At different times in the market cycle, where (healthy) corrections exist, I have always used the same strategy:

Protecting my exposure by buying calls on index-linked and leveraged ETFs when I detect an imbalance between volatility, momentum and correction risk. I have already used this methodology and, given the current conditions, I have implemented it again, and will continue to do so.

On this occasion, and after the recent slight correction, the approach is the same, calls OTM with strikes 8-10% above the underlying, and in this case as a position SPXL 220 JAN16’26 (again if I remember correctly). The objective is the same as in previous cycles, to maintain participation in a possible upward leg while limiting the risk to the premium and I retain flexibility to reopen exposure in futures, which I already did, averaging futures and earning some profitability on this trade.

What sets this strategy apart, and the reason why I repeat it and will continue to do so, is its asymmetric structure, a fixed risk from the outset, open upside, and time management based on renewing the position before entering the critical loss of value zone. This simply focuses me on acting systematically, avoiding unnecessary premium deterioration and moving exposure to maturities where convexity is more efficient, or moving directly to futures.

Through ETFs such as SPY, QQQ, SPXL or TECL, because I can replicating the market bias without bearing the full directional risk. If the market continues to rise, the option accompanies me, if a certain correction is confirmed, the loss is contained and allows me to return to my futures positioning from a more advantageous level, exactly as I did in the previous run.

I show you the performance below.

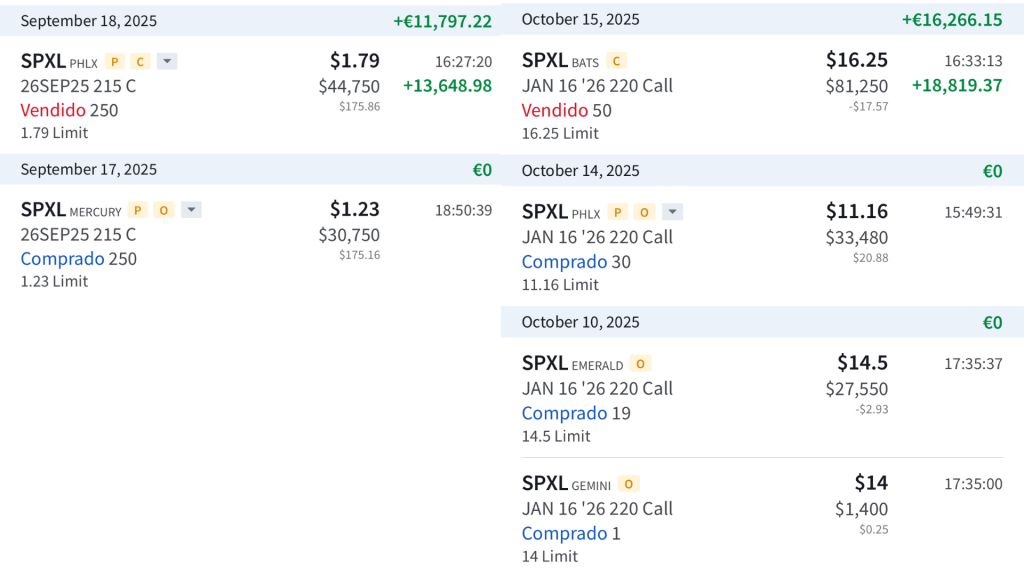

LONG OPERATION: SPXL STK 220 VTO 16/01/26

I resume the long strategy on SPXL STK 220 at maturity 01/16/26, I have already implemented this structure in previous phases of the market and it has delivered consistent results under the same risk and time management framework.

On this occasion, I obtained the following returns from this operation:

- First time: Entrance to 1.23 and output to 1.79, with an approximate yield of +45%.

- Second time: Entrance to 12.49 and close in 16.26, equivalent to a return close to +31%.

Both operations share exactly the same logic, risk limited to the premium, sufficient convexity to capture moderate upside legs and systematic rollover of the position before entering the downside zone.

If you would like to know more about the complete structure of this methodology, why I repeat it and how I manage it, please see here.

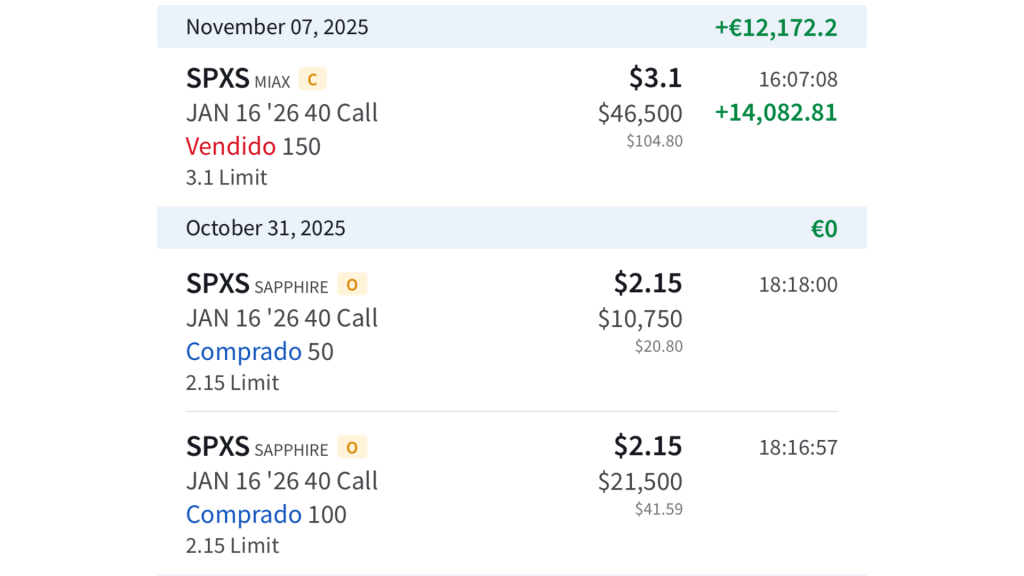

SHORT OPERATION: SPXS STK 40 VTO 16/01/26

Rethinking my tactical strategy once again with a short position with SPXS STK 40 at maturity 16/01/26, This is exactly the same structure that I have already used in similar scenarios to capture movements but this time in short.

In the trade with the same configuration, I was able to take advantage of the volatility phase and close the trade with the following performance:

Entry at 2.15 and exit at 3.10, equivalent to an approximate yield of +44%.

The logic of this structure is not simply to replicate the previous trade, but to use it again in a context where the relationship between momentum, implied volatility and probability of correction is once again favorable. SPXS, as a leveraged inverse ETF of the SPX, allows a bearish tactical view to be expressed without the need to resort directly to futures or directional shorts that require margin, with potentially unacceptable losses.

With a long maturity and a strike selection capable of accompanying the gamma convexity, with the position I seek to capture a potential tightening movement while keeping the risk circumscribed to the initial cost. If the market confirms a correction, the convexity accelerates the impact on the premium, if it does not, the loss is limited and the repositioning plan remains intact (with futures, as mentioned above).

Whoever wants to review the complete functioning of this methodology, again, can go into more detail. here.