In a market where it is difficult to find opportunities that really deserve attention, I am Diego García del Río and in this analysis I highlight three companies: Achieve Life Sciences ($ACHV), Zevra Therapeutics ($ZVRA), and Crinetics Pharmaceuticals ($CRNX)..

ACHV moves forward with cytisinicline for tobacco cessation; ZVRA drives MIPLYFFA in rare diseases; and CRNX is approaching the PDUFA of paltusotine for acromegalyscheduled for Friday, September 25. Each section offers key metrics, target price estimates and market patterns, geared towards professionals looking for opportunities in speculative biotechs with high growth potential.

Before going into the analysis, I leave you a table with the current price of these assets and the target price. Me, Diego García del Ríoestimate these targets based on medium/long-term potential:

| TICKER | CURRENT PRICE | TARGET PRICE | UPSIDE % |

| ACHV | 2.95 USD | 16.00 USD | 442.37% |

| ZVRA | 8.11 USD | 24.00 USD | 195.93% |

| CRNX | 33.72 USD | 72.00 USD | 113.53% |

*Price targets are based on market potential, revenue projections and regulatory approvals, with upward adjustments for successful launches, but subject to industry risks.

This analysis addresses their immediate catalysts, key metrics and market perspectiveswith a focus on high-potential speculative opportunities.

$ACHV: Fundamental X-Ray and Value Potential in Cytisinicline

In my opinion, as Diego García del Río, Achieve Life Sciences ($ACHV) is a non-revenue biotechnology company focused on developing cytisiniclinea smoking cessation drug with solid liquidity but growing losses and high risk linked to clinical success.

Achieve Life Sciences ($ACHV) is a biotechnology company focused on the development of cytisinicline, a late-stage smoking cessation drug, with no revenues due to its pre-commercial stage and total dependence on external funding to advance clinical trials and regulations. With a market cap of approximately 150.76 million and a business value from 105.32 million as of September 2025, the company is listed at 2.96 dollars per sharewith 51.1 million shares outstanding and a float of 41.82 million. Your beta of 1.54 indicates an above-market volatility, typical of speculative biotechs, while the institutional ownership reaches 61.42%indicating interest from professional investors, although the insiders retain only the 4.24%.

In the income statement, ACHV recorded zero revenues in the last twelve months (LTM), with operating loss of US$ 50.11 million and a net loss of TTM 50.42 millionequivalent to a Diluted EPS of -$1.48. For Q2 2025 (ended June 30), the net loss was 12.7 milliondriven by R&D expenditures, which grew 28% year-over-year from a loss of 39.83 million in 2024. Profit and operating margins are zero, with a ROA of -50.63% y ROE of -120.11% TTM, reflecting a high consumption of capital with no immediate returns.

The balance sheet shows a strengthened financial position due to a recent public offering that raised US$49.3 millionresulting in 55.4 million in cash and cash equivalents at the end of Q2 2025, in front of a total debt of only 9.96 million. This generates a current ratio of 6.64 and a shareholders' equity of 20.90 million at the end of 2024, with a book value per share of US$ 0.84 and a price/book ratio of 3.62. Total assets amounted to 38.63 million at the end of 2024, with liabilities of 17.73 million, providing a estimated runway to 2027 without additional dilutions.

The analysts' consensus reflects optimismwith predominant ratings of "Buy"(Buy) from firms such as H.C. Wainwright, Oppenheimer, Rodman & Renshaw, Jones Trading, CG Capital and Raymond James, and target prices between US$11.00 and US$20.00 per share. The average target price of $15.50 involves a revaluation potential >400% from the current closing price, based on projections of regulatory success and commercialization of cytisinicline.

The potential market for cytisinicline is vast, with the global smoking cessation therapy sector projected to grow at 5.2 billion dollars by 2028aimed at some of the 1.2 billion smokers worldwideparticularly in the USA and Europe where the prevalence exceeds 20%. Recent milestones, such as the NDA submission to FDA in Q2 2025 and a strategic alliance with Omnicom for marketingtogether with data published in Thorax on its efficacy in patients with COPDACHV is positioned for a possible approval in 2026.

$ACHV: Key Catalysts

Potential catalysts for Achieve Life Sciences ($ACHV) are as follows:

- FDA PDUFA Decision (June 20, 2026): The approval of cytisinicline could enable the commercial launch, prompting action in the face of a 5.2 billion dollar market projected for 2028.

