One of my main investment strategies, and also one of my best performers, is to identify small pharmaceutical companies in the biotech sector that have a strong track record in the pharmaceutical industry. high appreciation potential. I rely primarily on three fundamental pillars: Differential science, upcoming clinical milestones y risk-benefit asymmetry. The approach I take combines an in-depth analysis of therapeutic platforms with the search for optimal entry windows, usually linked to clinical, regulatory or strategic catalysts, potential acquisition rumors, etc., mainly with the objective of maximizing the convexity of each operation.

During the last few months I have applied this strategy and, in this article, I will review each of the companies in which I have made trades, analyzing their performance and the days they have remained open.

Below is a table with the cumulative returns of each position and the days elapsed since the opening of each trade, before entering into the analysis:

| FULL NAME | TICKER | PURCHASE PRICE ($) | CLOSING PRICE ($) | PERFORMANCE (%) | DAYS |

| Aurinia Pharma | $AUPH | 8.23 | 15.68 | +112.77% | 370 DAYS |

| Sana Biotechnology | $SANA | 2.85 | 5.96 | +109.17% | 267 DAYS |

| Syndax Pharma | $SNDX | 9.37 | 14.31 | +52.74% | 45 DAYS |

| Crinetics Pharma | $CRNX | 1.30 (CALL) | 4.30 | +230.77% | 3 DAYS |

| Zevra Therapeutics | $ZVRA | 8.17 | 9.01 | +10.28% | 1 DAY |

| Achieve Life Sciences | $ACHV | 2.98 | 4.30 | +44.30% | 24 DAYS |

| Gain Therapeutics | $GANX | 2.35 | 3.00 | +27.66% | 2 DAYS |

| Gossamer Bio | $GOSS | 2.47 | 3.18 | +28.74% | 10 DAYS |

In several cases we opted for exit the position, not because of a lack of conviction in the future development of the company, but in order to unlocking liquidity and redirect capital to new opportunities. The decision was supported by quantitative models used, which indicated that the return obtained in the short term was more than acceptable from a risk-benefit perspective.

This methodology allows me to capture asymmetric movements without giving up on re-entering in the future. In fact, in all of these companies, I maintain a constructive bias in the medium and long term, I do not rule out reopening positions if the prices, clinical milestones or valuation metrics come back in line with my entry criteria.

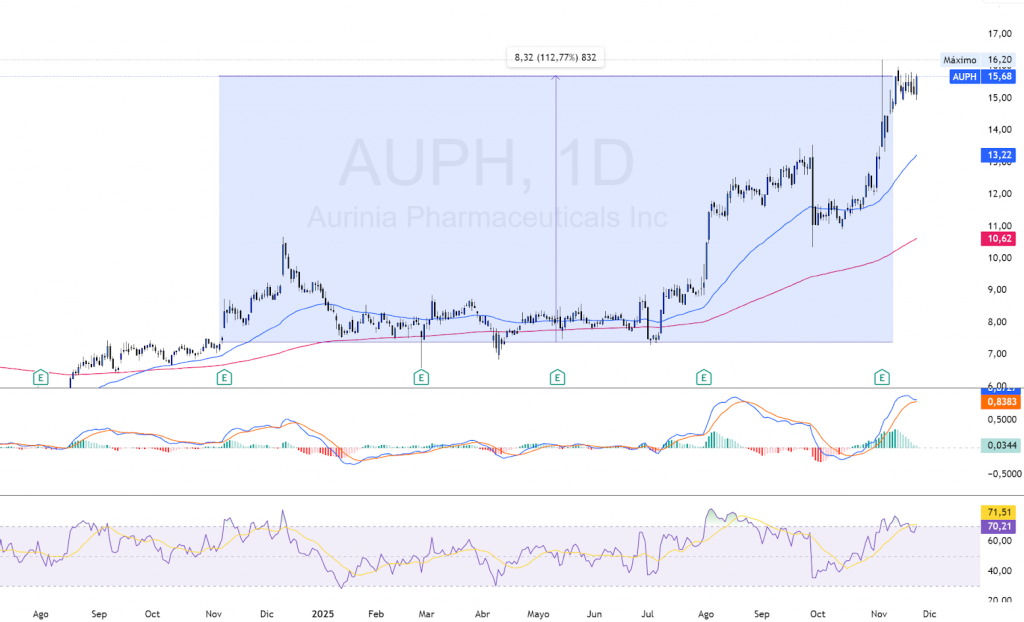

Aurinia Pharma ($AUPH)

