The biotechnology sector continues to offer opportunities for those willing to take early-stage risks, as was the case with $CRNXan operation that recorded an intraday performance of +446,15%. However, where the progress is particularly interesting is in the field of cellular immunotherapy.

In this field, Adaptimmune Therapeutics plc ($ADAP) stands out mainly for its focus on T-cell therapies targeting solid tumors, a historically complex segment with high disruptive potential.

The market for cell therapies for solid tumorsas the synovial sarcoma (≈ $500 M) and other more extensive cancers such as ovary (≈ $5-10 B), is part of a global market estimated at between. $20 and $30 billion by 2030. Your leading candidate, afami-celcould generate annual revenues of between $50 and $200 million in case of approval.

As of October 9, 2025the stock trades at $0.2201with a market capitalization of 1TP4Q34.19 million. This analysis asks whether ADAP represents an undervalued opportunity or a high-risk investment; in my view, it is an undervalued opportunity or a high-risk investment; in my view, it is an undervalued opportunity or a high-risk investment. rare opportunity within the sector.

The objective price that I, Diego García del Río, consider to bebased on the company fundamentals and in the market projectionsI place it at $2 per sharewhich would imply a revaluation potential of +808.6% from current levels.

Adaptimmune specializes in the development of therapies T-cell oriented to solid cancers, with a pipeline led by afami-celwhich has shown encouraging clinical results. The company maintains relevant collaborationssuch as the one established with GSKas most clinical-stage biotechs, it is not yet generating profits and, like most biotechs in the clinical phase, it is not yet depends on external financing to sustain its development.

Fundamentals: Valuation and Performance of Adaptimmune Therapeutics ($ADAP)

It currently trades at low multiples, which is likely to attract investors looking for growth, even so, its margins are negative and reflect a high R&D cost (as is logical in this type of company at this type of stage):

Market Capitalization34.19M USD. Low, which gives me to understand an undervaluation and even a perception of high risk.

Price/Sales (P/S): 0.51. High attractiveness against biotech competitors, shows potential if revenues scale.

Price/Book (P/B): 2.68. Moderate, but book value is negative (-0.27 USD/share).

Net Margin-260,82%. Significant losses due to operating expenses.

Diluted EPS (TTM): -0.66 USD. Improvement from -1.02 in 2021, but still in negative territory.

Revenue Growth (QoQ)-89,30%. Recent drastic drop, although in 2024 it increased by +195% y-o-y.

I think that low valuation may be an opportunity for particularly patient investors.The volatility (beta of 2.49) and lack of profitability could make it a speculative bet.

Earnings Analysis $ADAP

ADAP's revenues grew exponentially in 2024, increased to USD $178M from USD $60MThe TTM is a new, mostly driven by their clinical milestones and collaborations that they had. Still, the TTM reflects a contraction, being -64% in 2024The company's operations, most likely due to delays in collaborations.

| Metrics | TTM | 2024 | 2023 | 2022 | 2021 |

| Total Revenues (000s) | 65,085 | 178,032 | 60,281 | 27,148 | 6,149 |

| Operating Expenses (000s) | 207,271 | 230,371 | 198,319 | 191,113 | 168,395 |

| Net Income (000s) | -169,756 | -70,814 | -113,871 | -165,456 | -158,090 |

Interestingly, the net losses reduced in 2024 to -$70M from -$113M in 2023However, even so, the operating expenses, being ~80% in R&Dcontinue to exceed revenues, as is logical given the type of company and stage.

Balance Sheet

The balance sheet shows a certain liquidity, but with a net worth affected by the accumulation of losses.

Total Assets (12/31/2024): $245.96M. Down from $282.62M in 2023.

Cash (MRQ 30/06/2025): $26.06M. Estimated runway of 3-6 months at current burn rate.

Total Debt (MRQ): $48.68M. Rising from $25.24M in 2023.

Equity: $11.85M. Down 70% from 2023.

Current Ratio (MRQ): 1.52. With sufficient liquidity, but with pressure for financing.

The greatest risk is the increasing debt and the possible need to issue more sharesThe company's shareholder base (currently 265M shares outstanding) could be further diluted, even though dilution should not be immediateThe estimated runway is sufficient to reach the next catalyst, estimated at the end of 2025.