- Progress in commercial alliances (Q4 2025-Q1 2026): Collaboration with Omnicom for the launch could generate payer coverage announcements or market strategies, improving the perception of execution.

- Conference presentations (Q3-Q4 2025): Events such as H.C. Wainwright (8 Sep 2025) y Lake Street BIG9 (11 Sep 2025) could reveal new clinical data or projections, generating positive volatility.

- Clinical or indicative updates (2025-2026): Data in COPD patients or other cytisinicline extensions would reinforce confidence in the pipeline.

- Quarterly reports (2025): reports showing runway extended beyond 2027 (55.4M in cash) or operational improvements could attract analyst upgrades and greater institutional interest.

Of all of these, the most relevant catalyst for Achieve Life Sciences ($ACHV) is the FDA PDUFA decision on cytisinicline on June 20, 2026. An approval would not only open the door to the commercial launch of the first truly competitive smoking cessation treatment in decades, but would also position the company within a market estimated at 5.2 billion dollars by 2028.

$ACHV: Analysis of your Option Chain

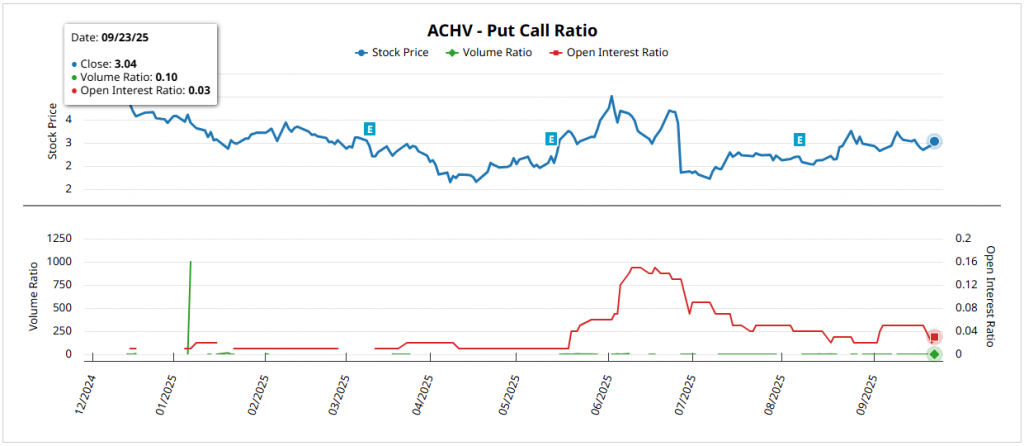

Considering that the data are mid-September 2025In view of the low trading volume and expected movements until December, I would take into account the following.

The total volume of options are usually extremely low, especially when tracking inter-session activity, reflecting limited liquidity y little immediate speculative interesttypical of a small-cap biotech precommercial with capitalization of ~150M of dollars. A low volume like this suggests neutrality in the daily flowThe number of transactions per day is not statistically significant given the remarkably low average number of transactions per day.

In contrast, the open interest (OI) shows a strong upward bias: OI puts = 658 in the face of OI calls = 18,935resulting in a put/call ratio of current OI = 0.03 (well below the conventional bearish threshold of 0.7). This asymmetry indicates positioning in callspossibly anticipating catalysts such as the PDUFA of cytisinicline in June 2026with greater exposure to upside than to the downside.

The implied volatility (IV) is located in 262.05%with a rank of 30.63% y 89% percentilepointing out expectations of large movements although not at recent historical peaks, in line with the historical volatility of 72.14%.

For the expiration on December 18, 2026 (~15 months remaining), the expected movement is ±1.40 dollars (±45.83%) from the current price of 3.06 dollarswith a superior rank of 4.46 dollars and lower than 1.66 dollars. This implies a symmetrical upside and downside potential of 45.75%although it is reinforced by the bias in calls that medium-term options traders show.