Aurinia is focused on therapies for autoimmune diseases, it is interesting as it consolidates its position in 2025 driven by the performance of LUPKYNIS® (voclosporin), The first FDA-approved oral treatment for active lupus nephritis. The company reported total revenues of ~205.9 M USD (+17% YoY)with LUPKYNIS net sales of ~197.2 M USD (+24%). Raising your 2025 roadmap to 275-280 M USD, supported by sustained demand, operational improvement and pipeline progression (including forthcoming studies of aritinercept - AUR200).

We started with options on the asset and subsequently migrated to equities, obtaining a return of +112.77% at about 370 days, the longest duration operation in all of them. This transition from derivatives to equity allowed us to capture greater initial convexity and, subsequently, to consolidate the position with a more stable risk profile, also given the situation at that time, with delays in the publication of relevant information, and seeking to maximize return without increasing nominal exposure.

Sana Biotechnology ($SANA)

Sana focuses on modified cell therapies for serious pathologies, advanced in 2025 by prioritizing key programs on its platform hypoimmune (HIP).

The company closed the quarter with 153.1 M USD on hand, and a balance of pro forma of USD 170.5 M after the latest ATM operations, extending its runway until the end of 2026. SANA raised 115.8 M USD gross in the quarter through ATMs and equity, offsetting a operating use of USD 111.2 M. GAAP net loss was reduced to 42.2 M USD (0.16 USD/share), a decrease of 30% year-on-year.

Unlike AUPH, in this operation we work exclusively with equities, obtaining a yield of +109,17% in 267 days. The purely equity structure allowed us a linear exposure to the movement of the asset, optimizing the capture of upward momentum without adding derivative complexity. Management is based on price discipline, risk control and continuous validation of catalysts, which allowed us to maximize returns within a time horizon that, for us, is long.

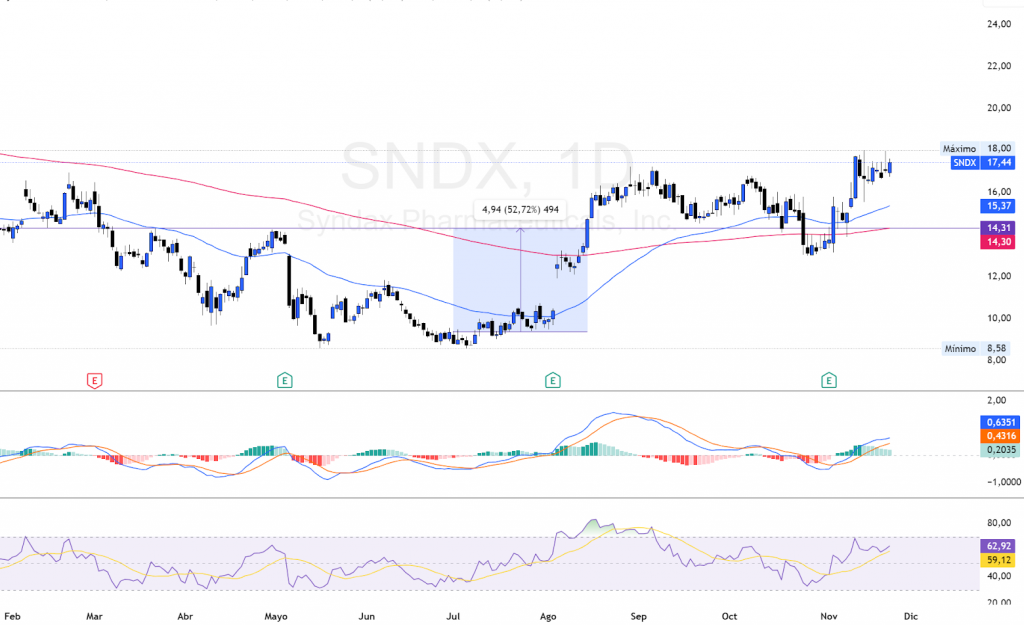

Syndax Pharmaceuticals ($SNDX)

Reviewing Syndax, it is a biotech focused on oncology and advanced immunology, with two FDA-approved assets: Revuforj® (revumenib) for AML with KMT2A rearrangement and Niktimvo™ (axatilimab) for cGVHD after multiple lines of treatment. Both form the company's commercial base, while the pipeline expands indications into mutation. mNPM1, pulmonary fibrosis and new combinations in oncology.