Cash Flows

ADAP burns cash quickly, with negative operating cash flows covered by debt and equity, and again, is completely normal for the type of company and stage it is in..

Transaction Flow (TTM): -$190.03M.

Free Cash Flow (FCF): -$192.91M.

Financing (2024)$78.75M (debt/equity issuance).

Logically, the company is completely dependent on external financing, which limits its autonomy in the event that markets tighten.

Target Market for Adaptimmune Therapeutics ($ADAP)

Focused on the development of personalized cellular therapiesspecifically in T-cell receptors (TCR-T)which modify the patient's immune system to attack cancer cells. Its main target market is the treatment of solid tumorsThis is an area of unmet medical need, unlike CAR-T therapies, which have been more successful in hematologic cancers.

Key Segments

Synovial sarcomaYour lead candidate (or lead drug), afami-celis in advanced trials (phase 2/3) for this rare form of soft tissue cancer. The incidence is ~1,000-1,500 cases annually in the US.

Ovarian, head and neck, and other solid tumors.Other candidates such as Letetresgene autoleucel (in collaboration with GSK) target cancers with higher prevalence, such as ovarian cancer (~20,000 cases/year in the U.S.).

Market Size

According to cell therapy industry estimates, the global market for cell therapies is expected to reach $20-30 billion by 2030with a CAGR of ~15%. Solid tumors represent a high-growth segment due to the lack of effective therapies.

Over synovial sarcoma has a small market, ~$500M globally, it is an entry point for ADAP, as an afami-cel approval could validate their platform.

For larger solid tumors, the market for cancers such as ovarian or lung cancer is significantly larger, with a potential of $5-10 billion for successful TCR-T therapies.

Income Potential

ADAP's revenue potential depends primarily on three key factors: Regulatory approvals, scalability of your pipeline, y collaboration agreements.

Current Income (Baseline):

In 2024 its revenues were $178.03M, an increase of 195% vs. $60.28M in 2023, mainly due to collaborative milestones (e.g. GSK) and its own clinical breakthroughs.

TTM (as of 06/30/2025)$65.09M, reflecting a drop of 64% from 2024, most likely due to delays in milestone payments or less progress in trials.

Current revenues are mainly derived from:

Milestone paymentsContracts with (again) partners such as GSK for the development of Letetresgene autoleucel (aka lete-cel).

R&D collaborationsNon-recurring revenues related to advances in clinical trials.

Future Income Potential:

Afami-cel (Synovial Sarcoma): In the event that afami-cel receives FDA approval, it could generate initial revenues of $50-100M/year in the US, assuming a price per treatment of ~$400,000 (standard for cell therapies) and a penetration of 50% in ~1,500 patients/year. Considering an optimistic scenario, with expansion into Europe and increased adoption, it could reach $200M USD/year by 2028. Even so, it has a small market; its real impact would come from validating the TCR-T platform for larger indications.

Other candidates (lete-cel, etc.)With indications such as ovarian or head and neck cancer that have much larger patient populations (20,000-50,000 cases/year in the U.S. per indication), an approval could generate $500M-1B/year per indication, assuming similar pricing and 20-30% penetration. Under an optimistic scenario if ADAP achieves multiple approvals and commercialization agreements, revenues could exceed $2B/year by 2030.

Collaborations and Licenses: Agreements with GSK and other partners could provide $100-300M/year in milestone payments, royalties (~10-15% on sales), and upfronts. The best example is the deal with GSK for Letetresgene autoleucel (aka lete-cel) which already generated significant revenues in 2024.

Projected Revenues:

| Scenario | 2026 | 2028 | 2030 |

| Conservative | $100-150M | $300-500M | $500-800M |

| Moderate | $150-250M | $500M-1B | $1-2B |

| Optimistic | $250-400M | $1-2B | $2-4B |

All of the above taking into account the following key events: approval of afami-cel, at least one more approved candidate by 2028, growth of the cell therapy/adoption market in solid tumors and the continuity that exists right now with strategic partnerships (e.g. GSK).