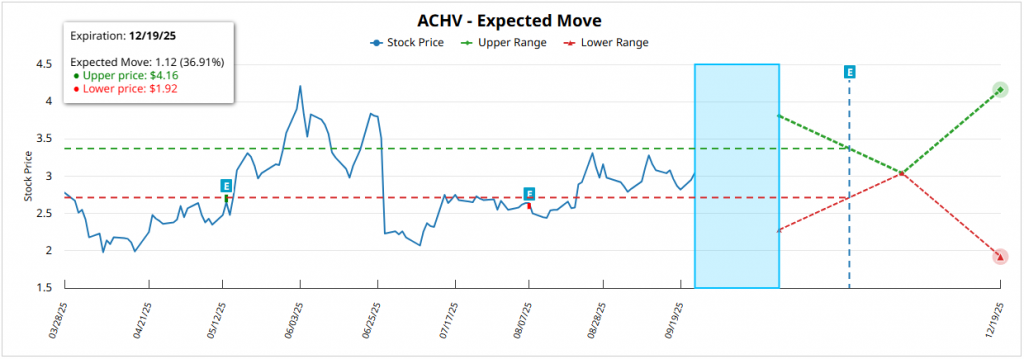

$ACHV: Technical Analysis

Technical analysis of Achieve Life Sciences ($ACHV) shows a price structure in a phase of consolidation with an upward biasThe stock is trading within a range of 1.5 billion euros, according to the latest chart data as of September 23, 2025. The stock trades within a descending lateral range from July's highs (~$4.50), with a moderate volume which has not yet generated significant breaks. Currently, the price remains above the EMA 50 and still below the 200 EMA, which reflects a short-term bullish tone within a larger corrective framework.

In intermediate time frames, there is a significant rising wedgedelimited by a resistance around 3.50 dollars and a support on 2.40 dollars. This pattern, historically resolved on the upside in a 60-70% of casescould be triggered by a volume spike above 1.5M shares per dayanticipating a technical breakthrough even before the most relevant fundamental catalyst, the PDUFA June 2026.

The RSI (14) remains in the neutral zone (~45), with no significant bearish divergences, while the MACD histograms, but without a confirmed bearish crossover, suggesting a technical pause prior to a directional movement.

The current structure aims at a cautious medium-term upward biaswith a first objective around 3.80 dollars after the wedge breaks, conditioned to the volumetric confirmation and regulatory news developments.

$ZVRA: Fundamentals of an Innovation in Rare Diseases

From my analysis, Diego García del Río, Zevra Therapeutics ($ZVRA) is a biotechnology company with increasing revenuesfocused on MIPLYFFA for hypersomnia and narcolepsy, with strong liquidity after selling a PRVbut with operating losses and risk linked to clinical and regulatory success.

Zevra Therapeutics ($ZVRA) is a biotechnology company specializing in the development and commercialization of treatments for rare diseaseswith its main product MIPLYFFA (formerly KP1077) approved for the idiopathic hypersomnia disorder and in development for narcolepsyalong with other pipeline candidates such as arimoclomol for Niemann-Pick type C disease. In early commercial stage but with growing revenuesoperates with a market capitalization of 446.27 million dollars and a enterprise value of 305.94 million as of September 23, 2025, quoted at 7.95 dollars per sharewith 56.14 million shares outstanding and a float of 46.89 million. Your beta of 1.56 reflects high volatility, while the institutional ownership of 65.04% indicates strong investor backing, although insiders maintain only the 0.73%.

In the income statement, ZVRA generated net revenues TTM of US$62.02 millionwith a 486% year-over-year growth in Q2 2025 where the net sales reached 25.9 milliondriven by MIPLYFFA with 21.8 million in sales. However, it recorded a 60.41 million TTM operating loss of and a net loss TTM of -0.25 dollars per sharealthough the net result was positive by 2.64 million thanks to non-operating income. For Q2 2025, it reported a EPS of -0.06 dollarsbelow expectations but with revenue exceeding estimates by 14.8%. The ratios show ROA of -18.85% y ROE of 3.53%with 72% gross margins but pressured by rising expenses.

The balance sheet at the end of 2024 showed total assets of $178.13 million, liabilities of 138.46 million y total debt of 60.30 millionresulting in a book value per share of US$ 0.71 and a P/B of 3.81. Strengthened by the sale of a PRV for 150 million in Q2 2025, the cash exceeds 200 millionextending the financial runway to 2028 without immediate dilutions and with a current ratio >5x.

The analysts' consensus reflects optimismwith predominant ratings of "Buy"(Buy) from firms such as Citizens JMP, Cantor Fitzgerald, H.C. Wainwright and Guggenheim, y price targets between US$18.00 and US$29.00. The average target price of $22.80 involves a revaluation potential >180% from the current level, based on projections of business expansion y additional approvals in the pipeline.

