In the field of US biotechnology, I found interesting three companies that, in my view, they bring together tangible advances, sound science and catalysts close to home.: Iovance Biotherapeutics ($IOVA), Gain Therapeutics Inc. ($GANX) y Gossamer Bio Inc. ($GOSS).

IOVA leads the development of TIL cell therapies for advanced solid cancers; GANX develops small allosteric molecules based on its platform Magellan™. for neurodegenerative diseases; and GOSS moves forward with seralutinib, an inhaled treatment for pulmonary arterial hypertension (PAH) and the pulmonary hypertension associated with interstitial disease (PH-ILD). Each analysis collects key metrics, target price estimates y key clinical catalysts, with a focus on investors looking for speculative opportunities with high appreciation potential.

Before entering into the analysis, I leave you with a table showing the current price of these assets and the target price. Me, Diego García del Río, I estimate these objectives based on the medium/long-term potential:

| TICKER | CURRENT | TARGET PRICE | UPSIDE % |

| IOVA | 2.30 USD | 10.00 USD | 334.78% |

| GANX | 2.36 USD | 12.00 USD | 408.47% |

| GOSS | 2.50 USD | 15.00 USD | 500.00% |

*Target prices are based on market potential, revenue projections and regulatory approvals, with upward adjustments for successful launches, but subject to industry risks.

Iovance Biotherapeutics ($IOVA)

Iovance Biotherapeutics ($IOVA) is a commercial-stage biopharmaceutical company developing cellular therapies based on tumor infiltrating lymphocytes (TILs) autologous therapies, focused on the treatment of advanced solid cancers such as melanoma, cervical cancer and non-small cell lung cancer (NSCLC). Put simply, what it does is to extract immune system cells called TILs from the tumor, multiply and strengthen them in the laboratory, and then introduce them back into the patient's body to recognize and destroy the cancer cells.

It was founded in 2007 and is headquartered in San Carlos, California, currently operating in an initial growth phase following the regulatory approval of its lead therapy, with sales revenues of approximately 68 M USD in the third quarter of 2025, and expansion projections of more than 70 authorized treatment centers (ATC) by the end of this year, driving increasing clinical adoption.

$IOVA - Fundamental Analysis: Growth Profile and Competitive Positioning

Taking into account your profile, your phase and therapy, Iovance Biotherapeutics presents a fundamental profile very characteristic for high growth potential, but like any other company, with risks inherent to their stage of development, including significant operating losses and valuation volatility. It has a market capitalization of USD 913 million, which is equivalent to positions it slightly as a small company in the biotechnology sector., The company's average value is USD 1.1 billion, below its peer average of around USD 1.1 billion, but much higher than its sector average of around USD 81.8 billion, its size reflects its recent transition to the commercialization of its lead drug, Amtagvi® , but also with a pronounced correction in the share price, with a total price return of -78.27% in the last year. Its beta of 0.85 indicates lower systemic volatility compared to the market., which marks the interest of conservative investors in biotechnology, although its 52-week high is only at 21.2%, compared to its peers at 59.1%, which shows a limited recovery potential in the short term until new ones are consolidated clinical or commercial catalysts.

In terms of valuation multiples, IOVA trades at a target P/E ratio of -2.3x, a negative value reflecting net losses, The total loss ratio for the sector was USD -397.6 million, but higher (based on higher losses on peers) than for the sector, at -9.3x, and lower (based on lower losses on peers) than for the sector, at -0.6x, which means a loss of USD -397.6 million (based on lower losses on peers), which means a loss of USD -0.6x. suggests that it is being valued a little better than its competitors for its advanced pipeline in immuno-oncology (and looks more promising). The ratio PEG of -0.11 suggests a potentially attractive valuation if the projected growth materializes, since a negative value indicates that the company is still does not generate profits, but it could be undervalued if its future expansion is consolidated or, failing that, if it successfully achieves its main objectives. The price/sales is 3.6x locates below its peer average of 8.1x, although aligned with the sector average at 3.3x, The market's cautious assessment reflects the uncertainty about its growth. On the other hand, the price/free cash flow of 1.6x sample liquidity pressures, as the company maintains a negative free cash flow, i.e, spends more than it generates, This limits its financial margin in the short term.

About your current price in relation to its fair value, is estimated at 31.7% vs. 15.7% of its peers, and a analysts' target undervaluation of 204.30% (this compared to the 99.70% of the sector average) which shows a interesting upside potential if the company is able to meet its projections. His optimism is supported by the possible expansion of the use of its therapy to new types of cancersas the NSCLC, and in strategic partnerships that could accelerate their growth. Even so, the Negative EBITDA of -411.3 M USD and a gross margin of -158.8% show operating inefficiencies and high production costs, The results are typical of personalized cell therapies that require complex and not very scalable processes in their early commercial phases.

From a financial perspectivethe revenues of ~250.4 M USD show a explosive growth of 175% year-over-year, well above the 10.8% peer average and of the 6.2% of the sector, mainly driven by the acceleration in sales of its lead drug, Amtagvi®. after its approval by the FDA in 2024. Even so, the operating income of -411.3 M USD and the net income of -397.6 M USD show high research and development expenditures and in despliegue comercial, although they are practically typical for a company that is transitioning from clinical to commercial stage, for this reason, the CAGR of net income is not yet measurable.

About your balance sheet shows strength, with total assets of USD 904.9 M (higher than 296.6 M USD of its peers and close to the sector average of US$ 1,051 M) y 524.2 M USD, which actively provides you with a financial cushion sufficient for 12-18 months of operation without significant dilution or search for financing. Even so, the net debt not specified therefore it is important to follow up on it. The Five-year revenue CAGR not yet measurable, although the EBITDA CAGR of 40% (in front of the 38% of its peers) shows a progressive improvement in efficiency and margins as the optimization of your production.

