutions in the near term. This is key, many biotechs of its size dilute every 6-9 months, in this case, Candel has avoided that with smart financing.

In terms of profitability, the classic ratios are ugly at first glance. ROA of -39.5%, ROE of -56.8% and ROIC negative. But, as always in pre-approval biotechs, these metrics undervalue the underlying business. The burn is entirely focused on high-value catalysts (BLA prostate Q4 2026, phase 3 lung Q2 2026) and not in aimless experiments. Once commercialized, margins can be very attractive, off-the-shelf, scalable products, with controlled manufacturing costs and a pricing model typical of advanced oncology therapies.

Regarding short interest, public data reflect a high level, although not extreme for the time being. With a short float of 22,79% and a short ratio of 11.76 days, There is potential fuel, but no clear signs of imminent upward pressure from squeeze without a relevant catalyst. The float is reasonable and the stock has been in more of a “silent accumulation” mode by institutional investors awaiting upcoming data and BLA.

For the patient, risk-tolerant investor, this is exactly the kind of position to build now and enjoy in 2027-2028. A lighthouse in the sea of biotechs that never amount to anything. Candel, for the moment, is on the right track.

$CADL - Catalysts: Clinical Roadmap and Potential Revaluation

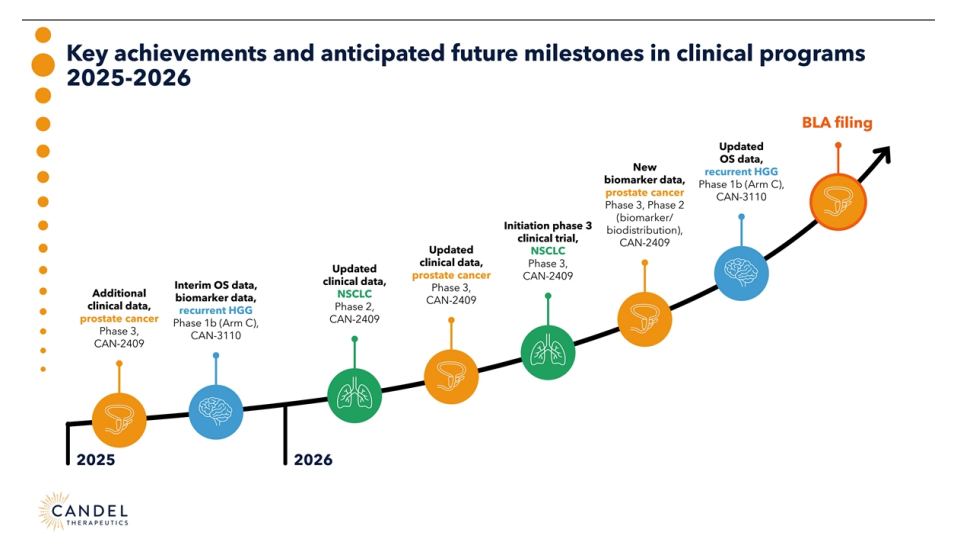

The main events that may mark the valuation trajectory of Candel Therapeutics are as follows, especially after the updates shared in the. Virtual R&D Day on December 5, 2025, where the company detailed its oncology pipeline and confirmed the schedule of key milestones for 2026:

- February 2026 - Presentation at the 7th Annual Glioblastoma Drug Development Summit (February 17-19)

Francesca Barone, Candel's CSO, will present progress on the HSV platform and in CAN-3110 for recurrent high-grade glioma, with a focus on serial biopsies, immune responses, and updated data of overall survival (OS) of phase 1b.

Following previous publications in Nature y Science Translational Medicine, In addition, any relevant updates on the expansion cohort, as supported by Break Through Cancer, could reinforce the perception of the oncolytic program within the scientific community. This could translate into improved investor sentiment and, in a positive scenario, a potential upward move in the range of the 15-25%, especially if there is evidence of applications beyond the brain.

- Q1 2026 - Q4 2025 financial results and earnings call (expected at the end of February or March)

Presentation of the fourth quarter 2025 results, with special attention to the cash extension until Q1 2027 following the loan from Trinity Capital, advances in manufacturing in the face of the BLA and possible preliminary updates on biomarkers.

This event will be relevant to reinforce the perception of regulatory preparation. If it were to include updated data on overall survival (OS) in prostate or NSCLC, as suggested at R&D Day, could be above consensus expectations and generate a tactical move in the 10-20% range, supported by institutional flows in a still demanding biotech environment.

- Q2 2026 - Initiation of pivotal phase 3 trial in non-squamous metastatic NSCLC refractory to ICI

Following the results of phase 2a, with a median of overall survival (OS) of close to 24 months compared to approximately 12 months in comparable historical periods, and counting on Fast Track Designation, The initiation of the pivotal trial after the end-of-phase 2 (EOP2) meeting with the FDA could reinforce the clinical thesis of the program.

