About critical metals for the energy transition, of all the companies that are present in the market, TMC the metals company Inc. ($TMC) appears to be an interesting speculative bet, a company that seeks to extract nickel, cobalt, copper and manganese from deepwater polymetallic nodules, with the objective of supplying battery and renewable supply chains from an alternative source to traditional land-based mining.

Before entering into the analysis, I leave a table with the current price and estimated valuation scenarios, where I, Diego García del Río, I approach them on the basis of the medium/long-term operational and financial potential, as well as the regulatory outcome (NOAA/ISA) and the degree of execution of the projected production plan through 2027.

| $TMC | CURRENT | PESSIMISTIC | NORMAL | OPTIMIST |

| PRICE (USD) | 5.17 | 1.50 - 3.00 | 7.00 - 9.00 | 12.00 - 20.00 |

| UPSIDE/DOWNSIDE | - | -71% to -42% | +35% to +74% | +132% to +287% |

*Target prices are based on the Estimated combined NPV of ~US$23,600 M, the planned permitting and production schedule (Q4 2027), the evolution of the price of critical metals (Ni, Co, Cu, Mn) and regulatory/environmental risk.

The optimistic scenario assumes accelerated NOAA approval and implementation without delays; the standardized discounts an advance in accordance with current guidance; and the pessimist incorporates long delays, new dilutions and/or severe metal correction.

TMC the metals company Inc. ($TMC)

TMC the metals company Inc.$TMC) is a company of deepwater mineral exploration which is focused on the collection, processing and refining of polymetallic nodules from the seafloor in the Clarion Clipperton Zone (CCZ) of the Pacific Ocean. Its objective is to extract critical metalsas nickel, cobalt, copper and manganese, essential for electric vehicle batteries, renewable energy and defense supply chains. Although it does not work with rare earths in the strict sense, is part of the critical raw materials sector because its metals are strategic for electrification and energy transition, simply put, TMC collects rocks from the ocean floor containing valuable metals, The underwater robots bring them up to the surface, and then extracts these metals in terrestrial plants. Their proposal consists of obtaining these materials in a potentially more sustainable way than traditional mining, avoiding problems such as deforestation, displacement of communities or water pollution.

Founded in 2011 and headquartered in New York, TMC currently operates in a phase of advanced development, after publishing its Pre-Feasibility Study and Initial Assessment Report in 2025. The company has a liquidity of ~165 M USD, although still with no revenues and a reported net loss of 184.5 M USD due to non-recurring costs. Its first cycle of commercial production is projected for Q4 2027., with an estimated annual capacity of 10.8 million tons of wet nodules and economic studies that place its net present value (NPV) combined in approximately 23.6 BILLION USD.

$TMC - Fundamental Analysis: Valuation, Critical Metals and Business Model

As an early development company, it incurs significant operating losses by investments in robotic technology and permits, together with high volatility in its valuation driven by geopolitical and commodity news. Its business profile is based on exploiting minerals in deep waters, being in pre-commercial phase and mainly focused on the sustainable harvesting of polymetallic nodules for critical metals (nickel, cobalt, copper and manganese) essential in EVs and renewable energies

Your market capitalization is around 2.03 B USD, positioning it as a mid-cap company within the metals sector, above the average of its peers (107.7 M USD) and industry (476.2 M USD), reflecting positive expectations for its reserves in the Clarion Clipperton Zone (CCZ). Your beta of 1.82 shows its high systemic volatility.

In terms of valuation multiples, TMC trades at a P/E ratio of -16.0x, which results in net losses of 184.5 M USD in Q3 2025, worse than the -0.8x of peers and the 0.6x sector. The PEG of 0.53 points to an underestimation relative to projected growth (CAGR >76% post-2027), whereas its P/B of 25.7x (primarily driven by NORI-D reserves) far exceeds the 0.7x of pairs. It does not have price/sales as he has no income, yet his peers are trading at 6.0x forward, This may determine a considerable upside after sales start in 2027. The price/ free cash flow of 40.2x reflecting liquidity pressures due to cash burn typical of the sector.

