Entering the Spanish market, which is not our main focus but an area that we constantly monitor for emerging opportunities, Izertis S.A. ($IZER) stands out as a technology company with a sustained growth profile and a strategic roadmap for comprehensive digital transformation.

Izertis operates in segments such as technology consulting, artificial intelligence, cyber security, data & analytics, cloud, systems integration and business solutions, The company has a competitive positioning within the European IT services ecosystem. In recent years it has shown a rate of organic and inorganic expansion, driven by acquisitions and by its strategic plan, which prioritizes business scalability, sector diversification and internationalization.

Here is a table with the current price and a estimation of valuation scenarios, I establish based on its operating performance, compliance with the strategic plan and the sector's medium/long-term growth expectations:

| $IZER | CURRENT | PESSIMISTIC | NORMAL | OPTIMIST |

| PRICE (EUR) | 10.50 | 9.00 | 13.00 | 16.00 |

| UPSIDE/DOWNSIDE | - | -14% | +24% | +52% |

*The target prices are based on projected growth in operating margins, consolidation of the digital projects pipeline, the largest contribution of high value-added services and the progress of the strategic planwith upward adjustments in the event of new acquisitions, accelerated international expansion or improvements in revenue recurrence.

Izertis S.A. (IZER)

Izertis is a Spanish technology consultant, mainly specialized in digital transformation e innovation, offers comprehensive services to help companies optimize their processes through advanced technologies such as artificial intelligence, cybersecurity, cloud computing y software development.

Its approach is based on strategic consulting to the implementation of customized solutions, primarily dedicated to the following sectors banking, insurance, industry, public administration y telecommunications. Its objective is to promote the operating efficiencythe customer experience and the sustainable growth in the digital environment. To put it simply, Izertis acts as a technology partner, designs and deploys systems to enable the company to compete in the digital age, using tools such as cloud platforms y data analysis to solve complex problems efficiently.

Your business model combines organic growth with strategic acquisitions, which allows you to expand its global presence y diversify its portfolio of services, minimizing risks associated with dependence on local markets or obsolete technologies.

It was founded in 1996 and is headquartered in Gijón, Spain. Izertis has evolved from a local firm to a global international organization with operations in more than 25 countries, including production hubs in Europa, Latin America e India. Currently, it is in a consolidated expansion phase, having contributed to the Continuous Market of the Spanish stock exchanges since July 2025, after his initial departure to the BME Growth in 2019.

$IZER: Key Fundamentals and Potential Value

With a stable financial position in the sector of technological consultancy, is mainly characterized by a sustained growth in revenues and profitability, driven by strategic acquisitions, international expansion and a focus on high-value services like artificial intelligence, cybersecurity y digital transformation. It has a market capitalization of approximately €351.4 M, positioning itself as a large actor in the technology services segment, outperforming sector peers (€69.63 M) in operating scale and geographic diversification, and also above the sector average (€94.37 M). Your recurring revenue model is based on consulting, implementation of solutions and maintenance, with operations in more than 25 countries and a strategic pipeline under the plan «Izertis 2030», which points to a significant expansion in key markets such as Europe and Latin America; we will develop this further below.

Taking into account the IZER valuation indicators, These reflect a moderate premium with respect to its peers, backed by a projected growth outpacing the sector. Presents a P/E trailing P/E of 55.0x, above the average of pairs (8.8x) and of the sector (11.7x), which indicates high confidence on its earnings trajectory. The PEG ratio of 2.21 is higher than the peer average (0.08) and sectoral (0.01), which suggests a less attractive growth-adjusted valuation, The company's focus on innovation is offset by its strong focus on innovation. Its P/BV multiple of 3.3x is competitive with 2.3x of pairs y 2.4x of the sector, highlighting a well-valued asset basewhile the P/S of 2.0x is above pairs (0.5x) but below the sector (2.3x). The estimated upside potential of 24.4% aligns with the sector (24.4%), although it is well below the 80.3% of pairswith a discount to fair value of the 4.4% versus 18.2% of pairs y 4.4% of the sector.

Currently IZER does not distribute dividends, aligned with peers and sectors that do not do so either, which denotes a reinvestment priority, expansion and acquisitions.

The IZER's total assets amount to €274.7 M, clearly superior to its pairs (€70.15 M) y sector (€128.5 M), reflecting aggressive growth investments. The net income from related parties (€6.40 M) contributions stand out in a context of international expansion. The operating income (€12.73 M), together with a total debt of €109.4 M, being far superior to pairs (€16.05 M) y sector (€8.85 M), This shows a aggressive growth strategy, IZER invests heavily, accumulates more assets, is supported by intercompany revenues and maintains a level of senior debt, a sign of a expansionary bet with higher financial requirements.