Factors that Drive Potential:

With regulatory approvals by the FDA and the EMAThe company's potential would be drastically boosted by a fast-track/breakthrough that could accelerate review and commercialization timelines.

Even so, the company will have to improve the manufacturing scalabilitysince the TCR-T therapies are inherently complex and costly to produce. The reduction of operating costs should be a key factor in achieving profitability and competitiveness in the medium term.

Also, the presence of consolidated competitors such as Gilead (CAR-T) or Crispr Therapeutics (CRSP) could limit market share if they develop therapies with similar mechanisms of action. However, their participation may also limit their market share if they develop therapies with similar mechanisms of action. boosting the segment's potential, al validate commercial and scientific feasibility of cell therapies in solid tumors, attract greater investment interest y accelerate clinical adoption of this type of treatment, to the benefit of all the companies involved.

Risks that Limit Potential:

The main factors that could limit the potential for Adaptimmune are concentrated on three fronts.

First of all, the clinical delays or eventual failures in phase 3 trials which pose the greatest risk, could delay or prevent the approval of their therapies.

Secondly, the box burning is presented as a relevant threat, with only a small number of 1TP4Q26.06 million in cash at the end of the last reported quarter (June 30, 2025) and a burn rate of approximately $190 million per yearADAP could be forced to resort to dilutive financing to sustain its operations.

Finally, the increasing competition in the field of solid tumorsThe new company, driven by big pharma and other biotechs with greater resources, could restrict its market share and put pressure on its positioning in the long term.

Catalysts from Adaptimmune Therapeutics ($ADAP)

ADAP mainly presents mixed catalysts for the remainder of 2025 and early 2026, following the recent sale of its core pipeline (TECELRA, lete-cel, afami-cel and uza-cel) to US WorldMeds for $55 million upfront more up to $30 million in milestonesannounced on July 28, 2025. This transaction, which retains rights to preclinical programs such as PRAME and CD70, extends the cash runway to 2026, although it reduces near-term revenues.

Immediate Catalysts (Q4 2025)

Initiation of BLA Rolling Submission for Letetresgene autoleucel (Late 2025): Managed by US WorldMeds following the pipeline sale announced on July 28, 2025, it is based on Phase 2 results presented at ASCO, which showed an overall response rate (ORR) of 40% and a median response duration of ~11 months (June 2024 analysis). If the submission proceeds smoothly, it could trigger up to $30M in milestones for ADAP, extending its cash runway beyond 2026 and validating its TCR-T technology. Given that we are in mid-October, this catalyst is imminent (within 1-2 months), and any update from US WorldMeds or progress on the BLA could drive action.

Q3 2025 Financial Results (Expected in November 2025): With TECELRA sales off the books post-Q2, minimal revenue is expected, which could pressure the stock if there is no positive guidance on costs, cash runway or preclinical breakthroughs. However, any mention of new partnerships for PRAME/CD70 could generate a speculative bounce, similar to the +52% seen on October 8, 2025.

Preclinical Program Updates (PRAME and CD70)Adaptimmune retains these assets in solid tumors. Any announcements of initiation of Phase 1 trials or in-licensing (e.g. with GSK or others) in the coming months could validate the post-sale "restart" and attract investors. No fixed dates, but updates are expected in the November earnings call.

Medium-term catalysts (2026)

Regulatory Milestones and Payments for the Sale to US WorldMedsUp to $30M in additional milestones linked to approvals or sales of transferred products (e.g. afami-cel for synovial sarcoma). Possible triggers in H1 2026 if there are advances in Phase 3 trials or BLA filings, extending the runway beyond 2026 and reducing dilution risks.

Allogeneic Platform Development (Off-the-Shelf T-Cells)Adaptimmune is pivoting towards allogeneic therapies for solid tumors, combining its platform with lessons from autologous therapies. Updates at conferences such as ASCO or ESMO (mid-2026) or preclinical data in Q1/Q2 2026 could be significant catalysts, attracting collaborations and raising valuation (current P/S of 0.51 suggests upside if there is validation).

Nasdaq Compliance Risk: If the stock does not sustainably outperform USD 1TP4Q1, it could face delisting in 2026, acting as a negative catalyst unless there is a recovery on positive news.