In terms of profitability, IOVA has common negative metrics for biotechs in expansion phase, The company's investment and upfront costs are very high. Its net margin of -158.8%, despite the deterioration of the -929.2% in pairs and in front of the 0.3% positive sector, shows a still inefficient operation, The ratios are within the typical range for the segment/sector. The ratios of ROIC, being -44% y ROA of -41.9%, both lower than the peer average of -30.7% and -40.6%, respectively, show a low efficiency in the use of its capital during this scaling stage. In turn, the ROE of -53% and the ROCE of -61.4%, as opposed to -63.3% and -62.8% in competitors, determine a shareholder dilution derived from the operational cash burning. Even so, the unmeasurable net income (NM) reflects that the company is not yet profitable (in addition to its losses mentioned above), but maintains an interestingly high transformational potential thanks to its TIL platform, in a immunotherapy market that is valued at billions of dollars..

It has a high short interestwith a short float of 28.57% and a short ratio of 5.27, levels that indicate a sustained accumulation of bearish positions during the last few months. This trend shows market skepticism in the short term, but also in the short term, but also opens the possibility of a short squeeze if they occur positive catalysts. The progressive increase in short interest from 22% in September to the current 28.6% suggests that an upside surprise in earnings or corporate news could generate a accelerated hedging of bearish positions, The stock's upward movement was amplified.

As of today, on its fundamentals, Iovance Biotherapeutics represents a high-risk, high-reward opportunity. Your growth metrics superior to the industry and its peers support its pioneering position in TIL cell therapies, although the negative profitability and a valuation still compressed make the value dependent on key catalystsas new regulatory developments or strategic alliances. The value results suitable for aggressive portfolios with a investment horizon of 2-3 years, and presents a implied target price close to ~2,040 M USD, derived from the undervaluation estimated by analysts, conditioned to a strong and sustained business performance.

$IOVA - Catalysts: Clinical Expansion and Revaluation Potential

On its revaluation potential and upcoming catalysts of Iovance Biotherapeutics I can highlight the following:

- IOV-LUN-202 (second-line non-squamous NSCLC): Data released in November show an increase of objective response rate (ORR) of 25.6% in a population highly resistant to previous therapies (10 of 39 patients, including 2 complete responses)., together with a average response time (mDOR) not yet reached (>14 months), This suggests that the responses obtained are deep and long-lasting. The FDA issued positive feedback for a Supplemental Biological License Application (sBLA) in 2026 y commercial launch in H2 2027. A medical conference is scheduled for 2026 that will be key to confirming the durability and safety of the responses, and could accelerate both strategic alliances and the regulatory approval process.

- IOV-END-201 (second-line endometrial cancer): The phase 2 data reading, planned for the second half of 2025, primarily evaluate the effectiveness of lifileucel (Amtagvi®) in patients with advanced endometrial cancer who have already received previous treatments. The trial aims to target an ORR of 25%, which would be a result highly relevant in an indication with limited treatment options y historical response rates of less than 15%. A positive outcome would enable Iovance to submit a supplemental Biological License Application (sBLA). y expand the use of its TIL platform towards a higher value gynecological market, estimated at more than USD 1,000 M in peak sales if it achieves approval in multiple indications. In addition, success in this study would reinforce the Amtagvi® versatility beyond melanoma, consolidating the Iovance's diversification strategy in solid tumors.

- IOV-4001 (pretreated metastatic melanoma): The phase 1/2 data update, scheduled for first quarter of 2026, will display a improved version of the TIL approach (lifileucel) in patients with metastatic melanoma resistant to standard therapies, including PD-1 inhibitors. This study has the potential to demonstrate clinical superiority against current treatments, showing higher response rate and durability, two critical factors in refractory populations. A positive result could strengthen Amtagvi® positioning not only in later lines, but also in first line and in combinations with pembrolizumab, The standard for immunotherapy in melanoma. In addition, it would validate the technological evolution of the TIL process Iovance, more efficient and scalable, a key point for improve margins and competitiveness in the global immuno-oncology market.

- International regulatory and commercial expansion: The submission to the EMA is ongoing, with potential approval in 2026, next to the launching in Canada. The income guide 2025 is maintained at 250-300 M USD, driven by the Amtagvi® sales (USD 68 M in Q3) and expansion to more than 70 authorized treatment centers (ATCs).

- Improved margins and profitability: It is currently estimated that gross margins to exceed 50% by Q4 2025, thanks to the in-house manufacturing at Iovance Cell Therapy Center (iCTC) and logistics optimization. Projections point to profitability in Q4 2026, even without international revenues, driven by the adoption in community hospitals.

- Short squeeze potential: A persistent accumulation of short positions despite the positive clinical datawith high loan volumes. A accelerated compression could occur if the following are confirmed durabilities >40 months in NSCLC and the no direct competition in TIL therapies.

- Analyst sentiment: Firms such as UBS The most noteworthy are the H1 2026 catalysts (IOV-4001 and IOV-END-201) and a financial runway to 2027, supported by 307 M USD in cash. Consensus projects a 100-200% upside in 12-18 months, conditioned to a flawless commercial execution and to the validation of clinical data in long-term follow-up.

Revaluation Scenarios

In a bullish scenario, with full compliance of clinical catalysts and accelerated international expansion, the target price would be between 17 and 25 USDwhich implies a upside potential from +640% to +990% from current levels (~$2.30). This approach builds on outstanding clinical results (ORR >30% and mDOR >18 months in NSCLC and melanoma), gross margins higher than 60%, positive cash flow in 2026, and possible strategic alliances or acquisitions by large pharmaceutical companies. Under this framework, sales could exceed 1,500 M USD in 2027, with a capitalization of close to 5,000 M USD.