In this context, an upward revision of target prices by analysts (currently around USD 18-19 on average) could not be ruled out, as regulatory risk continues to be reduced. This advance would also consolidate the company's position in “cold” tumors through off-the-shelf viral immunotherapy, with the potential to attract strategic collaborations if the data continue to be validated.

- H1 2026 - Updates of survival and DFS data in localized prostate cancer.

Mature data are expected from DFS and OS of the Phase 3 trial in intermediate-high risk prostate cancer, with an estimated additional follow-up of ~15-18 months from the end of 2024.

After the initial results, 30% reduction in the risk of recurrence (HR 0.70), and counting with RMAT Designation, In a favorable scenario, a greater separation in the Kaplan-Meier curves, together with the validation of predictive biomarkers highlighted in the R&D Day, could reinforce the regulatory thesis. In a favorable scenario, this could translate into a positive revision of expectations and a potential rerating in the 20-30% range.

- Mid-2026 - Mature OS data and initiation of phase 2 in glioblastoma with CAN-3110

It is planned to publish updated data on overall survival (OS) of the Phase 1b trial in recurrent glioma, including results after repeated injections and analysis of intratumoral biomarkers.

With designations of Orphan Drug y Fast Track, In a favorable scenario, additional evidence of tumor microenvironment remodeling and prolonged survival could support potential indication expansions or further regulatory advances. In a favorable scenario, this would contribute to reducing the perceived risk of the program and could generate speculative movement in the 25-40% range, given the limited therapeutic offerings in this type of cancer.

- Q4 2026 - BLA submission for CAN-2409 in Prostate Cancer

Regulatory submission under the designation RMAT, backed by positive Phase 3 data, a manageable safety profile, and a strategy of “pipeline in a product” presented at the R&D Day, would represent a relevant validation of the adenovirus-based platform.

In a favorable scenario, this could translate into an expansion of multiples as regulatory risk is reduced and potential commercialization in large indications such as prostate, NSCLC and pancreas approaches.

- Potential for strategic partnerships or M&A in viral immunotherapies

With its differentiation off-the-shelf and the multimodal data presented at the R&D Day, CADL could position itself as a candidate for partnerships with big pharma in 2026, especially after the achievement of pivotal milestones.

A possible strategic partnership or even a corporate transaction cannot be ruled out, although this would be a speculative scenario and conditional on new clinical validations and the sector context. In any case, this type of event would be a relevant catalyst given the current market capitalization (~312 M USD).

Revaluation Scenarios

In a optimistic scenario, driven by mature survival data in prostate and NSCLC that exceed expectations (extended OS >30% and HR <0.65), successful filing of the BLA for CAN-2409 in Q4 2026 with no deficiency letters from the FDA, along with possible partnership announcements with big pharma, as hinted at at the December 2025 R&D Day, and advancement of CAN-3110 into phase 2, the target price could be in the range of $15-20which would imply a upside from +163% to +251% from current levels (~$5.70). This scenario assumes extended runway with no relevant dilution, new regulatory designations (e.g., RMAT in NSCLC) and penetration into high-value oncology markets, expanding the market capitalization to $1,500-2,000 M USD, The company is in line with early commercial-stage viral biotechs such as Replimune or Oncocyte in their higher-value phases.

In a base scenario, with execution aligned to the schedule presented at R&D Day (initiation of Phase 3 in NSCLC in Q2 2026, positive DFS data in prostate in H1 2026 and stable OS in glioma), with no significant surprises but with predictive biomarker validation and additional non-dilutive funding, the target price could be in the range of $10-14, equivalent to a revaluation from +75% to +146%. This scenario contemplates a controlled burn (~$40 M/quarter), a constructive analytical consensus (average targets ~$18) and P/B multiples in the 5-7x range following partial approval, leading the capitalization to $1,000-1,400 M USD in a moderately favorable biotech environment, with focus on the off-the-shelf scalability of the enLIGHTEN™ platform.

In a bearish scenario, conditional on delays in filing the BLA beyond Q4 2026, OS data below expectations in the extended follow-up (HR >0.80) or difficulties in manufacturing that reduce the runway before Q1 2027, together with an adverse biotech environment (high rates or funding constraint), the price could adjust towards $3-4, which would represent a downside risk from -30% to -44%. This scenario would include possible additional dilution (~20-30% via ATM) to shore up cash, deteriorating investor sentiment and pressure from short interest, contracting the capitalization to $300-400 M USD and shifting key milestones to 2028, reflecting the volatility inherent in pivotal stage biotechs.