Catalyst Summary Table

Ranked by potential impact.

| Catalyst / Event | Estimated period | Comment |

|---|---|---|

| Initiation of BLA Rolling Submission for lete-cel | Q4 2025 | Managed by US WorldMeds; could activate up to $30M in milestones and validate TCR-T technology. Immediate regulatory catalyst. |

| Development of allogeneic platform (off-the-shelf T-cells) | H1-H2 2026 | Advances presented at ASCO or ESMO could attract new collaborations and raise valuation. |

| Collection of milestones (up to $30 M) from sales to US WorldMeds | H1 2026 | Associated with approvals or sales of afami-celThe cash runway would be extended beyond 2026. |

| Updates on preclinical programs (PRAME and CD70) | Q4 2025 - Q1 2026 | Any announcements of Phase 1 trials or agreements with third parties (GSK or others) could validate the post-market "restart". |

| Q3 2025 financial results | November 2025 | Minimal revenues are expected; the market will be looking for signals on costs, liquidity and pipeline evolution. |

| Competitive pressure from Gilead and Crispr Therapeutics | Continuo | Competitors with greater resources could limit market share, although their activity validates the segment. |

| Need for additional financing | 2026 | With a burn rate of ~$190 M/year, the company could resort to dilutive financing to maintain operations. |

| Nasdaq delisting risk | 2026 | If the stock does not exceed 1TP4Q1 on a sustained basis, it could face exclusion from the market, affecting its investor perception. |

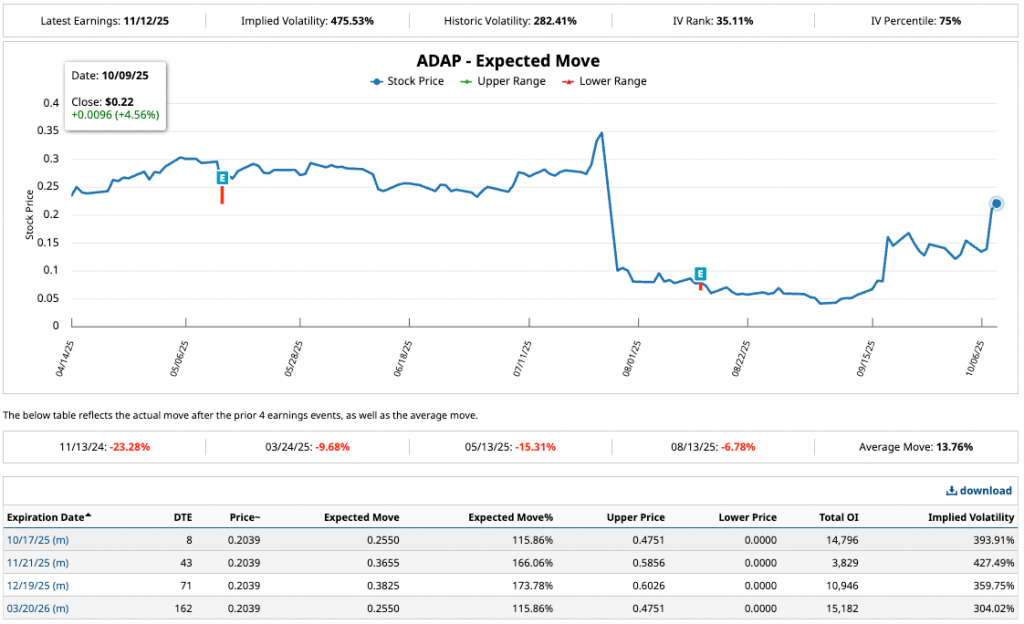

Financial Options Analysis of Adaptimmune Therapeutics ($ADAP)