The central catalyst was the FDA priority review (PDUFA 10/25/2025) to extend Revuforj to patients with mNPM1 mutation, representing 30-35% of AML cases. An approval would multiply by 3-4 times its target market, transforming Revuforj into the menin inhibitor with the broadest genetic spectrum in the industry. The company already has accelerated designations (RTOR, Breakthrough), which increases the likelihood of regulatory success.

In parallel, another of its drugs, Niktimvo, provides initial commercial revenues, strengthened by an agreement with Royalty Pharma for 350 M USD, which improves liquidity and reduces the need for dilution. SNDX closed Q1 2025 with ~602 M USD in cash, sufficient for ~21 months of operational runway.

At the valuation level, SNDX was trading at ~0.08-0.10x the projected 10-year cumulative income (approx. 7,590 M USD only with Revuforj), well below the range of the 0.26x-0.78x observed in comparable M&A transactions. In scenarios of total pipeline expansion, the addressable market would reach 12,000-16,000 M USD, with theoretical valuations ranging from 15,000 M and 80,000 M USD under standard biotech multiples.

At 45 days we obtained a yield of +52,74%, many days prior to the binary catalyst, we opted for a early departure, since the upside achieved in such a short period of time was already considerable and we prefer to reduce exposure before the binary event, The management was based on price discipline and continuous validation of expected catalysts. Management relied on price discipline and continuous validation of expected catalysts. All this is something I do, and I will repeat it later, as the saying goes: “A bird in the hand is better than a hundred in the air”.

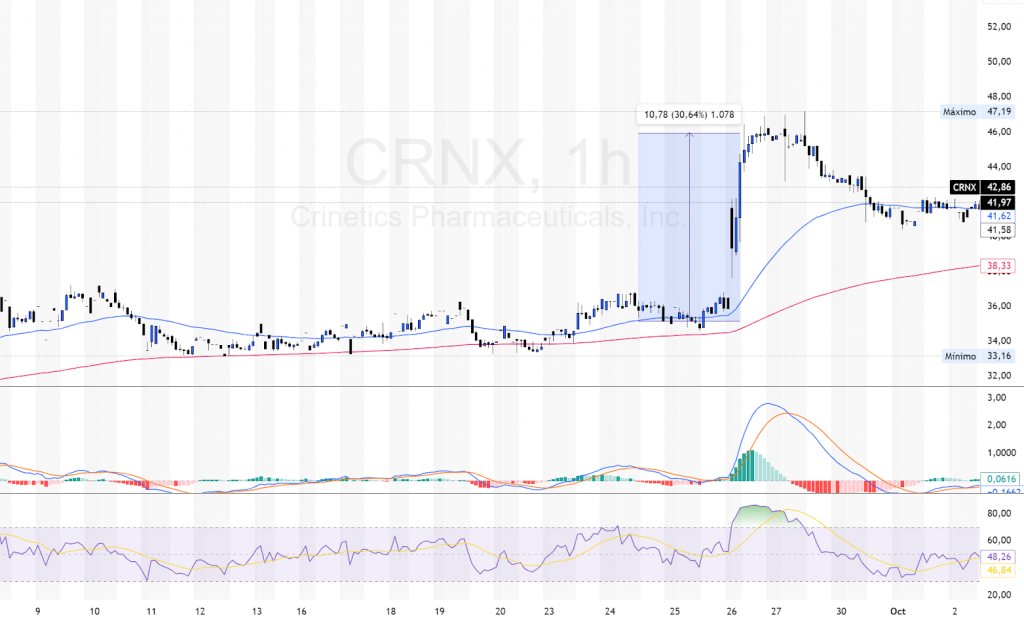

Crinetics Pharma ($CRNX)

Crinetics is a biotechnology company focused on oral therapies for rare endocrinology, with paltusotine as the main catalyst was its PDUFA of the 25/09/2025 and a pipeline that includes atumelnant y CRN12755. It had a strong financial position (~1.2 B USD in cash), high institutional ownership and target prices that pointed to significant upside potential, see their developed analysis. here.