On its current price to fair value ratio, TMC presents a -30.9% (undervaluation), worse than even (-16.5%) and sector (-1.4%), but with a estimated upside potential of 33% (target price: 7.33 USD) based on analyst coverage. The optimism is supported by innovations such as its battery-grade manganese sulfate and projected capacity of 10.8 Mt/year, in a global market for critical metals valued in the trillions. Even so, it has a EBITDA of -76,019 M USD and its gross margin is 0%, The company's pre-revenue stage and high regulatory costs are a reflection of this.

With revenues of 0 M USD (non-income), an impairment of operating income at -76.3 M USD in Q3 2025 (-299% year-on-year), where compared to its peers it recorded 81.56 M USD in revenues (+114.6% YoY), expenses of 9.6 M USD in exploration, 45.7 M USD in G&A, y 129.2 M USD in non-recurring items and a Net income CAGR zero, is practically in line with the start of production at Q4 2027, where mainly a growth ramp >76% is expected.

Your balance shows some strength, with total assets of USD 173.7 M y 165 M USD in cash, by granting a 18-24 months runway without potential dilutions. It has a minimum total debt of USD 2.48 M, which would be 1.4% of its assets, much smaller than even (25.97%) or the sector itself (76.06%), this mitigates potential leverage risks. It also has a Projected EBITDA CAGR of 301Q3Q3T which poses progressive improvements as technological and regulatory optimization progresses.

In terms of profitability, TMC presents negative metrics typical of explorers in the sector: ROA -112.2%, ROE -791.9% y FRICTION -321.3%. These metrics measure the efficiency with which a company uses its assets to generate profits (e.g., the efficiency with which a company uses its assets to generate profits).ROA, Return on Assets), the return on shareholders' equity (ROE, Return on Equity) and the return generated on total invested capital, equity + debt (ROCE, Return on Capital Employed). Being much lower than peers (ROA -1.9%, ROE -12.1%) and the sector (ROCE 0.9%), these negative values mainly reflect its pre-operational stage, rather than a structural deterioration. Net profit over revenues is zero, consistent with companies with no sales (and therefore no operating income).

Currently, as of the date of publication of this analysis, the company has a short float of 17.46% and a short ratio of 2.45 (~2-3 days to cover positions), levels that have been increasing and remain moderate considering the environmental and regulatory risks of the sector. Relying on a certain pause in the increase of short interest since october suggesting more contained downward pressure, even so, catalysts such as advances with NOAA could trigger accelerated hedging and forced upward movements.

$TMC - Catalysts: NOAA/ISA Permits, Production 2027 and Revaluation Potential

Regarding the factors that could boost The Metals Company Inc.'s valuation in the short to medium term, the following catalysts stand out:

- NOAA Regulatory Approval: On October 30, 2025, the National Oceanic and Atmospheric Administration (NOAA) sent the White House a proposed rule that would combine exploration and recovery permitting into a single process. This would speed up access to commercial permitting for TMC, currently the world's only company positioned to produce at scale by 2027. The approval would represent an important de-risking of the business model, facilitating financing and offtake agreements.

Speculation is circulating about the recent appointment of a NOAA administrator strategically aligned with the Trump administration. Some analysts interpret this as potentially accelerating the decision on the commercial subsea mining license for TMC. The market discounts that a positive resolution could act as an immediate catalyst for price, given that TMC is seen as first mover absolute in this niche. - Start of Commercial Production (Q4 2027)TMC plans to start production in the fourth quarter of 2027, subject to approval of the reclamation permit. The company recently stated 51 million tons of proven reserves and a Combined NPV of USD 23.6 billion, including 5,500 M USD only in the NORI-D area, validating the economic viability of the project.

- Technical Collaborations and Underwater TestingIn the first quarter of 2027, TMC will conduct subsea mining tests together with a Japanese university, using the Hidden Gem vessel in collaboration with Allseas. These tests could generate initial revenues and function as an operational prelude to large-scale commercial mining.

- Boost for the U.S. Critical Minerals List: The four metals contained in the TMC nodules (manganese, nickel, cobalt and copper) are included in the U.S. Critical Minerals List. The strengthening of the U.S.-Japan alliance in subsea mineral processing is interpreted as a bullish signal for the sector, driving demand for sustainable alternatives to land-based mining.