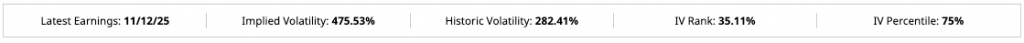

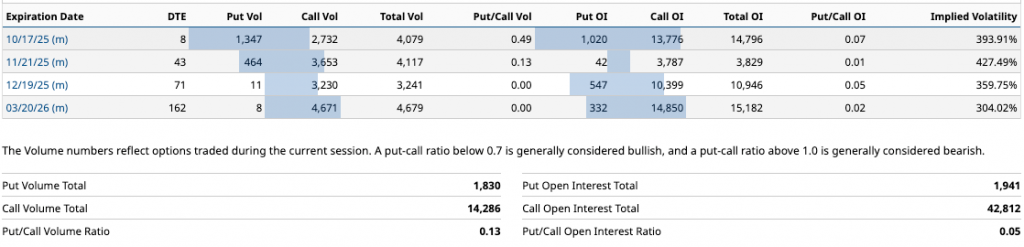

Regarding ADAP options, it shows a market dominated by call activitywith low put/call ratios suggesting general bullish sentimenttypical in speculative biotechs post-events such as the July 2025 pipeline sale. Implied volatility (IV) is elevated at close expirations (300-400%), but the overall IV (47.53%) is below historical volatility (281.90%), indicating moderate movement expectations for next earnings (November 12, 2025) or a catalyst of great relevance.

Put/Call Ratios and Volatility

Low put/call ratios (put/call < 0.5) reflect higher interest in calls, which is interpreted as bullish (investors betting on upside). The total volume of puts is only 13% of calls, and the open interest (OI) of puts is marginal (5%). The high IV on nearby strikes suggests high premium for expected volatility, but the IV rank of 35.11% (75% percentile) implies possible "IV crush". post-earnings/post-catalyst.

The general trend of volume ratio (green) and RO (red) remain low as of December 2024with volume peaking in July-September coinciding with pipeline news. The share price (blue) has fallen ~75% YTD, but the low P/C suggests call accumulation for a rebound.

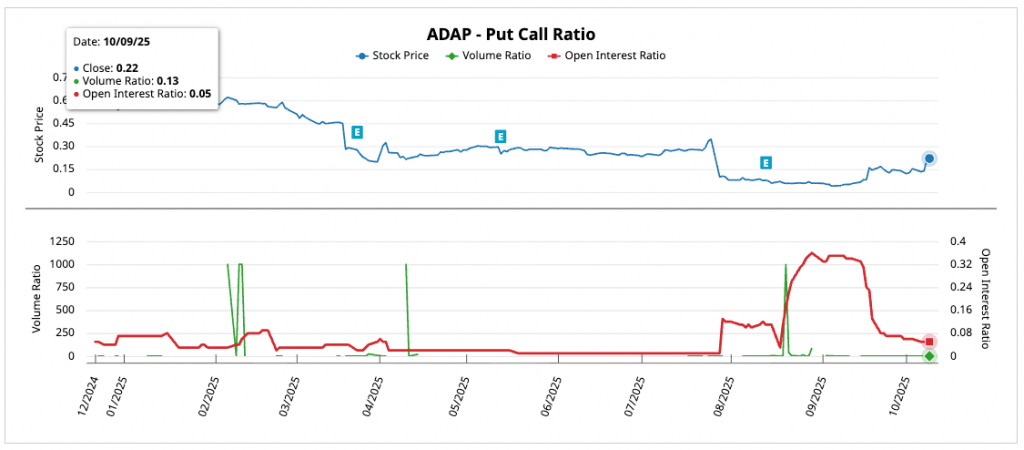

Expiration Option Chain (9/10/2025)

Key strikes data (ATM/OTM close to the price of 0.22 USD). Volumes and OI concentrated in low strike calls (e.g., 0.5), indicate a moderate upside speculation. IV falls in distant expirations, reflecting less uncertainty in the long term.

I can highlight a large concentration of ~80% of volume and OI in low strike calls (0.5-1.0 USD), betting on a post-earnings rebound or catalysts such as BLA of lete-cel (late 2025). The IV skew is high at nearby puts (up to 427%), but low at distant calls, suggesting downside protection but upside optimism.

Expected Move Analysis (Expected Move)

The chart shows an expected movement of ~11.5% for the 12/11/2025 earnings (based on IV of 47.53%), with upper range 0.475 USD (+115%) and lower range 0.000 USD (theoretical). Historical post-earnings movements average 13.76%, with ranges from -23% to +23% over the last 4 reports (e.g., November 2024: -23.28%).

