Few weeks concentrate as much tension as the one we are in, it begins from the October 27 to November 2, 2025 and at this moment, everything converges at the same time: The decision of the Federal Reserve on interest rates, the key corporate resultsa U.S. government shutdown of record time and a international summit amid an increasingly fragile geopolitical environment (US-China tariffs).

The general feeling is one of compression, the markets reach this point with artificially contained volatility, an unbalanced institutional positioning and an enormous expectation that the Fed will define the tone of the year-end, and every piece of data, every statement and every technical movement can act as a trigger in a market that continues to rise artificially, without clear triggers for a rise, without fundamentals to justify it.

I am Diego García del Río, In this analysis I explain how the factors that make this very likely are aligned, the most intense week of 2025.

The Fed's Decision: A Likely Cut Amid Weak Data

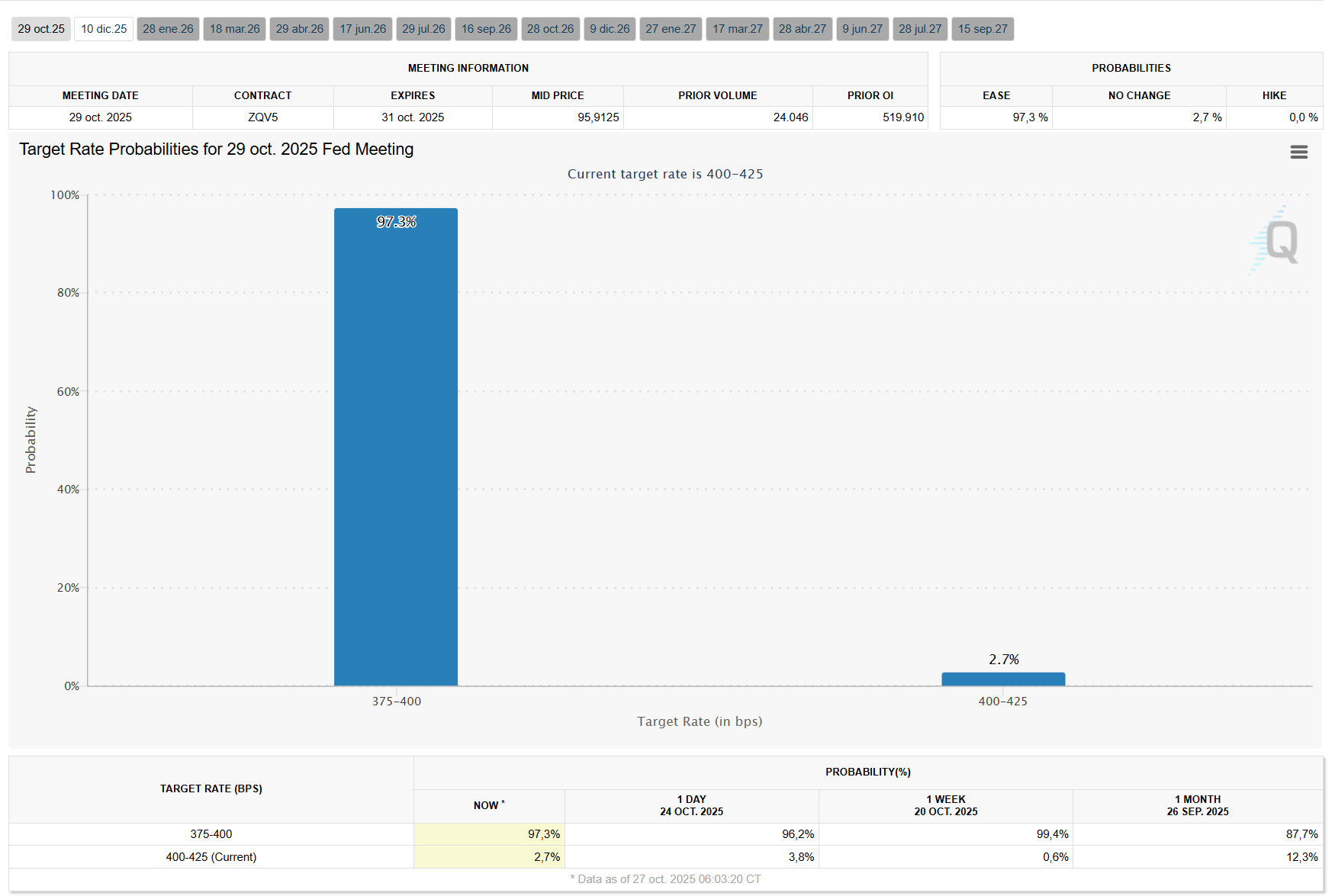

The wednesday, october 29th, at 19:00 Spanish time (13:00 in New York)the Federal Reserve will publish its decision on interest rates, followed thirty minutes later by the president's appearance. Jerome Powell. According to current market projections, there is a 97.8% probability of a 25 basis point haircut (0.25%), which would place the range of rates in the 3.75%-4.00%, This expectation is reinforced mainly by the current macroeconomic context, the partial government shutdown has severely limited the release of key reports, In addition, employment data have shown an unexpected slowdown and inflation has registered weaker-than-expected readings, raising the odds of a more dovish (flexible or expansionary) policy.

