In the field of rare neuromuscular diseases y new generation gene therapies, within the universe of biotechnology companies in the clinical phase, Dyne Therapeutics Inc. ($DYN) stands out as a speculative bet with a clear risk/return asymmetrya company focused on DMD, DM1 and FSHD through its platform FORCE™, with high cash burn today, but with direct exposure to a potential market of >10,000 M USD in therapies for rare diseases.

Before entering into the analysis, I leave a table with the current price and the estimated valuation scenarios, where I, Diego García del Río, I approach them on the basis of medium/long-term operational and financial potential, as well as the degree of clinical/regulatory success (DYNE-251 and DYNE-101) and the implementation of the commercialization plan from 2026 onwards.

| $DYN | CURRENT | PESSIMISTIC | NORMAL | OPTIMIST |

| PRICE (USD) | 18.70 | 10.00 - 12.00 | 30.00 - 36.00 | 40.00 - 50.00 |

| UPSIDE/DOWNSIDE | - | -35% to -45% | +60% to +92% | +115% to +167% |

*Target prices are based on the probability of accelerated approval from DYNE-251 (DMD) y DYNE-101 (DM1), the estimated size of the market for rare neuromuscular therapies, the evolution of liquidity and the risk of dilution.

The stage optimist assumes superior clinical data and regulatory performance without delays, the standardized discounts a trajectory aligned with the current guidance and the pessimist incorporates suboptimal clinical readings, approval delays and/or new dilutive capital increases.

Dyne Therapeutics Inc. ($DYN)

Dyne Therapeutics is a biotechnology in clinical phase specialized in therapies new generation oligonucleotides for genetic muscle diseases. Its proprietary platform FORCE™ allows these treatments to be delivered accurately to the muscle tissue, central nervous system and affected organs, The use of the product has been shown to improve efficacy and reduce side effects outside of the target tissue.

It focuses on rare neuromuscular pathologies such as the Duchenne muscular dystrophy (DMD)the myotonic dystrophy type 1 (DM1) and the facioscapulohumeral dystrophy (FSHD), with the objective of restoring muscle function through targeted genetic corrections. In simple terms, DYN designs therapeutic molecules that specifically travel to the muscle, where they correct the genetic defect responsible for the weakness, avoiding affecting other tissues.

Founded in 2018 and headquartered in Waltham, Massachusetts, DYN is already operating in a stage of advanced clinical development, having reported in 2025 new Phase 1/2 data and obtained regulatory designations, including the FDA Breakthrough Therapy for your candidate DYNE-251 at DMD. The company maintains a strong liquidity position (~573.6 M USD), although it continues to have no operating income and reported a net loss of 108.14 M USD in Q3 2025, mainly derived from R&D investments.

Your first shipment for accelerated approval FDA filing is scheduled for Q2 2026, while its pipeline, with programs in DMD and DM1, points to a market for gene therapies for rare diseases estimated at >10,000 M USD in the coming years, which strengthens its position in neuromuscular biotechnology.

$DYN - Key Fundamentals: Biotechnology Model, Balance Sheet and Valuation Metrics

At the time of publication of this analysis Dyne Therapeutics is at. clinical phase, where it records high operating losses, The company's business model is based on the development of new products, mainly driven by intensive R&D expenditures and a high sensitivity to clinical results and regulatory announcements. Their model is based on developing oligonucleotide therapies for rare muscle diseases (DMD, DM1, and FSHD), using its platform FORCE™ for targeted delivery to muscle and nerve tissue, covering unmet medical needs in genetic neuromuscular pathologies.

It has a market capitalization of ~2,684 B USD, where it places it as mid-cap within the biotech sector, being well above the average of peers (576.7 M USD) and the sector (82.947 B USD). Its beta of 1.30 The volatility is higher than that of the market, which is consistent with the risk profile of companies in the same clinical stage.

On valuation, DYN trades with a PER of -6.3x, reflecting net TTM losses of -423.8 M USD, The company's financial results were worse than those of its peers (-3.1x) and the rest of the sector (-0.6x). The PEG of 1.92 suggests a certain overestimation in relation to expected growth (CAGR income >11%), while their P/B of 3.9x is well above the 1.9x of peers and 2.6x of the sector, driven by the value of intangible assets (R&D), which determines that its future expectations far exceed the current accounting balance. With no revenue, it has no P/S, yet comparables trade at ~6.2x forward, pointing to revaluation potential if its first product is approved at 2026.

On an operating basis, it continues to have no sales, with net TTM losses of -423.8 M USD (-43.9% YoY), while its peers recorded USD 61.52 M in revenues (-34.9% YoY). Spent 97.2 M USD in R&D in Q3 2025, in line with the progress towards accelerated submission expected for Q3 2025, in line with the progress towards accelerated submission expected for Q3 2025. Q2 2026. This is completely normal as it is not in the commercial phase. Growth projections exceed +16% after its first approval.