- Rally Continuity Narrative: After an increase of more than +420% in 2025, In addition, certain segments of the market speculate that TMC could continue its rally if regulatory approvals materialize, supported by a high NPV and possible strategic agreements. Still, concerns persist about shareholder dilution, The most aggressive consensus interprets this as “a matter of when, not if”.

- Recent Financial Results and Liquidity: In Q3 2025, TMC reported a operating loss of USD 55.4 M and a net loss of 184.5 M USD, influenced by non-recurring items. With a liquidity of 165 M USD and potential inflows estimated at more than 400 M USD, the market is speculating on an extended operating runway of an additional 12 months, although the decisive factor continues to be obtaining the regulatory permit.

Revaluation Scenarios

Taking into account the upward scenario potential, with accelerated NOAA approval of the reclamation license, regulatory support from the ISA and a favorable environment for critical metals, the target price would be in the range of 12-20 USD, implying a potential upside of +130% to +285% from current levels (~5.17 USD). This approach assumes entry into initial production before 2027, full exercise of the ~400 M USD in warrants, geopolitical stability in US-Japan supply chains, and growing demand for nickel, cobalt, copper and manganese. Under this framework, the combined NPV of USD 23.6 billion would begin to be partially reflected in the valuation, projecting a market capitalization of close to USD 1.5 billion. 4,000-6,000 M USD.

In a standardized/baseline scenario, with an execution aligned with current planning, regulatory approval would materialize by first half of 2026, production can be started in the Q4 2027. Successful subsea testing in 2027 with Allseas, partial warrant exercises and stability in metal prices are contemplated. The target range would be between 7-9 USD, which represents a revaluation of +35% to +75%, supported by offtake agreements, secured liquidity until 2026 and a high but manageable beta (1.82). The capitalization would move around 2,200-3,000 M USD, The company's growth rate is in line with current consensus estimates. Even so, taking into account a bearish scenario, conditioned by prolonged permitting delays, environmental regulatory pressure or the need for new dilutive financing, the price could retreat towards 1.50-3.00 USD, which implies a downside risk of -40% to -70%. This case would assume a prolongation of operating losses (>-130M USD), depressed prices in critical metals and accelerated liquidity depletion before 2026 with no external inflows. Capitalization would fall to a range of 300-800 M USD, reflecting a deterioration in market confidence and a shifted operating calendar beyond 2028.

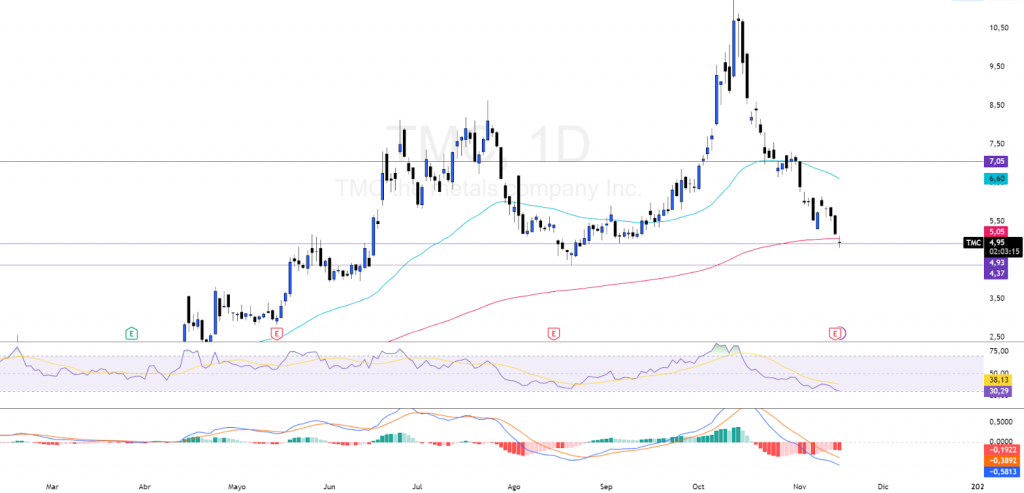

$TMC - Technical Analysis: Trend, Key Supports and Resistances

Currently, as of the date of publication of this analysis, it is at a downward trend after a bullish rally that took it from ~4.40 USD to its ATH 11.35 USD in October. The technical structure shows quite clear deterioration, the price perforated the EMA 50 (~6.60 USD) and the EMA 200 (~5.05 USD), The price remains slightly below the 200 EMA, indicating weakness but also the possibility of a technical rebound if the price stabilizes in the current area. The price remains slightly below the 200 EMA, indicating weakness but also the possibility of a technical rebound if the price stabilizes in the current area.