In a standard scenario or base case, If execution is in line with consensus expectations, the target range would be between 9 and 12 USD, being a revaluation potential of +290% to +420%. This scenario contemplates regulatory approval for NSCLC in 2026, Amtagvi® sales of up to USD 550 M in 2026 y 50-55% marginswith a financial runway longer than 36 months. Expansion to more than 80 authorized treatment centers (ATC) and approval in the European Union and Canada strengthen its position in immuno-oncology, projecting a capitalization of approximately 2,500 M USD. While in a bearish scenario, influenced by regulatory delays or poorer than expected clinical outcomes, the price would move between 1.50 and 3.00 USD, which represents a downside risk down to -35%. This would involve limited sales (<200 M USD per year), margins below 40%, y reduced commercial adoption (<50 active ATCs in 2026). In addition, a higher cash burn and need for additional financing would put downward pressure on the stock, reducing its capitalization to the range of 400-700 M USD.

$IOVA - Technical Analysis: Key Levels and Momentum

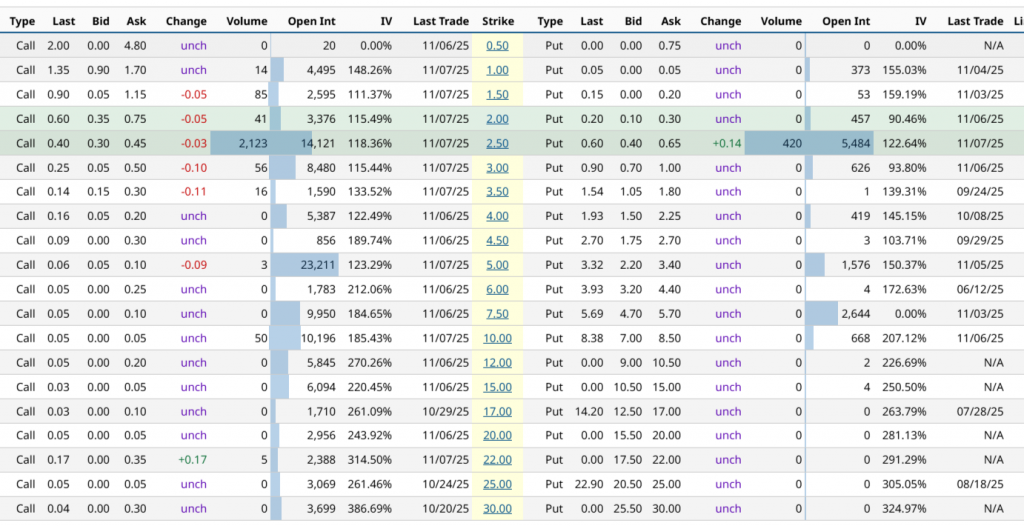

The current price is above after a bearish-consolidated trend the 50 EMA, where it seems to be supported, although it is below the 200 EMA which gives it room until a new bullish rally.

The momentum indicators reinforcing the positive trend. The RSI remains in a bullish zone in a convergence of its mean and above its neutral line although with a return to its neutral zone behavior and the MACD in a positive crossover, entering the buy zone, all this in TF 1D.

About technical standards, the main key support is located at its 50 EMA at ∼2.20 USD, a break of this support could lead it to test its 52-week low (1.64) while its main resistances are located at 2.85, followed by its 200 EMA at ∼3.39 USD, needing a strong breakout would mark a sustained uptrend.