Its balance sheet shows some strength, 867.1 M USD in assets y ~USD 574 M in liquidity, which give it a 18-24 months runway with no immediate need for dilution. Total debt amounts to 120.5 M USD (13.9% of assets), slightly higher than peers (10.9%) but manageable compared to the sector (8.4%). sU's projected net income CAGR is ~11.8%, The company's clinical milestones and regulatory progress support an improvement.

In profitability, DYN has negative metrics that are to be expected at this stage of the company's business with a ROA -51.8%, ROE -60.7% y ROIC -50.1%. This reflects the efficiency in the use of assets (ROA), shareholder return (ROE) and return on total capital (ROIC), although lower than peers (ROA -28.8%, ROE -31.2%) and sector (ROIC 0.7%), which is explained by its pre-commercial stage.

On potential short squeeze, it has a short float 13.74% and a short ratio of 5.78 (~5-6 days to cover) remain at low levels with no prospect of growth.

$DYN - Key Catalysts: Clinical Data and Approvals

On the potential events that could determine the valuation trajectory of Dyne Therapeutics The following stand out:

- Q4 2025 - Additional data DELIVER (Phase 1/2, DYNE-251 - DMD)

Additional data from the Phase 1/2 DELIVER trial for DYNE-251 (z-rostudirsen) in Duchenne muscular dystrophy (DMD), with emphasis on high-dose cohorts and efficacy measures such as exon 51 skipping and dystrophin levels. This readout is critical to support the accelerated approval application to the FDA in Q2 2026, with potential launch in Q1 2027 under priority review. - Q4 2025 - Completion of ACHIEVE recruitment (Phase 1/2, DYNE-101 - DM1)

Allows to prepare data topline for mid-2026, possible to support a BLA in H2 2026 on consistency function on surrogate endpoints (including vHOT). - Q2 2026 - Submission of application for Accelerated Approval for DYNE-251

Backed by FDA designations: Breakthrough Therapy, Fast Track, and Rare Pediatric Disease.. Analysts are looking at a upside potential of +102% (target price ~80 USD) if regulatory milestones are met. - Mid-2026 - Data topline of DYNE-101 (DM1)

Multi-billion dollar market with high unmet need; positive results would accelerate Dyne's strategy in neuromuscular indications. - H1 2026 - Potential initiation of Phase 3 (DYNE-101) and preclinical breakthroughs

Includes progress in DYNE-302 (FSHD) y DYNE-401 (Pompe), The company's diversification of the pipeline was reinforced. - Target acquisition potential (M&A)

Following the purchase of Avidity Biosciences ($RNA) for Novartis for USD 12,000 M, In addition, the market speculates that Dyne could be the next candidate due to its greater efficiency in targeted muscle delivery, according to analysts. Specialized forums highlight strategic similarities and position DYN as “the next big player” in the oligonucleotide space.

Revaluation Scenarios

In a upward scenario, The company's two key programs are based on superior clinical data, DYNE-251 (DMD) y DYNE-101 (DM1), along with an accelerated approval by the FDA in 2026, the target price estimated would be between 40-50 USDwhich implies a upside potential from +115% to +167% from current levels (~18.70 USD). This approach assumes Phase 1/2 results with clear improvements in dystrophin (>30% from normal levels), validation of functional endpoints in DM1, strategic alliances with big pharma and a solid commercial ramp from 2027. Under this framework, the market capitalization would expand towards 6,500-7,500 M USD, This would reflect a considerable positive assessment in line with biotechs of late-stage gene therapies.

In a standard scenario/baseline case, with execution aligned to current planning, DYN is expected to present positive but non-transformative data in Q4 2025, with an accelerated approval application for DYNE-251 in Q4 2025. Q2 2026 and robust topline data from DYNE-101 at mid-2026. This scenario envisages sufficient liquidity (USD 400-450 M after potential moderate financing), maintenance of the short ratio at stable levels and reasonable multiple expansion. The target price would be located between 30-36 USD, which is a revaluation from +60% to +92%, The company has been approved mainly in a neuromuscular disease market valued at billions and a positive analyst consensus. Where it would obtain a capitalization of 5,000-5,300 M USD. Even so, considering a bearish scenario, conditioned by insufficient clinical data, such as low levels of dystrophin in DYNE-251 or limited efficacy of DYNE-101 in surrogate endpoints, regulatory delays beyond 2026, or new rounds of dilutive financing due to high cash burn, the price could fall back towards 10-12 USDwhich implies a downside risk from -35% to -45%. This case would assume higher operating costs (>100 M USD per quarter), drop in institutional confidence, pressure up to the valuation of 1,500-1,700 M USD and displacement in the commercial roadmap until 2028 onwards.