The momentum indicators reinforce the bearish reading. The RSI (14) at 30.15 is entering a zone of extreme overbooking, levels from which similar high-beta assets have previously bounced. Still, the downward slope of the indicator suggests that selling pressure could extend before a clear turnaround. The MACD maintains a consolidated bearish crossover, with the MACD line below the signal and a continuous negative histogram, confirming the seller dominance in the analyzed TF (1D). The deceleration of the histogram could anticipate an exhaustion of the fall if accumulation appears in current volumes (6-10 M daily).

Regarding key technical levels, the historical supports are located in the area of 4.37 USD, corresponding to the August low. A clear break below this range would open the door to an uncontrolled decline, and we could seek the 52-week minimum (0.72 USD), This would confirm an extended bearish scenario in the medium term. On the upside, the EMA 200 (~5.05 USD) acts as the first immediate resistance, followed by the EMA 50 (~6.60 USD) and the area of ~7.05 USD. A sustained recovery above the 50 EMA, accompanied by increasing volume, would be the key signal to reactivate an uptrend with potential targets at 10.00-11.00 USD looking for a new ATH.

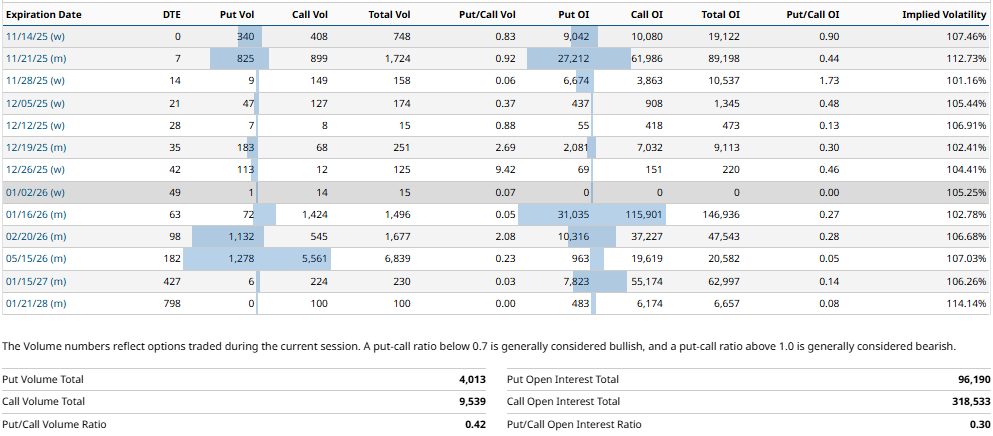

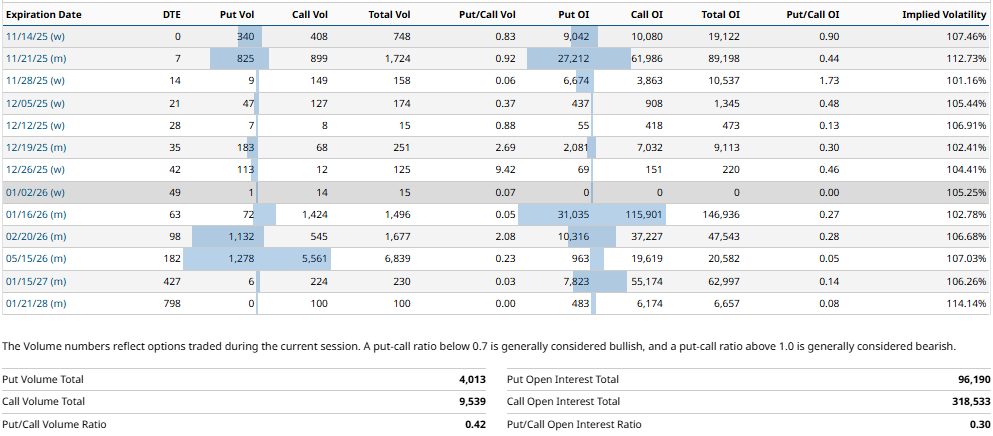

$TMC - Financial Options Analysis: Open Interest, Volatility and Expected Move

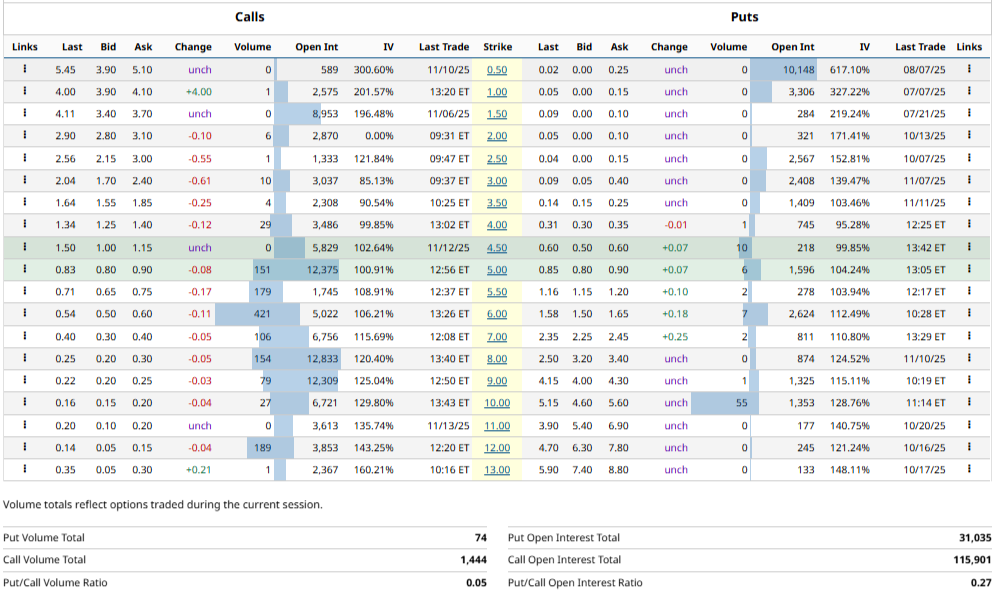