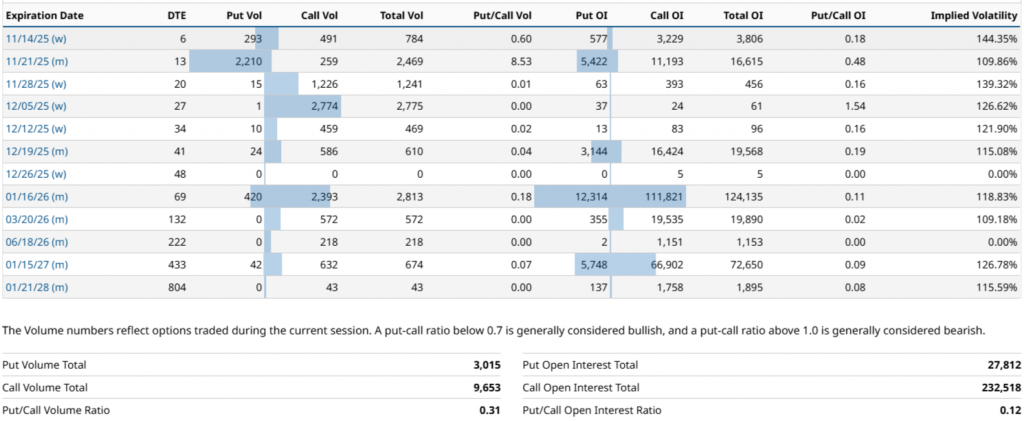

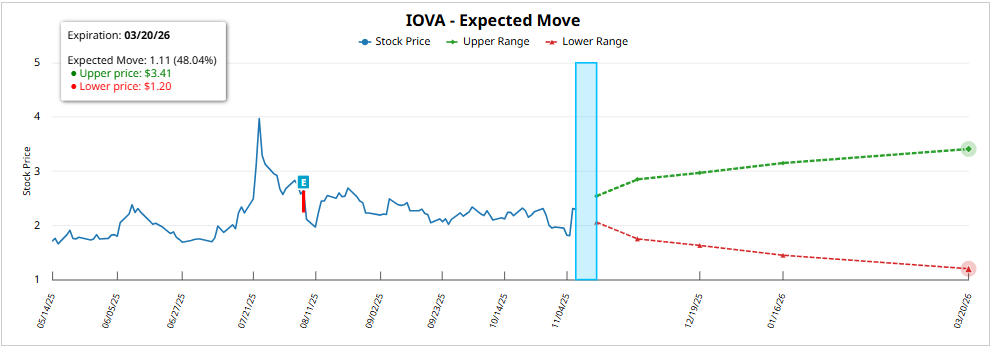

$IOVA: Financial Options Analysis

Based on November 7, 2025 data., the performance of the options market shows a deeply bullish bias, driven by the OI accumulation in calls, 111,921 of calls in the 01/16/26 maturity, with an open interest rate of 111.921. Put/Call OI ratio of 0.11 representing 48.12% of the total open interest, with 232,518 calls compared to 27,812 puts, a Put/Call OI ratio of 0.12 in its entirety.

This imbalance towards call positions reflects a expectation of bullish continuity y increases the probability of a gamma squeeze, If the share price begins to rise rapidly, the market makers who have sold these calls (the counterpart of the current positioning) must buy shares to cover its exposure. This results in a forced coverage that can generate a bullish feedback loop, where the technical demand for shares further boosts the price in the short term, amplifying movements beyond what the fundamentals justify and generating potential explosive rallies in strong momentum scenarios.

Regarding the major positioning of open interest being the contract dated 01/16/26, the contract is distributed among several strikes. In order from highest to lowest, 5.00 strikes stand out with 23,211 open contracts (OI), followed by the strike 10.00 with 10.196 OI and the strike 7.50 with 9,950 OI, among other relevant levels, as shown in the attached image.

Now taking into account the positioning of ATM optionsthe implied expected movement for the contract with highest concentration of open interest, expiration 16/01/26, is estimated at ~36.96%, this is a projected price range between 3.15 and 1.45 USD a 69 days from maturity. In the shorter term (11/28/25, 20 DTE)the projection is 10.35%, with an estimated range between 2.54 and 2.06 USDwhile the greater movement in the short term is that of the maturity on 11/21/25 (13 DTE)with a expected movement of 15.52% and a projected range between 2.66 and 1.94 USD, backed by a implied volatility of 109.86%. At the opposite extreme, the longer horizon (01/21/28, 804 DTE) reflects a implied movement of 116.04%, with an estimated range between 4.97 and 0 USD, evidencing the wide dispersion of market expectations in long-term maturities.

Gain Therapeutics Inc ($GANX)

Continuing the analysis, Gain Therapeutics is a clinical-stage biotech company specializing in the development of novel allosteric small molecule therapeutics targeting neurodegenerative disorders and lysosomal storage diseases with unmet medical needs, such as GBA-related Parkinson's disease and other rare genetic conditions. What is interesting is in their approach, is to use its proprietary computational platform Magellan™., which combines artificial intelligence with supercomputer-assisted physical modeling to identify “hidden” binding sites in proteins implicated in these diseases. This technology makes it possible to design drugs that modulate protein function precisely, restoring, stabilizing or degrading it depending on the pathology, instead of blocking it directly as many conventional treatments do.

It was founded in 2017 and is headquartered in Bethesda (Maryland, USA), The company is in the early stages of clinical advancement. Its main program, GT-02287, is under evaluation in a study of phase 1b for GBA-associated Parkinson's disease, its recruitment was completed in the second quarter of 2025. GANX does not yet generate sales revenue, therefore it reports a net loss of 0.19 USD per share in the second quarter of 2025, together with a collection of 7.1 M USD The company's financing to extend its cash position, which is practically normal for this type of company at similar stages. The projections point to the potential start of a phase 2 in 2026, mainly driven by positive interim data and strategic collaborations in its preclinical pipeline focused on central nervous system disorders.

$GANX - Fundamentals: Magellan™ Platform & Value Thesis

Gain Therapeutics presents a typical fundamental profile of a pre-revenue biotech, with a high growth potential based on technological innovation, but as companies of the same type, it presents significant financial and clinical risks. The company is at an early stage of clinical advancement, with its main program in the pipeline. GT-02287, currently in Phase 1b for GBA-associated Parkinson's disease, with a projected Phase 2 launch in 2026. Its approach is based on its proprietary platform Magellan™., which combines artificial intelligence and physical modeling to identify “hidden” allosteric binding sites in proteins, enabling the design of molecules that restore or stabilize protein function, a differential approach in the precision therapeutics segment.

Your current market capitalization is around 89.51 M USD, well below the peer average, which amounts to ~153 M USD, but not lower than the sector average (82 M USD), this spread poses a reduced scale valuation and a risk discount associated primarily with its early stage. In terms of volatility, its beta of 0.13 places it as a stock with a low correlation to the general market, a characteristic that can limit liquidity, but also reduce exposure to macroeconomic shocks.

Going into its valuation, the available multiples confirm a speculative profile. With a PER from -4.8x, reflecting net losses consistent with its phase, as compared to the 2.9x of their peers and to the -0.6x sector. The PEG ratio of -0.07 suggests a certain underestimated growth potential, this logically provided that the expected clinical milestones are met, while its P/B of 19.1x, significantly higher than that of peers (0.8x) and to the sector (2.6x), this shows that the market highly values the intangible aspects of its pipeline and its computational platform..