With IV rank low, the market expects less volatility than historical, but catalysts such as Q3 results (November) or regulatory milestones could exceed 11.5%. Current position at 75% percentile of IV suggests sellers of straddles/strangles to capture crush.

Market Sentiment and Risks

Low P/C ratios + high OI in calls = accumulation, I interpret a bullish indicator for an upside (e.g., preclinical partnerships or US WorldMeds milestones). Idea also supported by the call volume 8x puts in November (pre-earnings).

Now, with low put volume I think it may indicate complacency, if earnings disappoint (e.g., short runway) or catalyst is not given in time, a quick downside (historical -15-23%) could occur.

It should be made clear that ADAP is a volatile penny stock, has low liquidity in puts (wide bid/ask spreads) and has short interest 11% amplifies swings, it also has to reach Nasdaq compliance ($1 minimum), which is a potential risk in 2026.

Adaptimmune Therapeutics Current Scenario ($ADAP)

As of today, Adaptimmune Therapeutics plc ($ADAP) demonstrates an ownership structure that reflects its status as a low market cap speculative biotech ($58.34M), with a moderate distribution between institutions and insiders, but with a significant short interest that adds volatility. The short float is of the 11.31%This means that approximately 29.65M of the 255.41M shares in float are in short positions. This level is moderate in comparison to typical short squeeze thresholds (generally >20-30%), and the short ratio (days to cover, calculated as short interest divided by average daily volume of 90.01M shares) is approx. 0.33 daysindicating that shorts could close quickly if a bullish catalyst emerges. However, a short squeeze genuine seems unlikely in the near term: although the stock has shown extreme swings (e.g., +52% on October 8, 2025 on partnerships rumors), low relative volume and the absence of a massive catalyst such as an acquisition or imminent FDA approval limit the potential for an explosive squeeze. That said, if the BLA rolling submission for Letetresgene autoleucel (aka lete-cel) in late 2025 (managed by US WorldMeds) generates unexpected milestones or positive news in November earnings, it could force short covering and a temporary rebound of 20-50%, amplified by the 2.49 beta and 11% short interest.

Regarding insiders e institutionsthe latter control the 27.58% of shares, a low level for the biotech sector (average ~50%), suggesting skepticism from large funds in the face of cash burn and recent dilution (net insider transactions at -89.68%, indicating aggressive selling). The insiders have only the 3.64%This contrasts with the high float (96.36% outstanding shares of 265.05M), facilitating liquid trading but exposing manipulation by shorts. This contrasts with the high float (96.36% of outstanding shares of 265.05M), facilitating liquid trading but exposing to manipulation by shorts.

Thoughts on the above

With insiders selling and a cash runway until 2026 dependent on milestones (~$30M potential), future equity issuance could pressure the price, benefiting shorts.

Short interest has risen ~3% in the last month, aligned with bullish bias in options (P/C ratio 0.13), suggesting retail traders accumulate calls to counter shorts. Monitor Nasdaq compliance ($1 low) as a negative catalyst in 2026.

For speculators, the setup favors long-biased strategies (e.g., OTM calls); for conservatives, low institutional ownership is a red flag. For me ADAP is a high-risk/high-reward with shorts as a brake, but preclinical catalysts that tip the balance.

Analyst Ratings for Adaptimmune Therapeutics ($ADAP)

Analysts show a mixed consensus with a bias towards "Hold" in the most recent updates (July-October 2025), albeit with price targets implying significant upside (average ~2.50 USD, +1036% from current price of 0.22 USD). Primarily reflects optimism for the preclinical pipeline and potential milestones, but some caution due to cash burn and dependence on US WorldMeds.