Based on November 14, 2025 data, the performance of the TMC options market shows a clearly bullish bias, driven by the strong accumulation of open interest in calls, with a total of 318,533 call contracts versus 96,190 puts, which is a Put/Call OI ratio of 0.30 (77% of the OI inclined towards calls). The maturity with the highest concentration is the 01/16/26 (63 DTE), where the OI (open interest) amounts to 115,301 calls versus 31,035 puts, with a Put/Call OI ratio of 0.27, reinforcing the market's bullish preference in the short-medium term.

Taking into account the contract with the highest OI (01/16/26, 63 DTE) and on its distribution, in order from highest to lowest stand out: 8.00 USD with 12,833 contracts, 9.00 USD with 12,309, 5.00 USD (relative ATM) with 12,375, 7.00 USD with 6,756, 10.00 USD with 6,721, y 4.50 USD with 5,829, The accumulation in strikes above the current price, among other levels, raises expectations of a technical recovery attempt towards the 6.00-8.00 USD zone if the buying flow increases.

Considering now the at-the-money (ATM) positioning, the expected implied movement for the maturity with the highest concentration, being the 01/16/26, 63 DTE, is estimated at ~42.70%, projecting a quotation range between 7.04 USD and 2.82 USD. In shorter terms, the maturity of the 11/21/25 (7 DTE) shows an expected movement of 15.60%, with a range between 5.70 and 4.16 USD, while that of the 11/28/25 (14 DTE) projects a 19.80%, with a range between 5.91 and 3.95 USD. On the longer horizon, 01/21/28, 798 DTE, the implied transaction amounts to 168.70%, with an estimated range between 13.25 and 0.00 USD, This results in a wide dispersion and great uncertainty associated with long-term maturities.