In terms of profitability, the company has operating losses that are to be expected at this stage. Its operating result is -17.26 M USD, compared to average profits of 13.69 M USD in pairs, with a net income of -18.59 M USD. The ROA of -128.1%the ROE of -240.2% and the ROIC of -124.1% The company's investments are inefficient in the use of invested capital, attributable, of course, to the R&D burden and the absence of recurring revenues. Its financial structure, is conservative, however, it has a total debt of only USD 0.68 M, as opposed to 22.3 M USD of their peers and 8.8 M USD in the sector, which mainly mitigates refinancing risk. Its total assets (9.83 M USD) and its cash position is ~11 M USD with a burn rate (monthly expense) of ~1.5 M USD guarantee it an operating autonomy of approx. 6 months, The time to reach nearby catalytic converters is sufficient.

Analysts give GANX a valuation of “Strong Buy”with a average target price of 8 USD (range 6-12 USD) and what is a upside potential of +308% from current levels, significantly above the industry average (+44.9%) and pairs (-26.5%). This optimism is supported by the expectation of positive clinical data in 2026, especially in Parkinson-GBA, and in the validation of its platform. AI-driven, which could be extended to other neurodegenerative diseases.

$GANX - Upcoming Catalysts: Clinical Data and Scenarios

In the short term, taking into account the temporary nature of the important catalyst will occur during the Neuroscience 2025 congressthe November 19, where GANX will present a poster with new Phase 1b results. These preliminary data would indicate a alpha-synuclein reduction, The results showed functional improvements in the motor and olfactory performance of the patients treated for 90 days. If a positive trend is confirmed, these results would reinforce the thesis that GT-02287 could act as a disease modifier, a disruptive concept within the Parkinson's market, currently valued at over 10,000 M USD in symptomatic therapies.

In the medium term, we expect the start of Phase 2 in 2026, The trial has completed full enrollment in the second quarter of 2025, with full 90-day biomarker data expected in the second quarter of 2025, conditional on regulatory approval and confirmation of Phase 1b safety results. The study has completed full recruitment in the second quarter of 2025, and complete 90-day biomarker data are expected by end of fourth quarter 2025with a approved 12-month extension which could generate additional milestones. Based on analyst modeling, the estimated catalyst date for GT-02287 is November 30, 2025.

Interestingly, GT-02287 is currently being described as a possible “Parkinson's modifying treatment”.”, If validated, this would make GANX a potential acquisition target for large pharmaceutical companies with limited pipelines in neurodegeneration. Also as a additional catalyst in December 2025, With the full biomarker results, this catalyst is practically a turning point for the share price if the efficacy data are confirmed.

As mentioned above, the analysts maintain a consensus of “Strong Buy” with a average target price of 8 USD (rank 6-12 USD), involving a estimated upside of +308% from current levels. This optimistic scenario is supported by the validation of the platform. Magellan™. as an asset-generating tool and the possibility of strategic alliances during 2026.

To mention the insider activity, The fact that there are management buyouts in 2024 has been interpreted as a sign of internal confidence, reinforced by the CEO's statements. Gene Mack, The results of GT-02287 have been described as “amazing” and he has hinted at the interest of potential strategic partners, logically unbiased in his statements.

Revaluation Scenarios

In a upward scenario, with solid results in Phase 1b of the GT-02287 and confirmation of significant improvements in biomarkers (sustained reduction of alpha-synuclein and functional advances), the target price I estimate would be between 12 and 15 USD, involving a upside potential from +409% to +536% from current levels (~$2.36). This scenario assumes a smooth transition to Phase 2 in 2026, strategic alliances or acquisition by big pharma, and extension of the financial runway beyond 2026. Under this framework, capitalization could reach 420-525 M USD, validating the platform Magellan™..

In a standard scenario or base case, with execution aligned with consensus and positive but non-transformative data in Phase 1b, the target range would be between 8 and 9 USD, which represents a revaluation potential of +239% to +281%. This approach contemplates continued clinical development, a controlled loss (~-0.15 USD EPS), institutional support (e.g. Michael J. Fox Foundation) and low debt exposure (0.68 M USD). Projected capitalization would be around 280-315 M USD, with a high probability if constant progress is maintained, whereas in a bearish scenario, conditioned by ambiguous results or delays in Phase 2, the price could move between 1.00 and 1.50 USD, reflecting a potential drop from -36% to -58%. This case would assume a high annual cash burn (~17-18 M USD), absence of strategic collaborations and possible shareholder dilution in 2026, reducing the capitalization to a range of 35-50 M USD.

$GANX - Price Technique: Trend, EMAs and levels to Watch

The current price overcomes after a consolidated downward trend the EMA 50 and 200, where it seems to be finding support and generating a remarkable change in trend, being above the EMA 200 leaves you room for a new bullish rally.

The momentum indicators reinforce the positive trend. The RSI remains in a bullish zone, but be careful, entering overbought, with a convergence towards its mean y exceeding its neutral line, The MACD a positive crossover, entering the buy zone, all of this on TF 1D.

About technical standards, it is difficult to determine as it is not in a consolidated phase, I can determine that it would be around 2.37 USD, a rupture of this support could lead her to test EMA 50-200while the main resistors are located in 2.81 USD y 3.19 USD.