The potential ZVRA market is substantial: MIPLYFFA points to a market for hypersomnia and narcolepsy valued in the billions, with 2025 sales projections of 80 million (from previous 48). The global market for therapies for rare diseases will grow at a CAGR of 13.8% to 495 billion in 2033. Recent milestones include positive data from MIPLYFFA in September 2025, payer coverage to 52%a 500% revenue growth year-over-yearand advances in assays for arimoclomolpositioning the company for approvals in 2026.

Without a P/E trailing available for transition to profitability, but with a forward P/E of 10.06 and a price/sales of 6.84ZVRA currently has a attractive valuation for your business momentumalthough with an investment of moderate risk in biotechs with real revenues and a diversified pipeline, also exposed to regulatory volatilitycompetition in rare and possible future dilutions.

$ZVRA: Key Catalysts

Mainly, the potential catalysts of Zevra Therapeutics ($ZVRA) are as follows:

- Presentations at medical conferences (Q3-Q4 2025): Updates at INPDA and CNS on MIPLYFFA and OLPRUVA could validate long-term efficacy data and attract payer coverage.

- Investor conferences (Q3-Q4 2025): Participation in events such as Cantor Global Healthcare and H.C. Wainwright could reveal breakthroughs in sales and pipeline, driving analyst upgrades.

- Progress in trials of KP1077 for narcolepsy (H2 2025): Phase 2 topline in idiopathic hypersomnia and Phase 3 initiation in narcolepsy could support a future NDA, targeting a multibillion-dollar sleep disorders market.

- Financial updates (Q3-Q4 2025): Reports showing MIPLYFFA revenue growth (projected at 80 million by 2025) and runway extended to 2028 with over 200 million in cash could bolster institutional confidence.

Taking into account each one, the most relevant catalyst for Zevra Therapeutics ($ZVRA) in the short term is the progress in KP1077 trials for narcolepsy during the second half of 2025. The release of results from Phase 2 in idiopathic hypersomnia and the beginning of a Phase 3 in narcolepsy could support a future NDA and position the company in the multi-billion dollar sleep disorders market. This clinical breakthrough has the potential to become the primary driver of valuation and attraction of institutional capital.

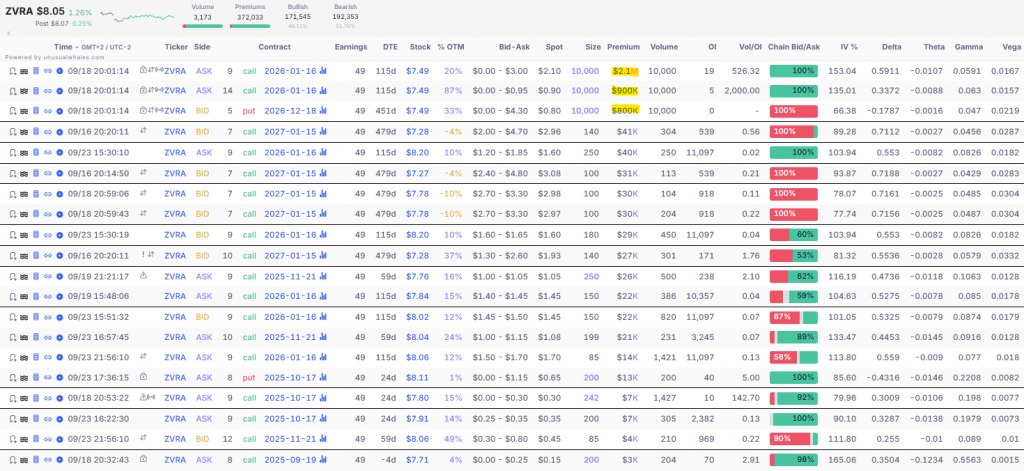

$ZVRA: Analysis of your Option Chain

Again, and I will repeat myself, based on data. mid-September 2025along with emphasis on the put/call ratio (OI)trading volume, expected movements until December and recent unusual volumes.

The total volume of options is on the rise, taking into account its average and prioritizing calls per session, which reflects a growing speculative interest in a mid-cap biotech (~446M market cap) with commercial momentum in MIPLYFFA. This high volume generates a put/call volume ratio = 0.08 (well below 0.7, the bearish threshold), indicating a strongly upward flow in daily transactions, possibly driven by catalysts such as the arimoclomol PDUFA.

The open interest (OI) reinforces this bias: puts = 11,139 in the face of calls = 38,499resulting in a put/call ratio of OI = 0.29 (also below 0.7). This disparity suggests sustained positioning in callsanticipating upside in MIPLYFFA sales or regulatory approvals, with less downside exposure despite the inherent volatility of the sector.