$DYN - Technical Analysis: Trend, Momentum and Decisive Levels

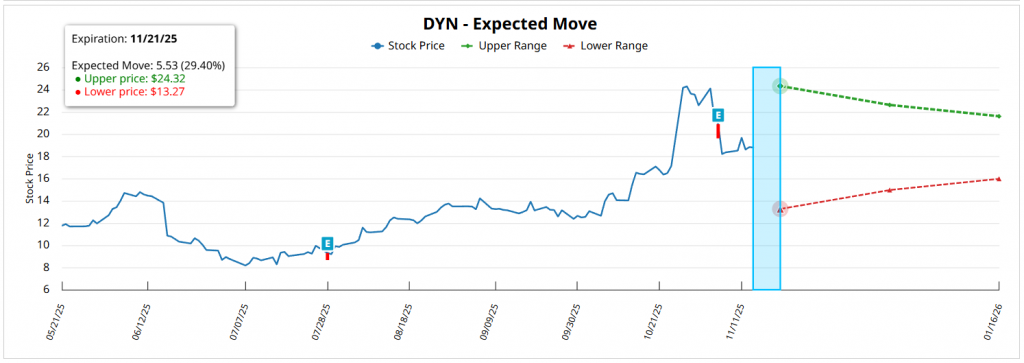

Entering at the technical level, as of the date of publication of this analysis, Dyne Therapeutics is in a practically mixed technical structure, since it maintains a bearish background bias after a downward trend that has dominated since mid-2024, but it shows recent signs of recovery after bouncing from the ~15.50 USD. It trades above the EMA 50 (~16.97 USD) and the EMA 200 (~15.63 USD), which poses a technical reboundwith a convergence of EMAs suggesting a possible change in trend.

On its momentum indicators, the RSI (14) is around average levels (50-60), after coming out of oversold territory in January; this behavior usually anticipates consolidation phases prior to a broader directional move. The MACD shows a recent upward crossover with a histogram progressively less negative, which indicates weakening of selling pressure and the possibility of continuing the rebound if the price remains above the moving averages. Even so, as long as the MACD does not sustainably cross at clearly positive territory, The technical backdrop remains vulnerable to any setback in the biotech sector.

In terms of technical levels, the immediate support is located in the EMA 50 (~16.97 USD), which coincides with the base of the rebound structure. A clear loss of this level would increase the probabilities of a correction towards the EMA 200 (~15.63 USD) and, in case of additional weakness, towards the September low at 13.50 USD, The breakout of which would open the door to a deeper bearish extension towards the 10.00-12.00 USD. At the top, the first relevant resistance is located at ~25.00 USD, level that coincides with the long-term downward trend and which was already rejected during the spike at the end of October. A break with growing volume above this zone would be the key signal that would confirm a change in technical bias and allow us to look for new bullish targets.

Right now it presents a technical structure still fragilebut with early signs of some strengthening. Overcoming the zone of 20.00 USD would be the trigger for a sustained upward movement, while the loss of 17.00-16.00 USD would invalidate the current rebound and reactivate the underlying downtrend.

$DYN - Option Chain: Sentiment, P/C Ratio and Expected Volatility

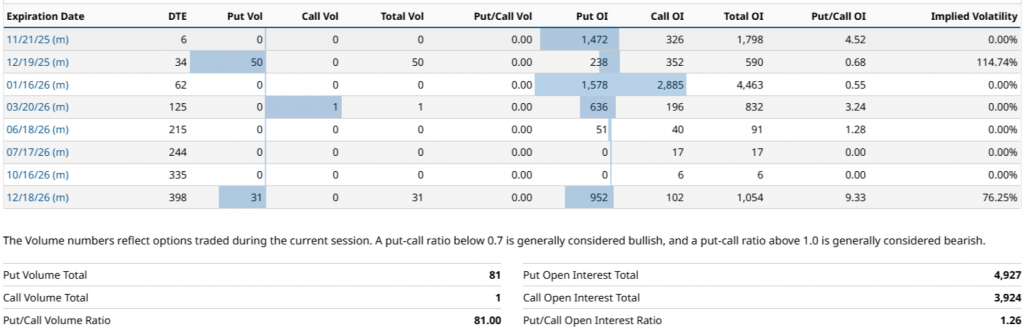

Based on the most recent option chain data, the market positioning of Dyne Therapeutics reflects a generally downward bias, determined by a higher concentration of RO in puts versus calls. In total, the OI amounts to 8,851 contractswith 4,927 puts y 3,924 calls, which places the Put/Call OI ratio at 1.26, a level that is usually associated with a more defensive market or one concerned about binary events in the short to medium term. Even so, this reading is not homogeneous, the expiration of the 01/16/26 (62 DTE) stands out as the point where the interest in call clearly dominates, accumulating 2,885 calls vs. 1,578 puts (ratio 0.55), making it the most relevant maturity in the chain and the only one with a sustained upward bias.