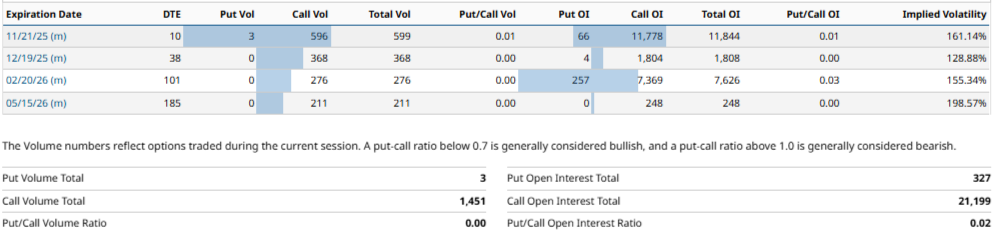

$GANX - Options: RO bias and squeeze risk

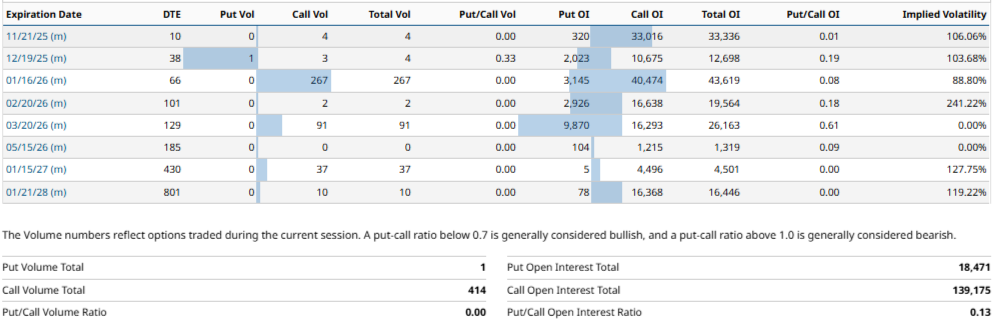

Based on data from the November 7, 2025, the performance of the options market shows a markedly upward bias, The concentration of the open interest en calls, with a total open interest of 21,199 contracts in calls vs. only 327 in puts, resulting in a Put/Call OI ratio of 0.02, representing the 98.5% of total open interest in bullish positions. This imbalance is particularly noticeable in short and medium-term expirationsas the expiration on 11/21/25 with 11,778 call contracts vs. 66 puts (equivalent to 99.4% of total OI), followed by the expiration of 02/20/26 with 7,369 call contracts vs. 257 puts.

Your options show a almost predominance of call positions indicating a collective expectation of sustained appreciation in the share price and also raises the likelihood of a gamma squeeze, If the underlying price starts an accelerated rise, the market makers who have issued those calls (acting as counterparty) will be obliged to to acquire shares to hedge its delta exposure. This dynamic coverage could trigger a bullish feedback loop, where hedging-induced demand further boosts the price in the short term, exacerbating movements beyond fundamentals and facilitating volatile rallies in a context of high momentum.

The expected implied movement for the contract with the highest concentration of open interest, corresponding to the maturity of the 11/21/25 (DTE: 10 days), is estimated at approximately 18.75%, which projects a quotation range between 3.12 and 2.14 USD in the short term.

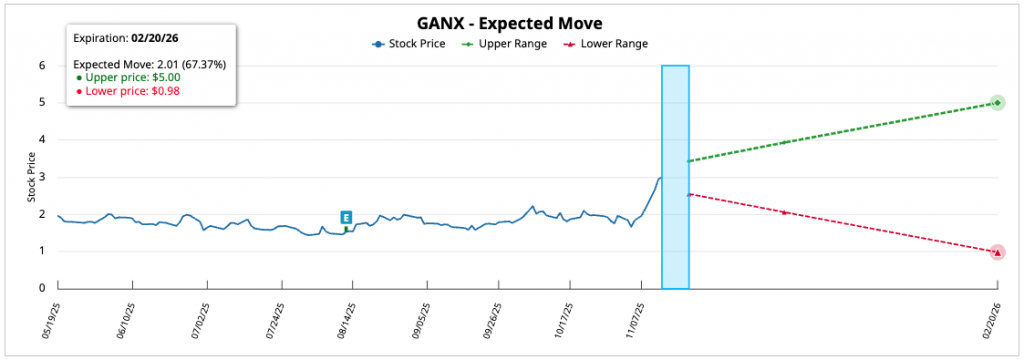

In the intermediate term (12/19/25, DTE: 38 days), the projection is 11.31%, with an estimated range between 2.93 and 2.33 USD, The largest movement in the medium term is observed in the maturity of the 02/20/26 (DTE: 101 days), with an expected turnover of 67.37% and a projected range between 5.00 and 0.98 USD, supported by an implied volatility of 154.39%, The company's financial position, which reflects expectations of considerable fluctuations.

In the most extended horizon (05/15/26, DTE: 185 days), the implicit movement is moderated to the 30.70%, with an estimated range between 3.44 and 1.82 USD, The market's expectations for long-term maturities are more contained.

Gossamer Bio ($GOSS)

Finally, Gossamer Bio Inc. ($GOSS) and again a biopharmaceutical company such as IOVA, a clinical-stage company specializing in the development of innovative therapies, this time for rare lung diseases, with a major focus on the pulmonary arterial hypertension (PAH) and the pulmonary hypertension associated with interstitial lung disease (PH-ILD). Its strategy focuses on the design of selective inhibitors administered by inhalation, being its leading candidate seralutinib, an inhibitor of PDGFRα/β, CSF1R and c-KIT formulated as dry powder inhaler, where its goal is to modulate key pathological pathways involved in pulmonary vascular remodeling. Rather than simply dilating vessels like classical therapies, its approach is to blocking cellular pathways that drive abnormal remodeling of lung vessels, The aim is to slow the progression of the disease and improve lung function and quality of life.