Market reaction will depend largely on signals from Powell during his speech at the press conference. Analysts foresee a moderately positive initial response on the stock market indices if the cutback is confirmed, with a potential upside of 0.5%-1% on the S&P 500, primarily driven by rate-sensitive sectors such as technology and consumer. Even so, any insinuation about the return of additional monetary stimulus, possibly mentioning the labor fragility, could amplify the movement, attracting flows into risky/more speculative assets, while a hawkish tone (rate hikes/balance sheet reduction/tightening of financial conditions) unexpectedly would generate a increase in volatility, amplified by the shortage of macro references derived from the shutdown.

The True Market Thermometer: Key Corporate Results

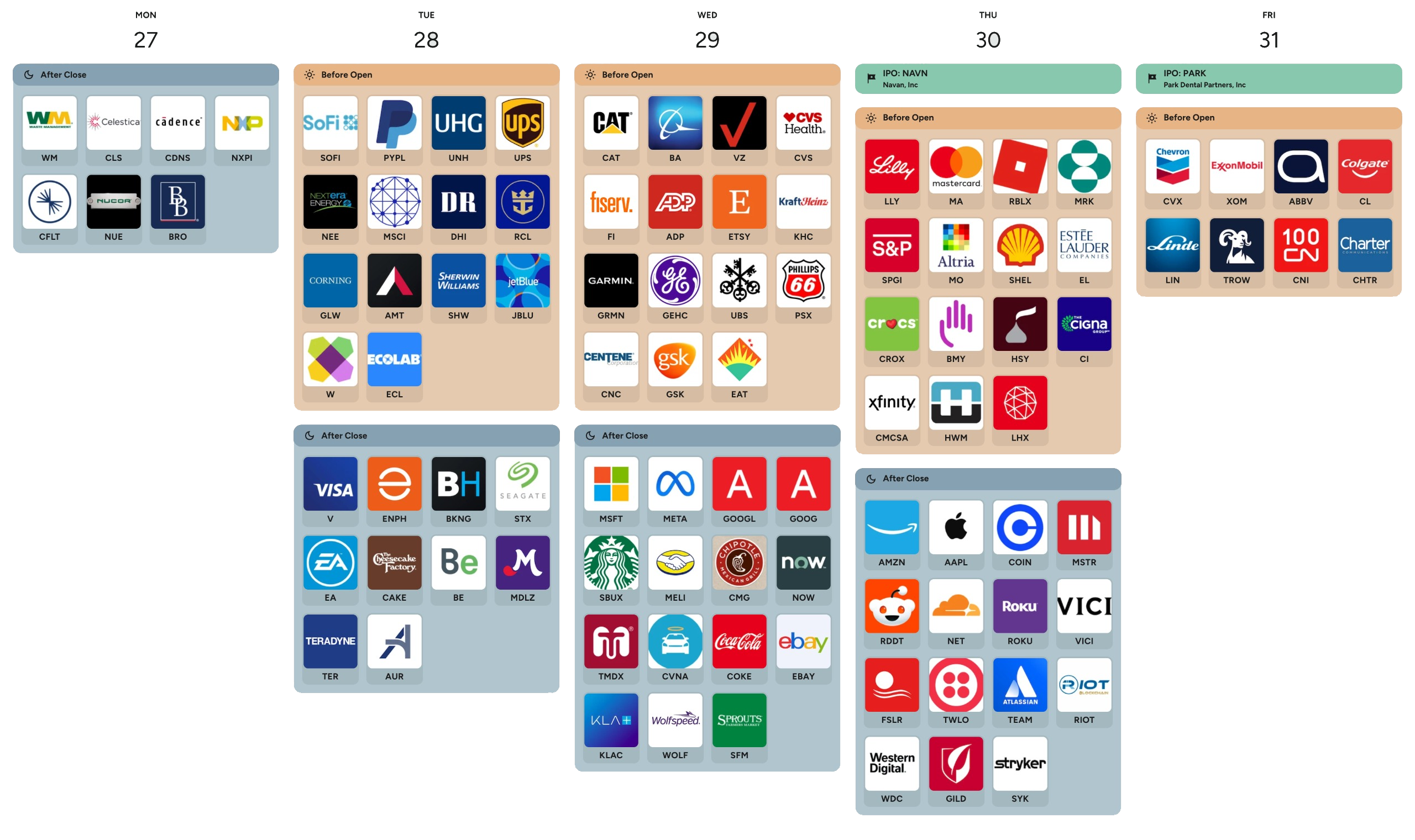

In a week where attention is focused on the Fed's decision, it also reaches a climaxing with the third quarter earnings season, The release of a flurry of publications could act as an immediate catalyst for the markets.