On the implicit movement, the maturity with the highest concentration, of the 01/16/26 (62 DTE), projects an expected variation of approximately ±14.97%, which places a theoretical range between 21.60-15.98 USD. In more immediate terms, the expiration of the 11/21/25 (6 DTE) anticipates a movement of the 29.40%, with an estimated range between 24.32 USD-13.27 USD, The market's long term exposure is mainly influenced by the strong weight of short term puts. For longer horizons, such as the expiration of the 12/18/26 (398 DTE), the implicit movement exceeds the ±50%, reflecting regulatory uncertainty and the dominant bearish positioning in long-dated puts, which act as an institutional hedge.

All this shows a divided landscape, and hedging in the short and long term, in the face of a clearly bullish cluster in January 2026, which is the market's strongest bet. This contrast suggests that investors are discounting elevated risk, but also remain alert to the possibility of a catalyst that could significantly alter valuation in the next 2-3 months.

Dyne Therapeutics Inc. Synthesis ($DYN)

Dyne Therapeutics is a mid-cap of the biotechnology sector directly exposed to the advance of the neuromuscular gene therapies, with a model based on new generation oligonucleotides delivered through its FORCE™ platform, a differential technology in precision and muscle selectivity. As of the date of publication of this analysis, it is at advanced clinical phase, This implies a total absence of operating income and significant losses derived from R&D and regulatory expansion, although it is supported by a pipeline with multibillion-dollar potential in DMD, DM1 and FSHD and by a solid liquidity (~US$574 M), which gives it between 18 and 24 months of runway without immediate need for dilution.

At the valuation level, DYN trades mainly on the basis of future expectations, with a negative P/E ratio (-6.3x), a PEG that indicates a premium over growth (1.92) and a High P/B (3.9x) which discounts intangible value of R&D rather than current assets. The company reflects typical pre-commercial firm, negative profitability metrics (ROA -51.8%, ROE -60.7%, ROIC -50.1%) and high sensitivity to clinical results, but ranking above peer average thanks to its superior mechanistic approach and relatively robust balance sheet structure. The market is currently discounting a combination of DYNE-251/DYNE-101 clinical results, accelerated approval probability, dilution risk and non-negligible possibility of M&A following Novartis' acquisition of Avidity.

From a technical point of view, the share shows a still fragile structure, but with early signs of recovery, trading above the 50 EMA and 200 EMA, RSI in the mid zone and MACD looking to turn upwards, although it remains contained under the main downtrend line (~25 USD). The key support is located at 16.0-16.9 USD, a loss would reactivate the downward leg towards 13.5 USD, while the overcoming of 20 USD would be the trigger to validate a change in trend.

The option chain reinforces the reading of high volatility speculative security, with a Put/Call OI ratio of 1.26, reflecting generalized downward pressure, but with a clearly bullish cluster concentrated on the expiration of the 16/01/26, where calls dominate notably. High IV in virtually all maturities anticipates wide ranges (±15-30% in the short term and >±50% in long horizons), consistent with an action dependent on nearby binary catalysts (readouts, trial completion, FDA decisions).

Priority catalysts that will determine the trajectory of the action:

- DELIVER (DYNE-251, DMD) Data - Q4 2025Dystrophin levels and skipping of exon 51.

- Completion of recruitment at ACHIEVE (DYNE-101, DM1) - Q4 2025.

- DYNE-251 Accelerated Approval Application - Q2 2026.

- Data topline DYNE-101 - mid-2026.

- Potential initiation of Phase 3 and preclinical breakthroughs - H1 2026.

- M&A rumors following the acquisition of Avidity for USD 12 billion.

As with other speculative ideas I have analyzed, Dyne is not a defensive thesis, Its value depends almost exclusively on binary catalysts, operational execution and financial discipline. If the company can clinically validate DYNE-251 and DYNE-101, secure accelerated approval in 2026 and maintain liquidity without aggressive dilutions, the company's risk-return asymmetry is tilted decisively to the upside, with scenarios that allow for a doubling or even tripling of valuation in 12-24 months. Even so, and on the contrary, underperformance, regulatory delays or rising operating costs could force dilutive rounds and push the stock towards the pessimistic scenario ranges (USD 10-12).

DYN, like other companies with the same characteristics, represents a speculative betting with very high impact catalysts, where scientific and regulatory performance will be the dominant variable in its valuation trajectory during 2025-2027.