Founded in 2017 and headquartered in San Diego (California, USA), The company is in advanced clinical development. Its main program, seralutinib, is being evaluated in the study of phase 3 PROSERA, aimed at patients with PAH in functional classes II and III according to the WHO, with recruitment completed (390 participants) and a primary endpoint based on the change in distance traveled of six minutes a 15-30 minutes at week 24. It also initiated a study SERANATA phase 3 registration at PH-ILD, which plans to include approximately 480 patients, evaluating doses of 90 mg and 120 mg BID. GOSS has presented preliminary data at conferences such as the European Respiratory Society Congress 2025, and has recently signed a strategic option agreement to acquire Respira Therapeutics, its leading candidate, an inhaled formulation of vardenafil, which is intended for on-demand treatment of pulmonary hypertension.

$GOSS - Fundamental Analysis: Seralutinib and PAH/PH-ILD market

Taking into account its stage of development and therapeutic approach, Gossamer Bio Inc. ($GOSS) right now presents a fundamental profile of a biopharmaceutical company at an advanced clinical stage, with a differentiated proposal within the segment of rare lung diseases.

Your market cap around the 574 M USD, The company's sales, higher than the average of its peers (USD 187 million) and of the sector (USD 82 million), merely reflect a larger scale within its niche. With a beta of 1.96, The share price is significantly higher than that of its peers, indicating high volatility and sensitivity to market movements. In terms of valuation, GOSS trades with a P/E ratio of -3.7x, typical of companies with no operating profits, and a P/Sales of 13.0x, lower than that of peers (24.4x) but still high compared to the sector (3.3x), which implies a positive market perception of the intangible aspects of its pipeline. Your P/Book value negative (-7.0x) reflects a deficit net worth derived from the financial leverage, while the PEG of 0.03 shows a slight improvement in growth expectations compared to its peers. Analysts estimate a upside potential of +236.6%, This is above the sector average (+43.3%), underscoring the speculative appeal as long as the clinical milestones are met according to schedule.

On its profitability, Gossamer Bio maintains negative metrics consistent with its intensive investment stage and typology. Its net margin is -354.5%, better than that of peers in their similar situation (-646.5%) but lower than the sector (0.2%), while the efficiency ratios show negative returns on both assets (ROA -55.8%) as well as on capital (ROE -576.9%), which clearly shows a still inefficient operational structure, understandable until its commercial phase.

As for its financial positionthe total income amounted to ~44 M USD, driven by collaborations and reimbursements. The operating result is negative at -153.3 M USD, and the net losses reached -156.2 M USD. The company has 208.8 M USD in assets and a total debt of 202.9 M USD, which generates a negative net equity, although with a strong cash position (USD 180.2 M) which, with a burn rate of USD 13.20 million, allows it to finance operations for approximately 13.65 months, until 2027 practically. Its current ratio of 3.28 reflects adequate liquidity to sustain its ongoing testing, although the operating cash flow (-158 M USD) confirms a high capital burnup typical of his stage.

In terms of growth, revenues showed an increase in contraction of -58 1Q03Q year-on-year, influenced by the completion of collaboration milestones, whereas the Projected 5-year CAGR (31.9%) which points to a gradual recovery as the results of the seralutinib phase 3 (topline planned February 2026). In the medium term, the start of SERANATA enrollment and the possible acquisition of Respira Therapeutics add strategic catalysts that could expand the pipeline into new inhaled formulations.

With a sound scientific basis and a advanced pipeline, this small-mid cap biotech interest to me, although I must emphasize its high financial risk and strong dependence on clinical results is, however, normal for this type of company. Its strong cash position provides operational visibility, although high debt and negative equity expose potential dilution. The stock could experience a significant appreciation if the data from PROSERA y SERANATA confirm efficacy and safety, while a negative outcome would limit its bankability. The value fits in high-risk profiles and long-term horizons, with the necessary monitoring of cash flow and debt evolution.

$GOSS - Catalysts: PROSERA, SERANATA and strategic optionality

Starting with the confirmed Gossamer Bio Inc. catalysts ($GOSS), we have the following:

Topline Results of the Phase 3 PROSERA Study (Seralutinib in PAH)Preliminary data are expected to be released in February 2026, which represents the main short-term catalyst. This trial, with recruitment completed in 390 patients of functional classes II and III of the WHO, evaluates the change in distance traveled as mentioned above. Success could validating seralutinib as a modulatory therapy of pathological pathways in pulmonary arterial hypertension (PAH), potentially enabling an application for regulatory approval. The company has emphasized a patient enrichment strategy to maximize clinical impact, with the expectation of a delta adjusted for placebo above 20 meters in the six-minute walk.

SERANATA (Seralutinib in HP-EPI) Phase 3 Study Initiation: The first recruiting site has been activated on the third quarter of 2025, with plans to enroll approximately 480 patients. This registration trial evaluates doses of 90 mg or 120 mg twice a day at pulmonary hypertension associated with interstitial lung disease (PH-IPD). The topline results projected for mid-2027, but advances in recruitment could generate intermediate updates in conferences or quarterly reports, extending market potential of seralutinib at an estimated value of more than 1 billion USD in this indication.

Option Agreement to Acquire Respira TherapeuticsAnnounced in September 2025, this covenant grants to Gossamer Bio the option of acquiring Breathe and its leading candidate, RT234 (an inhaled formulation of vardenafil for use as needed in pulmonary hypertension). The decision could materialize in the coming months, adding a complementary asset to the pipeline and diversifying the approach in inhaled therapies. This aligns with the global partnership with Chiesi Group, which covers marketing outside of the U.S. and could unlock additional financial milestones.

Participation in Investor ConferencesThe company will participate in key events in november 2025, including a luncheon hosted by Cantor Fitzgerald on November 12 in New York City, with the presence of the Dr. Roxana Sulica (researcher at PROSERA and TORREY). These forums could reveal updates on pipeline or preclinical data, The company is expected to make a number of presentations in the next few months, boosting market sentiment. In addition, presentations are expected in conferences such as the Congress of the European Respiratory Society, where the following have been shared positive data in 2025.