IZER shows far superior dynamism in growth metrics, with a 18.4% year-on-year increase in revenues, reaching €173.4 M, against the 1.5% of pairs y 6.9% of the sector. The 5-year earnings CAGR of 23.3% far exceeds the 4.3% of pairs and the 7.0% sectorial. The net operating income growth of 27.11TP3Q3, together with a CAGR of net income of 78.0% versus 15.6% of pairs y 10.7% sectorial, shows a expansion well ahead of the market. With growth projections of 25.9% (vs. 2.4% pairs y 5.4% sector), the company is well positioned to achieve its 500 M revenue target by 2030.

The IZER's profitability is robustwith a gross profit of €29.44 M and a net margin of 3.7%, exceeding the 1.8% of pairs y 2.6% sectorial. The ROIC of 5.5% is located above the 4.7% of pairs y 3.1% of the sectorwhile the ROA of 2.7% exceeds 2.1% pairs y 2.1% sectorial. The ROE of 6.5% is below the 8.5% of pairs, although higher than the 4.2% sectorial, and the 7.2% average ROCE compares favorably with 6.1% pairs y 5.2% sector. Overall, IZER maintains a solid profitability, outperforming the sector in most key metrics, showing consistent ability to generate value in an expanding technology market, relying on higher-margin lines of business such as IA y cybersecurity.

IZERTIS 2030

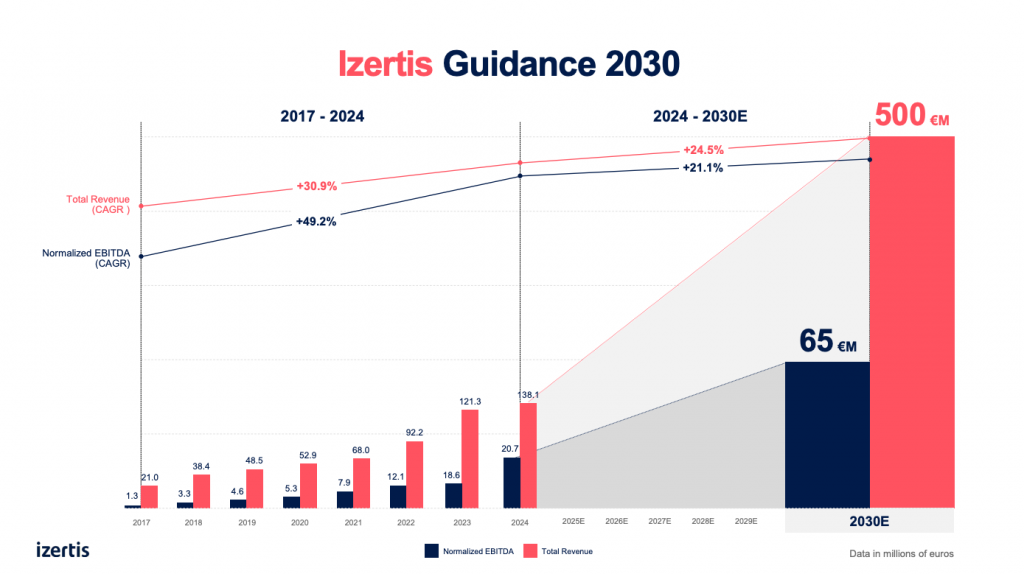

The September 10, 2025, Izertis presented its strategic plan «Izertis 2030», representing a comprehensive framework designed to propel its growth into new horizons. This document, communicated as insider information in accordance with article 226 of the Securities Markets and Investment Services Law 6/2023, establishes clear financial goals:

- Reach 500 M in total revenues y 65 M in normalized EBITDA for the year 2030.

This represents triple the current size of the company, based on the 138.1 M in revenues y 20.7 M in normalized EBITDA reported in 2024. This projection is based on a compound annual growth rate (CAGR) approximate 23.8% in revenues and of the 20.9% in EBITDA, figures that outperform historical performance but are aligned with the company's trajectory of accelerated expansion.

Entering into the analysis of the document itself, “Financial Guidance IZERTIS 2030”.”, available at CNMV official website, reinforces the strategic ambition and its desire to consolidate its position as a leading company in the major technology player in Europe.

Relevant to the document is its disclaimer, which underlines the prospective nature of the projections. These do not constitute guarantees, but estimates subject to risk and to changes in the environment or corporate strategy. This clause protects the company and remember that the non-GAAP information, as normalized EBITDA, should be interpreted in conjunction with audited data. From a strategic point of view, it allows Izertis to communicate objectives without absolute commitments, reinforcing the stakeholder confidence by openly acknowledging the uncertainties that could affect results.