The tuesday, october 28, Visa (V), PayPal (PYPL) y SoFi Technologies (SOFI) will start with the round with key data on the digital consumption and fintech activity, The two segments are particularly sensitive to interest rate movements, and their figures are decisive in measuring the American consumption in a context of lower monetary pressure.

The wednesday 29, The focus will be on the big names in technology and aviation, Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (META) and Boeing (BA), these results will be decisive in validating the momentum of the technology sector which has led the 2025 stock market expansion despite the deterioration of global trade relations, signs on the monetization and development of artificial intelligencethe demand for cloud services and the evolution of digital ad spending, which have so far maintained high margins, and in the case of Boeing, its operational recovery and delivery stability, in a quarter marked by production disruptions and supply chain tensions, where any improvement over the previous quarter could act as a short-term catalyst.

The Thursday 30, Apple (AAPL), Amazon (AMZN), Eli Lilly (LLY), Mastercard (MA) y Coinbase (COIN), the main focus being on the artificial intelligence, e-commerce and profitability margin metrics, key drivers of the 2025 rally. At Apple y Amazon signs on the consumer demand and the ability to maintain high margins, about Eli Lilly the strong demand for metabolic therapies, Mastercard a view on the pulse of global spending, y Coinbase to be able to evaluate the institutional interest in cryptoassets after the recent stability of the sector.

And we will close the friday 31 with ExxonMobil (XOM) y Chevron (CVX), The results will provide an accurate reading of the dynamics of the energy sector in a context of volatile crude oil prices y adjusted refining margins. The evolution of productionthe level of investment in energy transition projects and the free cash flow management, The company's profitability, key factors in assessing the sustainability of benefits in the run-up to 2026.

According to JP Morgan, the bank anticipates that the results of the MAGS 7 (Apple, Microsoft, Amazon, Google, Meta, Nvidia and Tesla) could far exceed expectations, The company's performance in the first quarter of the year has been more stable than in previous quarters.

The strategist John Schlegel, Head of Global Positioning Intelligence at JP Morgan, points out that although the institutional position in these shares remains high, at levels similar to those of the previous year. early 2024, when the group recorded new highs after a technical consolidation phase.

It also mentions that the U.S. equity positioning around the 90th percentile, which shows a market broadly exposed but still with room for further gains, in an environment supported by the macroeconomic strengththe positive seasonality and the rate cuts by the Fed, factors that could follow driving the market towards the end of the year.

Above all, the scenario continues to be constructivethe macroeconomic fundamentals remain strongthe profit growth continues to be in positive territory and trade tensions between the U.S. and China show some gradual moderation, In addition to all this, the reactivation of repurchase programs, that could make this quarter one of the most important in the world. strongest in the history of buybacks, a factor that has historically acted as an important structural support of the U.S. market.

If JP Morgan's forecasts are confirmed, about positive results of MAGS 7 could to drive a new bullish phase, backed by the Fed rate cut expectations, where such an environment would favor both the small caps as in the rotation to higher beta assets, expanding market share.

Source: Markets Matters: How high is positioning in U.S. equities? | J.P. Morgan Podcasts