Generalized optimistic consensus: Currently, there is a certain optimistic consensus, with emphasis on the potential of seralutinib as a disease-modifying therapy, differentiated from competitors such as sotatercept for its safety profile (no increase in hemoglobin and no serious side effects) and sustained effectiveness. Analysts maintain ratings of «purchase» with price targets around 9.5 USD on average, being a upside potential of 270.37% based on clinical success.

Probabilities of Success (PoS) for PROSERA: Numerous estimates of analysts maintain a probability of success of 75%but retail investors speculate on >90%, attributing it to the patient selection (higher proportion of functional class III) and ERS 2025 Congress data that confirm antifibrotic benefits.

Market Expansion: There is some speculation about commercial launches before the end of the decade in a market > USD 20 billion, covering PAH, PH-EPI and even idiopathic pulmonary fibrosis (IPF).. The partnership with Chiesi looks like validation, with potential for >500 million USD in sales in HAP alone.

Revaluation Scenarios

In a upward scenariowith solid results in PROSERA Phase 3 y improvements >40 m vs. placebothe target price would be between 15-20 USD, involving a upside from +500% to +700%. This case assumes superior efficacy to sotatercept, favorable safety profile y accelerated approval, with progress in SERANATA and possible acquisition of Respira Therapeutics, by raising the capitalization a 3,400-4,500 M USD.

In a base scenariowith moderate improvements (20-30 m) and confirmation of efficacy and safety, the price would be around 8-10 USD (+220% to +300%) and a capitalization of 1,800-2,300 M USD, supported by runway until 2027 and continuity in SERANATA. However, in a bearish scenariowith ambiguous or unsuccessful results (<15 m), the price could fall to 1.00-1.50 USD (-40% to -60%), reflecting no execution of Respira, cash burn dilution (~158 M USD) y high debt pressure (202.9 M USD).

$GOSS - Technical Analysis: Structure, EMAs and targets

The current price has recently exceeded the EMA 50 after a bearish consolidation phase, where it finds dynamic support, and maintaining above the 200 EMA, which provides a cushion for a potential additional upside rally.

The momentum indicators support this positive outlook. The RSI is positioned in bullish zone with a value of 56.88, above its neutral line of 50 y converging towards moderately overbought levels with no signs of bearish divergence, on the other hand, the MACD shows a continuation in the buy zone, with the MACD line above the signal and the histogram in positive territory, indicating buying momentum at TF 1D.

Regarding key technical levelsthe main support is located in the EMA 50 around 2.41 USD, a breakage of this level could drive a correction towards 2.08 USD followed by the next support at 1.85 USD, being the EMA 200. The key resistance is located in 2.84 USD, a rupture with high volume would confirm a uptrend to all-time highs at USD 3.60, where the next key resistance would be.

$GOSS - Options: Positioning, volatility and scenarios

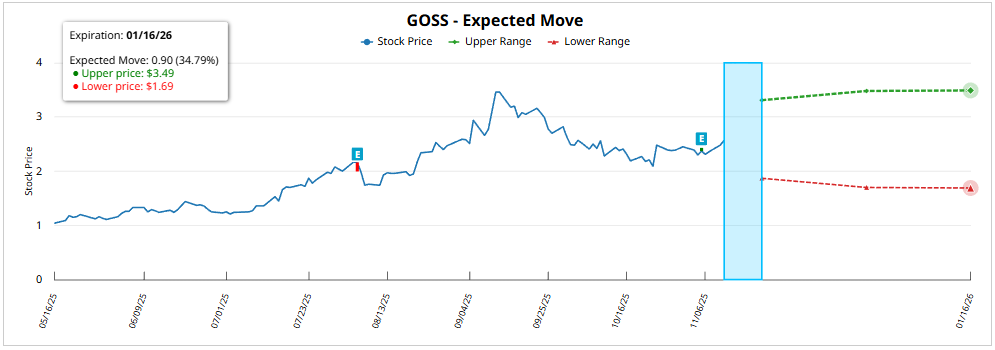

Finally and again, based on the data from the November 7, 2025, The performance of the options market shows a clear upward bias, mainly due to the predominant concentration of open interest (OI) in call positions. The OI of 40,474 contracts in calls for the expiration of the 16/01/26, with a Put/Call OI ratio of 0.08, which represents approximately 92,79% of total OI at that date (43,619 contracts). With respect to all maturities, the total OI in calls amounts to 139,175 contracts vs. 18,471 in puts, resulting in a Put/Call OI ratio of 0.13, The Company's share price is expected to appreciate.

Again, as in previous years, this imbalance towards calls suggests a anticipation of bullish momentum and raises the possibility of a gamma squeeze in the event that the share price to begin an accelerated ascent.

About your implied expected movement, taking into account the at-the-money (ATM) options positioning, on the maturity with highest concentration of OI (01/16/26, 66 DTE) is estimated at 35.06%, projecting a quote range between 3.47 USD and 1.67 USD.

In the shorter term (11/21/25, 10 DTE), the projection is 26.79%with a estimated range between 3.26 USD and 1.88 USD, backed by a implied volatility of 63.29%.

The greater movement in the short term is observed in the maturity date 12/19/25 (38 DTE)with a 34.07% projection and a range between 3.45 USD and 1.69 USD, driven by a implied volatility of 99.54%.

At the opposite extreme, the longer horizon (01/21/28, 801 DTE) reflects a implicit movement of the 104.46%with a estimated range between 5.26 USD and 0.00 USD, evidencing the wide dispersion of market expectations at long-term maturities and a implied volatility of 117.72%.