In its corporate summary, Izertis presents itself as a leading digital consulting firm, specializing in digital transformation e innovation. With revenues of €138.1 M in 2024a 15% EBITDA margin and a staff of 2,274 professionals, evidence of a solid operational base. The 478% magnification in the share price from 2019 and a market capitalization of €282.2 M in August 2025 reflect value creation and a good positioning after its transition to the Continuous Market. This performance, together with a CAGR of 26.6% in revenues and of the 38% in EBITDA (2021-2024), supports the credibility of its long-term objectives, although it also evidences sensitivity to the availability of specialized talent in a highly competitive industry.

The distribution by sector and business lines responds to a strategy of diversification limiting concentration risks. For 2025, The income is divided between:

- Public sector and healthcare (30.6%)

- Banking and insurance (30.3%)

- Industry and services (26.7%)

- Telecommunications and energy (12.4%)

By lines of business, the following stand out:

- CX and Business Solutions (40.9%)

- Consulting and governance (22.7%)

- Areas of high margin like artificial intelligence (3.8%) y cybersecurity (6.7%)

This mix is aligned with global digitalization trends and supports upper margins, although it is relevant to monitor regulatory changes o adverse economic cycles.

The described milestones reflect the evolution of Izertis since its founded in 1996 in Gijón until its consolidation as a multinational with presence in more than 25 countries and production centers in Europa, Latin America e India. The projected geographic distribution by 2025 shows a relevant weight of Spain (66%), but also opportunities in Latin America (10%) e India (5%), which provides scalability to the plan although it introduces risks associated with currency, regulation and market maturity.

The inorganic growth constitutes another essential pillar. From 1998, Izertis has completed 43 acquisitions, driving revenues from 21 M in 2017 to 138.1 M in 2024. This strategy allows rapidly enter new technologies and markets, generating synergies, although it involves challenges as operational integration, associated costs and cultural harmonization.

The financial projections the plan consolidate the strategic vision of the company. Based on four levers —international expansion, production flexibility, strategic acquisitions y high-value services—, “Izertis 2030” is looking for a growth well above the sector average and a enhanced positioning in areas such as IA, data y digital transformation. Even so, the achievement of these objectives will depend on a disciplined execution in an uncertain environment. It is a plan ambitiouswith proven track record of growth y ability to generate long-term value within the European technology ecosystem.

$IZER: Key Catalysts and Price Scenarios

Izertis is currently positioning itself for several potential catalysts that could influence its valuation and performance, prioritizing aspects such as recent acquisitions, financial projections and sector dynamics.

1. Implementation of the Strategic Plan «Izertis 2030».»The aforementioned plan represents a key catalyst in the medium/long term. Following the international roadshow held in September and October 2025 in cities such as London, Paris and Madrid, updates on progress on international expansion and high-value services (such as AI and cybersecurity) are expected. Any progress announcements in Q1 2026 could boost investor confidence, especially considering the historical CAGR of 26.6% in revenue between 2021 and 2024.

2. Fourth Quarter and Fiscal Year 2025 Financial Results Report2025 full year results are anticipated to be published in the coming months, possibly in February/March 2026, in line with standard Continuous Market practices. Given the 18.9% growth in revenues during 1H2025 (reaching €78M) and a normalized EBITDA of €11M, a strong year-end could validate the 2030 plan projections. This event is a recurring catalyst, as it could reveal improvements in margins (currently at 14.1%) and debt ratios (net to EBITDA of 2.9x at the end of H1), boosting the attraction of institutional investors.

3. Strategic Acquisitions and Inorganic ExpansionWith a track record of 43 acquisitions since 1998, Izertis has demonstrated its ability to integrate operations to accelerate its growth. Recent moves include the acquisition of Grupo ICA's digital transformation business in October 2025, which strengthens its presence in Spain, and the purchase of Central American group Coderland's 50% in April 2025, expanding its footprint in Latin America. Additional announcements are expected in the near term, driven by the focus on value-accretive M&A, as highlighted in BME Growth's April 2025 analysis. Such deals could act as immediate catalysts, raising the current market capitalization of approximately €351.4M.

4. Sector Awards and Recognition: The recent Capital 2025 Award for Innovation and Technology, received in November 2025, highlights Izertis' position in the technology ecosystem. Similar events or future certifications in AI and cybersecurity could generate positive momentum, especially in a context of European digital transition.

- Potential Partnerships or Acquisitions in Emerging MarketsAnalysts and investment forums speculate on possible additional expansions in India and Latin America, aligned with the 2030 plan. Unverified rumors suggest interest in AI startups, driven by the current low weight of this business line (3.8% of revenues in 2024), although they lack concrete evidence.

- Impact of the Temporary Suspension of the Liquidity ContractIn November 2025, Izertis announced a temporary suspension followed by reactivation of its liquidity contract, which has generated murmurings about adjustments to the financial structure to fund growth. Some investors interpret this as preparation for equity or debt issues, potentially linked to M&A, although the company has not provided additional details.