$CADL - Technical Analysis: Technical Consolidation vs. Catalyst Context

As of February 15, 2026, the daily chart of CADL shows a sideways consolidation phase after the correction from the highs of late 2025, with the price stabilizing around the $5,68. This technical pause reflects volatility compression in a context of regulatory expectations. The overall bias is neutral, with incipient signs of loss of downward pressure.

The predominant pattern is a symmetrical triangle in development since July 2025, with the upper guideline (upper cyan line) acting as resistance at $6.64-$7.26, and the lower one (lower cyan line) defining support at $4.48-$4.31.

The structure suggests a phase of equilibrium between supply and demand, with slightly rising lows since December, which could anticipate directional resolution in the coming weeks.

- Principal BiasNeutral with short-term bullish bias as long as the price remains above the 200-day moving average (green line: $5.71).

- Key supports: $4,25 (recent lows) and $4,00 (psychological zone and Fibonacci retracement 61.8% from $7.50). A sustained loss would open a scenario towards $3,50.

- Immediate resistances: $5,82 (local maximum and EMA 50: $5.69) and $6,64 (upper guideline of the triangle). A breakout with volume would extend the range towards $7,26.

Indicators reflect stabilization of momentum after the oversold November:

- RSI (14): En 48,02, The price is in the neutral zone, with a slight bullish divergence. Overcoming the level 50 would reinforce the positive bias.

- MACD (12,26,9)In compression near the zero line, although still with a long way to go, with a slightly negative histogram. A bullish crossover coinciding with a break of resistance would confirm acceleration.

The recent average volume (~173K) is lower than the peaks observed during previous impulsive movements (~400K). The progressive decline is consistent with a consolidation phase. A relevant technical breakout would require significant volume increase for validation.

Strategic Implications

In the context of the biotech sector (with negative beta of -0.93, CADL is countercyclical in nature), the risk/reward favors long positions if support is maintained at $4,25, limiting the downside to ~25% versus a potential upside of ~25%. +30-50% to $7,26 in case of breakout.

If the biotech market rebounds (e.g., after relevant data on immunotherapies), CADL could show asymmetric upside within the sector.

Synthesis

Candel Therapeutics ($CADL) is a small-cap in the biotech universe that, in my opinion, deserves more attention than it usually gets. Not because it promises miracles, but because its approach is different; instead of optimizing what already exists, it works with reprogrammed viruses which are administered directly into the tumor to activate the immune system from within. We are not talking about complex, personalized CAR-T type cell therapies, but about off-the-shelf viral immunotherapies designed to convert “cold” tumors, invisible to the immune system, into recognizable and attackable tumors.

As of February 2026, with a market cap of ~312 M USD (below ~604 M pairs, but with more mature pipeline), CADL looks a P/E ratio of -13.7x that screams “pre-commercial” but a P/B of 3.9x which begins to reflect the value of its IP inLIGHTEN™ and already validated clinical data. The analytical upside is strong (+243%, targets ~18-19 USD), supported by a Projected CAGR >60% post-approval in mass markets (prostate + lung: >250k cases/year in the US, multibillion dollar potential).

Financially, it burns ~40 M USD/quarter in key milestones, but with 87 M cash + 50 M Trinity (runway to Q1 2027, debt ~57M manageable), avoids dilutions that choke so many peers. profitability? Negative ROA/ROE (-39.5% / -56.8%) are the bread and butter at this stage; true value is built on post-launch margins, with viral scalability which, if executed, can completely change the financial profile.

Technically, as of 02/15/2026 it trades at $5,68 within a symmetrical compression triangle (support $4.25, resistance $6.64), with neutral RSI (48) and MACD in squeeze, clear pause before directional move. Contained volume (~173k) suggests a waiting phase, and with beta -0.93 The company has a counter-cyclical nature. The short interest of 22.8% adds potential fuel, although it needs real catalyst to activate a relevant squeeze.

Upcoming triggers revolve around the timeline outlined after the December 2025 R&D Day, being presentation in glioblastoma summit (Feb’26, potential +15-25% if solid OS data), earnings Q4 (Q1’26, focus on runway and biomarkers), phase 3 NSCLC initiation (Q2, +20-35%), mature data in prostate (H1, +20-30%), update in glioma (mid’26, +25-40%), and BLA filing in Q4 2026 (+40-60%). Partnerships or M&A with big pharma remain a strategic wildcard.

CADL is not a lottery ticket biotech, it's a thesis of validated science with clear asymmetry, The BLA, has a high binary risk (delays in BLA could take it to $3-4, -30-44%), but substantial base and upside ($10-14 base scenario +75-146%, $15-20 optimistic scenario +163-251%) if it executes. For the investor who tolerates volatility and understands the weight of regulatory milestones, it is that beacon that shines when the sector shuts down, not a blind moonshot, but execution with a timetable towards 2027. If the pipeline confirms, appreciation will follow.