Synthesis of TMC the metals company Inc. ($TMC)

TMC is a company mid-cap directly exposed to the subject matter of critical/rare metals for energy transition, with a model based on the extraction of nickel, cobalt, copper and manganese from polymetallic nodules in deep waters of the CCZ. It is currently in pre-commercial phase which means it has no operating income and has significant losses from capex in exploration, robotic technology and regulatory processes in which it is currently involved, yet it is backed by a Combined NPV close to ~23,600 M USD and a projected production plan for Q4 2027 with a capacity of ~10.8 Mt/year of wet nodules. Its current balance shows good liquidity (~165 M USD) and very low leverage (debt ~1.4% of assets), This gives it 18-24 months of runway with no immediate need for new expansions, even with a clearly negative profitability (ROA -112.2%, ROE -791.9%, ROCE -321.3%), which is logical in its pre-revenue stage.

From a valuation point of view, TMC trades with multiples mainly supported by expectations, with a P/E of -16.0x, P/B of 25.7x and a theoretical undervaluation of -30.9% vs. its estimated fair value (via investing.com), with a consensus target price around 7-8 USD and a market capitalization of close to USD 2.2 B. As of today, its market value discounts a combination of: Regulatory execution (NOAA/ISA), partial materialization of the declared NPV (including USD 5.5 billion in NORI-D), and the role of TMC as first mover in subsea mining in a critical metals market valued in the trillions. A strong rally in 2025 (+400%/+420%) and a subsequent correction leave it in a currently delicate technical area, with its price below the 50 EMA and 200 EMA, RSI close to oversold and a structure that suggests that it is in a very difficult position. adjustment/correction phase more than a structural ceiling, with possible technical bounces if the support in the 4.3-5.0 USD zone is respected.

Your option chain reinforces the high risk/high reward speculative value reading, with 77% of total OI in calls (Put/Call OI ratio ~0.30), a strong concentration in the 16/01/26 maturity and OTM strikes (8-9-10 USD) where they implicitly discount recovery scenarios towards the 6-8 USD zone and, in a very favorable context, higher extensions. Their expected moves The IV derivatives >100% on most maturities determine wide ranges (±15-20% in the short term and >±40% in the medium term), being fully consistent with a stock very sensitive to binary catalysts with a high beta (1.82). It contemplates some gamma squeeze risk such as tactical possibility, but not as a base case, which depends on a primarily bullish shock (e.g. positive news from NOAA) that drives the price quickly towards higher OI strikes forcing markets-makers to hedge.

Priority catalysts to be taken into account/follow up:

- NOAA/ISA regulatory process (2025-2026): Definition of the rule that combines exploration and recovery permits, timing of the commercial license and political signals from the U.S. and international organizations.

- Liquidity and financing structure: Cash evolution (~165 M USD), burn rate (opex + capex), potential use of the ~400 M USD in warrants and risk of further dilution if permits are delayed.

- Operational execution and testing with Allseas/“Hidden Gem” (2027): Results of the underwater mining tests with the Japanese university and technical validation of the complete extraction-processing chain.

- Price environment for critical metals (Ni, Co, Cu, Mn): Thesis sensitivity to commodity cycles, US/Japan security of supply policies and onshore project competition.

- Technical behavior and derivatives: Respect or loss of key supports (4.3-5.0 USD), price reaction to regulatory news and changes in the OI of calls/puts on 5-10 USD strikes.

Like other similar ideas that I have analyzed, TMC is a speculative, not defensive, opportunity (like virtually the vast majority of ideas I have shared). Its chain of regulatory, operational and market catalysts could multiply its valuation over the next 1-3 years, while significant delays, environmental regulatory pressure or poor capital management would result in severe downturns and recurrent dilution in search of liquidity to continue operations. The risk-return asymmetry If the company is able to secure permits, execute the ramp-up by 2027 without depleting cash and capture even a fraction of the estimated NPV, then TMC could establish itself as a key player in the sector in the supply of critical/rare metals for the energy transition.