On September 25, 2025 the FDA approved paltusotine, and the move in CRNX confirmed exactly the scenario I saw anticipated. The structure of the options market, IV at 99th percentile, OI put/call ratio at 0.07 and clearly directional flow into calls, pointed to an interesting catalyst.

The operation that I carried out was an entry in the Call 40 OCT-25 on September 24 at 1.30 USD and departure on Friday after approval to 4.30 USD, with a yield of +230.77% in two days (the premium reached 7.10 USD intraday, +446%). The share rose more than 25%, but the convexity of the derivative allowed it to multiply more than 3.3 times the initial capital. You can learn more about the performance of the operation. here.

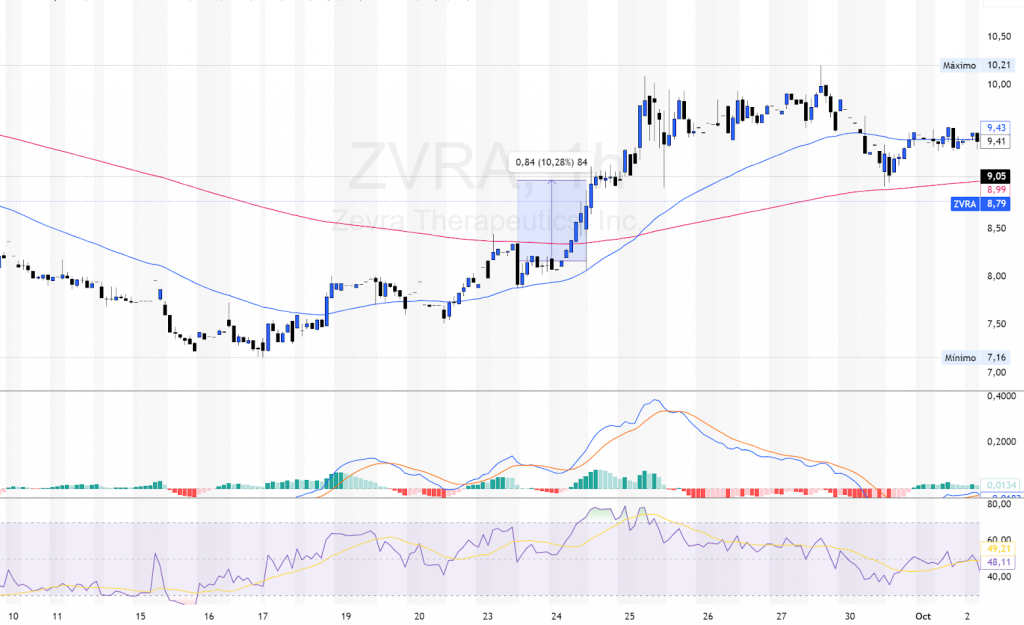

Zevra Therapeutics ($ZVRA)

Zevra, again, is a biotech company focused on rare diseases, with MIPLYFFA as the main commercial driver and a pipeline that includes arimoclomol and sleep disorders programs. The company combined strongly expanding revenues, strengthened liquidity following the sale of its PRV and an extended runway to 2028. The key catalyst in the near term is the progress of KP1077 in narcolepsy and hypersomnia, with results and clinical phases expected in H2 2025. Here you can see the full analysis and all relevant details.

On this occasion, we opted for an immediate exit after an initial movement, mainly prioritizing risk management and avoiding unnecessary exposure in a still volatile environment. We closed the position with a +10.28% in only 1 day, The market is a very short period of time, ensuring an acceptable return without waiting for the catalyst in the background. This type of quick execution is part of my approach when the market offers a clear return in such a short period.