Also to note, I found several unusual volumes in large blocks (18 Sep 2025)consisting of operations by ~3.8M in premiumspredominantly bullish:

- Purchase of 9,000 calls (strike 49, exp. Jan 2026, 115 DTE) a 7.49 $/contracttotal premium ~2.1M.

- Purchase of 14,000 calls (strike 49, exp. Jan 2026)total premium ~0.9M.

- Sale of 5,000 puts (strike 49, exp. Dec 2026, 45 DTE) a 7.49 $premium ~0.8M → implicit bullish position.

These blocks, with volumes/OI of up to 526% in callsreflect institutional interest in upside leverage medium term, linked to expectations of revenue growth 2025.

The implied volatility (IV) reaches 122.87%with rank 38.14% y percentile 72%which denotes expectations of moderate significant movementshigher than the historical volatility (79.69%)in line with the transition to profitability.

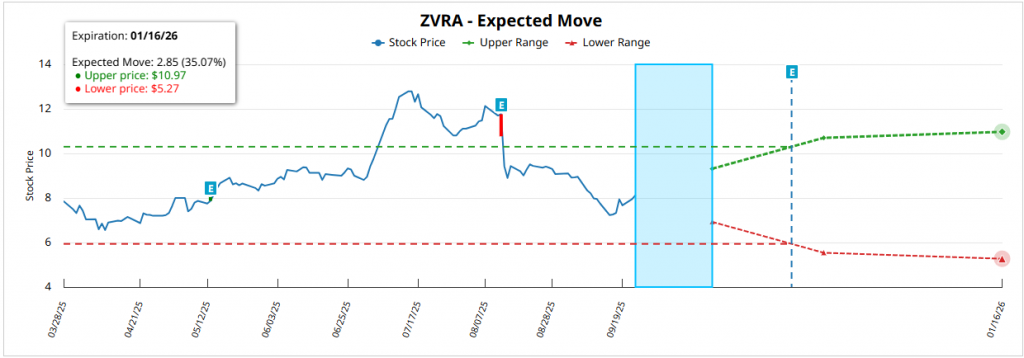

For the expiration January 16, 2026 (~115 DTE)the expected movement is ±2.98 $ (±36.84%) from the current price of 8.08 $with a higher rank in 11.07 $ and lower in 5.15 $. This implies a symmetrical upside and downside potentialalthough supported by the bias in calls that show the institutional flows.

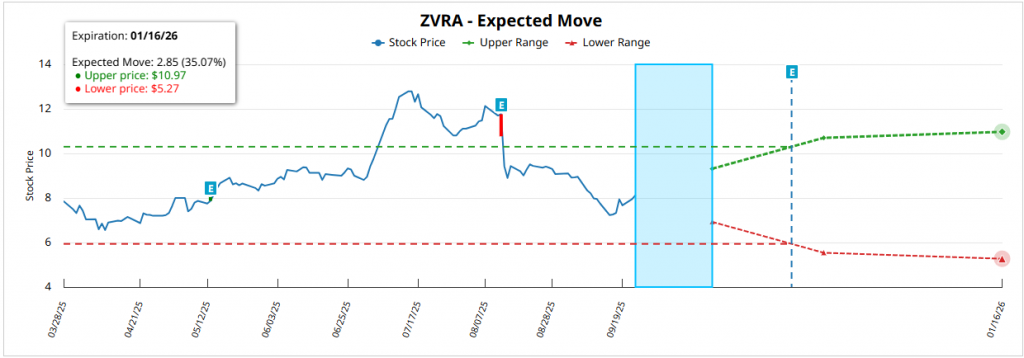

$ZVRA: Technical Analysis

Continuing with Zevra Therapeutics ($ZVRA)its technical analysis points to a rebound within a short-term downtrendbased on the daily chart at September 23, 2025. The current price is located around 8.11 dollarsafter a sustained decline from July's highs (~12.50 dollars) to mark ground in 7.16 dollars at the beginning of September. From that level there has been a partial recovery, although still insufficient to invalidate the selling pressure.

The EMA 20 and 50 The price remains in a clearly bearish configuration, with the price below both, reflecting the fact that the bias is still to the downside. structural weakness. The rebound has allowed the recovery of the 7.50 dollarsbut the immediate resistances are in the range of 8.50-8.75 dollars. Only a break with volume greater than 2.5M shares/day would pave the way for an initial target towards 10.50 dollarscoinciding with the screening of the EMA 200.