Government Shutdown: Towards an Historic Record

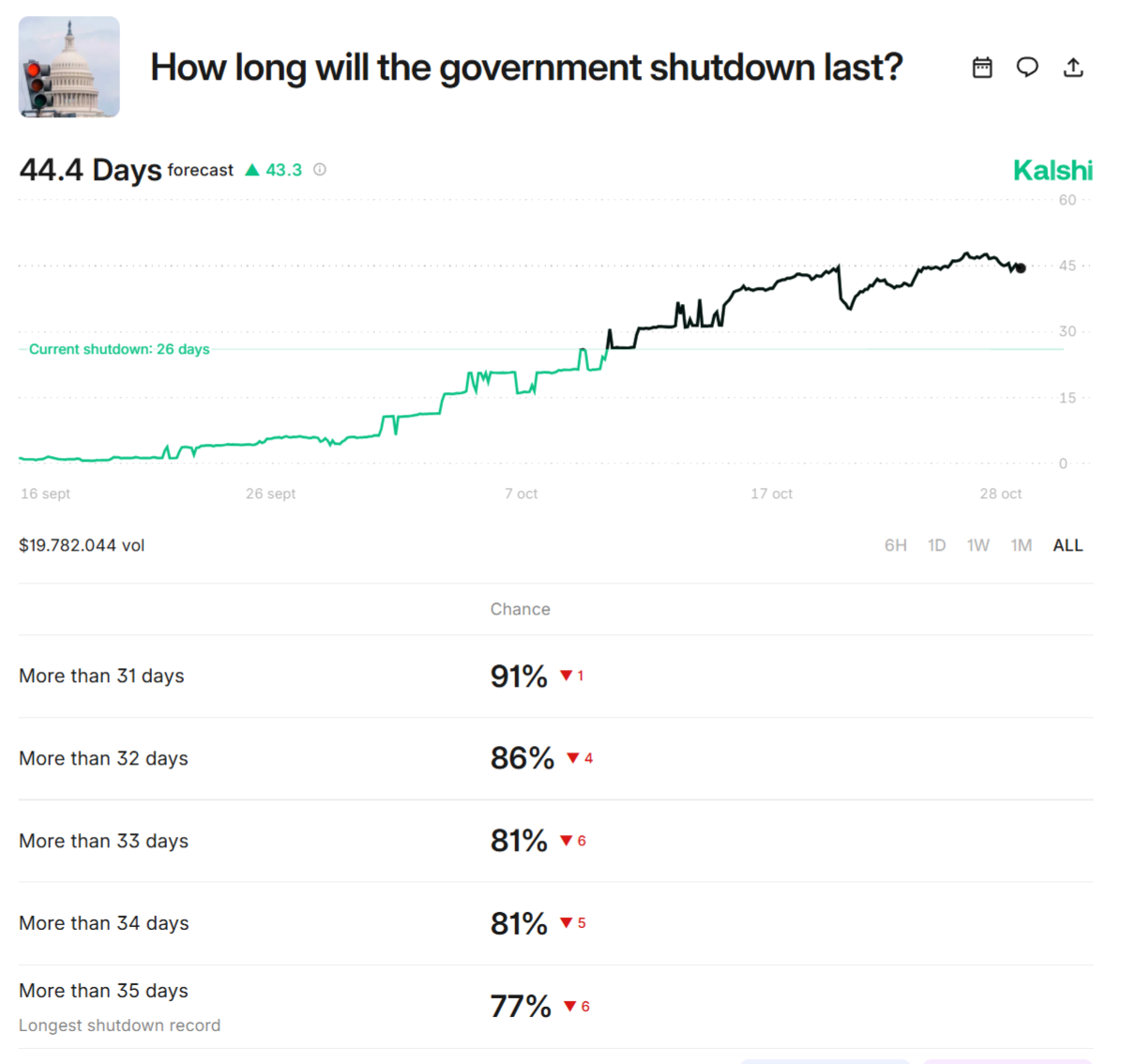

Another aspect is the partial U.S. government shutdown, started at the beginning of October, could be extended to reach 35 days duration with a estimated probability of 77%, according to prediction models based on the bipartisan negotiations. If it materializes, it will equal (and may even surpass) the all-time record for 2018-2019, when the budget impasse partially paralyzed the administration for more than a month.

This situation generates fiscal uncertainty y partially slows down economic activity, The government's decision to prevent the publication of official data that are key to determining the course of the economy, such as those of the Department of Labor or the Bureau of Economic Analysis. This absence of macro references begins to distort the growth projections, and there are estimates where a prolongation of the closure could subtracting about 0.2 percentage points from fourth quarter GDP.

Beyond the direct impact, the lack of official data on the limits the market's ability to interpret the real economy, which increases the volatility and reinforces the dependence on alternative indicators or private estimates, Although they are useful as a reference, they have clear limitations compared to official data in terms of reliability and market impact, at least until the situation is normalized.

APEC Summit: Trump and Xi at the Center of the Global Stage

Last but not least, the thursday, october 30 during the Asia-Pacific Economic Cooperation (APEC) summit at South Korea, the president Donald Trump will meet with Xi Jinping in a meeting that could redefine the overall economic equilibrium by conclusions reached. This meeting is scheduled for tomorrow local time, comes at a time of new trade tensions following the latest tariff measures introduced by Trump, an increase to 150% in tariffs.

The main topic will be the bilateral tariffs, the control of the rare earths and the technological restrictions, The two powers are at the core of the economic competition between them. Any progress, even partial, towards a substantial framework of understanding, as has been suggested in previous leaks, it could be to alleviate pressure on global supply chains, giving a respite for U.S. exporters (and with it the U.S. economy) and greater stability of raw materials.

Even so, a stalled or inconclusive negotiations would reactivate the risks of commercial retaliation, with a direct impact on the Asian markets and a chain reaction on Wall Street, where exposure to manufacturing, semiconductors and energy would cause volatility to pick up immediately.