Achieve Life Sciences ($ACHV)

Achieve is also a biotechnology company, focused on cytisinicline, its lead smoking cessation asset, currently undergoing advanced clinical review and with a PDUFA planned for the next three years. June 2026. The company operates with no revenues, high losses but with a strengthened cash position that extends its runway to 2027. The key catalyst is the regulatory approval of cytisinicline, in a global market of over 5,200 M USD. This company has one of the largest potential markets of all those mentioned, you can develop the analysis I did. here.

With a yield of +44.30% in just 24 days, we closed the position without waiting for the main catalyst. Again, we opted to lock in the return, unlock liquidity and limit additional exposure, always maintaining the disciplined management that I apply in operations of this type.

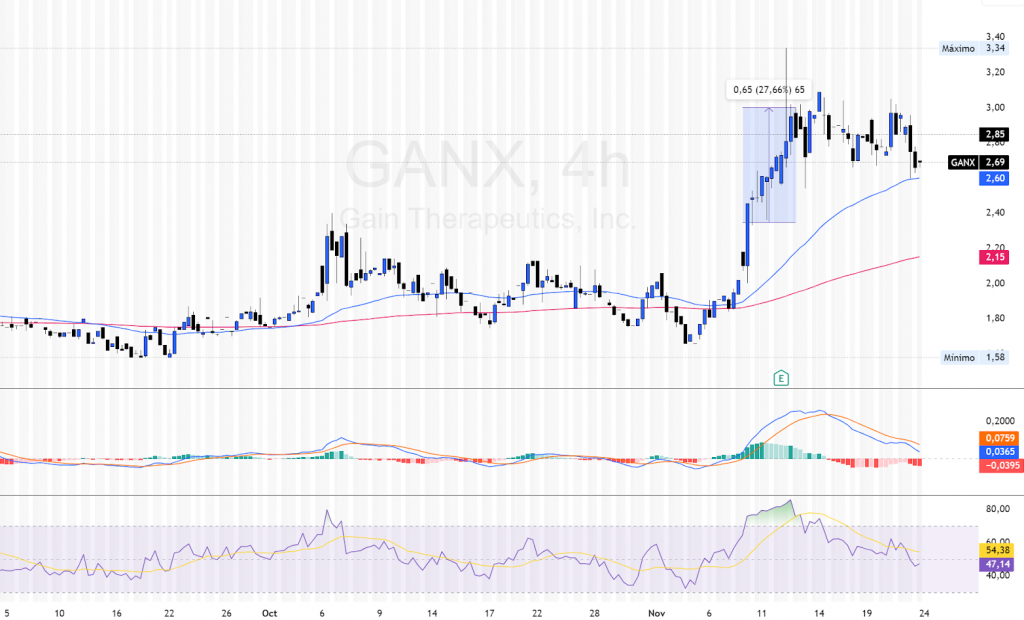

Gain Therapeutics ($GANX)

Gain, again, is a clinical-stage biotech focused on precision therapies for neurodegenerative diseases, with GT-02287 as a major asset at Parkinson-GBA and a proprietary computational platform (Magellan™.) that identifies “hidden” allosteric sites in proteins. The company operates on a non-revenue basis, with limited but sufficient liquidity to cover nearby catalysts, and with high speculative potential in the face of Phase 1b data and possible transition to Phase 2 in 2026. You can view the full analysis and detailed development here.

In only 2 days our position reached +27.66%, We decided to close without prolonging risk, prioritizing short-term profit over momentum. We opted to close without prolonging risk, prioritizing short-term profit for momentum.

Gossamer Bio ($GOSS)

Last but not least, Gossamer is a late-stage clinical-stage biopharmaceutical focused on rare lung diseases with seralutinib as lead asset in two Phase 3 studies (PROSERA in PAH and SERANATA in PH-ILD). The company combines a differentiated pipeline based on inhaled therapies and a high risk profile typical of the sector, with key catalysts between 2025-2026 that can potentially redefine its current valuation. You have here full analysis and development

On this occasion, in the short term, with only 10 days, we closed the position with a yield of +28.74%, We have been able to secure the expected move without waiting for the main catalysts. Again, we opted to materialize the early momentum you gave me and limit additional risk, thus avoiding entering into high volatility scenarios that can result in a considerable loss.