- Stock SpeculationsAnalysts on platforms such as Yahoo Finance/Marketscreener are discussing analyst projections that anticipate a potential upside of 24.4%, based on the trailing P/E of 55.0x. Rumors point to a possible positive re-rating if intermediate targets of the 2030 plan are met, although concerns persist about volatility in the technology sector due to macroeconomic factors.

$IZER: Revaluation Scenarios

In a optimistic scenario, The company's «Izertis 2030» plan is being accelerated by means of additional strategic acquisitions, more than 25% annual revenue growth driven by high-value services such as AI and cybersecurity, and a successful expansion into international markets such as Latin America and India, the target price would be around 16 EUR, involving an upside of +52% above current levels of approximately 10.50 EUR. This scenario assumes a favorable digital demand environment, EBITDA margins above 15% and possible alliances with large technology companies, raising market capitalization beyond €500 M and reinforcing the confidence of institutional investors.

In a baseline/standard scenario, The company would maintain a stable organic growth rate in line with analysts' consensus, reaching revenues close to €200-250 M by 2027 through gradual integration of acquisitions and geographic diversification. 13 EUR, reflecting a upside of +24% above current levels, supported by the normalization of operating costs, continuity in innovation policies in the EU and a normalized EBITDA growth of 10-15% per year. Even so, in a pessimistic scenario, a slowdown in acquisitions due to economic volatility, delays in the adoption of emerging technologies, or intensified competition in the consulting sector could limit appreciation, putting the target price around 9 EUR, equivalent to a downside of -14%. Even taking into account the sector context would remain favorable due to the global digital transition and Izertis' resilient track record, offering fundamental support even in an adverse environment.

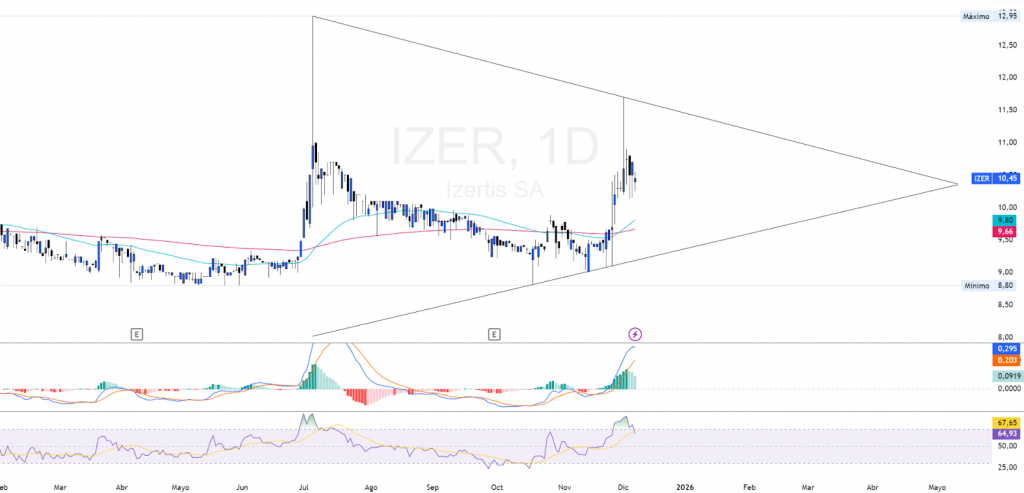

$IZER: Technical Analysis - Bearish Structure and Trend Break Signals

Izertis is listed on the Spanish market and currently holds a bearish technical structure on the daily chart, it is located within a descending triangle reflecting continued selling pressure.

The price pattern is defined by falling peaks from the 12.50 EUR registered in July and a horizontal support between 9.50 and 10.00 EUR. Although the rebound from the 8.50 EUR October shows some recovery, the main structure remains intact. Only one sustained break above 11.00 EUR would invalidate the bearish pattern and enable a move towards 12.00-12.50 EUR. On the other hand, the loss of EUR 10.00 exposes a descent into 9.00 EUR, relevant technical and psychological level.

About indicators, RSI at 67.14 signals overbought, which could determine an upcoming downward move, Positive MACD and with possible turnaround signals. The price is trading at above the 50 and 200 moving averages, with a crossover several days ago. Volume, below average in the rebound phase, indicates lack of buying conviction.

Critical levels are concentrated in 9.86 EUR as support y 11.70 EUR as main resistance. The breakout of any of these ranges will determine the direction of the next trend movement. A break would activate a theoretical target between 9.68 and 8.82 EUR.

It currently retains a bearish technical profile, with possible tactical rebounds as long as support is maintained. Validation of any scenario requires increase in volume y confirmation in closings. Follow-up of corporate upgrades linked to Izertis' strategic plan will be key to identifying changes in momentum and market perception.