Table with key ratings based on data as of October 09, 2025

| Entity | Current Position | Target Price (USD) | Change in Target Price | Previous Target Price (USD) | Action | Date |

|---|---|---|---|---|---|---|

| H.C. Wainwright | Maintain | - | - | - | Downgrading | 29/07/2025 |

| Mizuho | Maintain | 0.50 | +138.10% | 1.50 | Downgrading | 25/06/2025 |

| Mizuho Fargo | Maintain | 0.10 | +387.10% | 1.50 | Downgrading | 14/05/2025 |

| Wells Fargo | Maintain | 1.00 | +376.19% | 1.50 | Maintain | 14/05/2025 |

| Jones Trading | Maintain | - | +1328.57% | - | Downgrading | 11/04/2025 |

| H.C. Wainwright | Buy | 3.00 | +1328.57% | 3.50 | Maintain | 01/04/2025 |

| Guggenheim | Buy | 1.75 | +733.33% | 3.00 | Maintain | 26/03/2025 |

| Scotiabank | Buy | 1.40 | +566.67% | 3.15 | Maintain | 21/03/2025 |

| Mizuho | Buy | 1.50 | +614.29% | - | Maintain | 20/03/2025 |

| Mizuho | Buy | 1.50 | +614.29% | 3.00 | Maintain | 27/11/2024 |

| Guggenheim | Buy | 3.00 | +1328.57% | 4.00 | Maintain | 15/11/2024 |

Of the 11 recent ratings, 7 are "Maintain". (64%) and 4 "Buy" (36%), with a average target price of ~1.83 USD (+732% upside). The downgrades in 2025 (e.g., Mizuho and H.C. Wainwright) are in response to the pipeline sale in July, but high targets suggest faith in residual value (PRAME/CD70).

The implied upside is attractive to speculators, but the lack of "Sell" indicates no panic. The number of signings is typical for small-cap biotech, with a low volume of upgrades reflecting institutional skepticism.

Synthesis

In a single (long) sentence: Adaptimmune Therapeutics ($ADAP) is a small-cap biotech with high asymmetric potential supported by regulatory/commercial validation of its TCR-T platform and nearby catalysts (BLA rolling of Letetresgene autoleucel and potential milestones), but with elevated risks stemming from cash burn, potential dilution and Nasdaq compliance.

Right now I think it is more relevant than ever, as after the pipeline sale to US WorldMeds ($55M upfront + up to $30M in milestones), the company gains runway until 2026 and refocuses on preclinical assets (PRAME, CD70). In the short term, the initiation of the BLA (late 2025) and the November earnings can move the price; in 2026, regulatory milestones and breakthroughs in the allogeneic platform are impact catalysts,.

The field of cell therapies for solid tumors holds a relevant opportunity (≈ $20-30B to 2030). Afami-cel, which is its lead drug, could generate $50-200M/year if it obtains approval in synovial sarcoma, and most importantly, it would validate the platform for major indications (ovarian, head and neck).

With its current low capitalization and depressed multiples (P/S ≈ 0.51), the investment case is supported by revenue normalization via milestones/licensing and regulatory testing of Letetresgene autoleucel (aka lete-cel). Target Price I consider: $2 (theoretical upside ≈ +808,6% from $0,2201), subject to execution and positive news on the regulatory path.

The main risk is of the following type clinical and regulatorydelays or failures in phase 3 or in the BLA of Letetresgene autoleucel could disrupt the milestone schedule and significantly dent market confidence. burn rate of ~$190M/year in front of a $26.06M cash (06/30/2025) increases the probability of dilutive financing before 2026.

In addition, there is the risk of delisting on Nasdaq if the stock does not sustainably exceed the threshold of $1and the competitive pressure of Gilead y Crispr Therapeutics (CRSP)which, while validating the segment, could limit future market share and margin.

I will keep an eye on the BLA rolling submission of Letetresgene autoleucel expected by the end of 2025 and the possible milestone payments arising from the agreement with US WorldMeds. I think that it will also be determinant the Q3 2025 earnings reportwhere the market will evaluate the cost control, the duration of the cash runway and progress in the programs PRAME y CD70. In addition, I will closely follow the possible signature of new licensing or collaboration agreementsthe advances in the development of allogeneic T-cell therapies (with potential updates in ASCO/ESMO 2026) and the compliance with Nasdaq listing requirementsin view of the possibility of a reverse split if the action fails to stabilize above the $1 threshold.

I think it is a speculative opportunity with the potential for significant revaluation if regulatory/strategic milestones are achieved, but always and logically with high financial and performance risk. The risk-return balance improves if the BLA of Letetresgene autoleucel (aka lete-cel) materializes and milestone/licensing revenues are secured before cash pressures in 2026.