The RSI (14) is located around 42after coming out of oversold conditions, confirming an easing of the bearish pressure but still lacking relative strength. The MACD shows a incipient bullish crossoversupporting the rebound, although without solid momentum to suggest a change in trend.

This reflects a scenario of tactical recovery within a bearish structurewith a very short-term neutral-bullish bias, subject to the breakout of resistance.

$CRNX: Fundamental Analysis of the Next Rare Endocrinology Revolution

Under my approach, Diego García del Río, Crinetics Pharmaceuticals ($CRNX) is a biotechnology company focused on oral therapies for rare endocrine diseaseswith its biggest bet on paltusotine (PDUFA on September 25, 2025) for acromegaly.

Crinetics Pharmaceuticals ($CRNX) is a biotechnology company focused on the development of innovative oral therapies for rare endocrine diseasesas paltusotine (PALSONIFY™) under review by the FDA for acromegaly dated PDUFA estimated for September 25, 2025and other pipeline candidates such as atumelnant for congenital adrenal hyperplasia and endocrine tumors. With no significant revenues due to its pre-commercial stage, it has explosive sales projections by achieving commercialization. With a market capitalization of 3.18 billion dollars and a enterprise value of 2.03 billion as of September 23, 2025, the company is trading at 33.72 dollars per sharewith 94.18 million shares outstanding. Your beta of 0.28 indicates lower volatility than the market, whereas the institutional ownership exceeds 114.81%reflecting strong investor confidence, although the insiders maintain only the 2.01%.

In the income statement, CRNX generated TTM revenue of US$1.39 millionmainly from minor collaborations, with a TTM operating loss of $424.45 million and a net loss TTM of 369.83 millionequivalent to a EPS of -$4.10. For the Q2 2025reported revenues of 1.03 million (below estimates) and a net loss of $115.6 milliondriven by spending on R&D and SG&A which grew from 74.1 million in Q2 2024. The ratios show ROA of -23.77% y ROE of -36.94%with zero margins given the stage of development. Analysts project a EPS of -$4.65 in 2025 and a revenue growth of 529% per year.

The balance sheet as of the end of Q2 2025 shows 1.2 billion in cash, in front of a total debt of only 49.94 millionresulting in a current ratio >20x and a book value per share of US$ 12.46 (P/B of 2.71). This position provides a financial runway to 2029 without immediate dilutions, backed by previous financing and collaborations.

The analysts' consensus reflects optimismwith a predominance of qualifications "Buy"(Buy) of Cantor Fitzgerald, Citizens JMP, Jones Trading, Stifel, Piper Sandler and H.C. Wainwrighttogether with a "Maintain"(Hold) of Goldman Sachs. The target prices range from US$36.00 to US$97.00with a average of $74.20which implies a revaluation potential >120% from the current level, based on the regulatory success and future commercialization of paltusotine.

The potential CRNX market is substantial: paltusotine points to a market for acromegaly valued at >$2 billionwith a 20,000 patients in the U.S. who currently rely on daily injections, which provides an opportunity for disruption with oral administration. Sales projections for 2025 are in excess of 450 million post-approvalwhile the market for Rare endocrine therapies will grow at a CAGR of 8-10% until 2030.. Recent milestones include positive phase 3 data in ENDO 2025, orphan drug designation for atumelnant and advances in CRN12755 for Graves' disease, positioning the company for multiple approvals 2026-2027.

$CRNX: Key Catalysts

Main catalysts for Crinetics Pharmaceuticals ($CRNX):

- FDA PDUFA decision for paltusotine (September 25, 2025): approval in acromegaly could enable commercial launch with peak sales estimated at 1,000M within a 1.5 billion global market.

- Updates on atumelnant assays (H2 2025): start of Phase 3 in adults y Phase 2b/3 in pediatrics for congenital adrenal hyperplasia, in conjunction with topline in carcinoid syndromewould validate the pipeline.

- Presentations at medical conferences (Q3-Q4 2025): at ENDO 2025abstracts on paltusotine, atumelnant and CRN12755 could reveal additional efficacy data, attracting coverage.

- Investor conferences (Q3 2025): events such as Jefferies Global Healthcare (5 Jun 2025) and the like could provide updates on business readiness and projections.

- Financial updates (Q3-Q4 2025): reports showing 340-380M cash usage in 2025 and runway until 2029 with 1.2B in liquidity would strengthen institutional confidence.

The most relevant catalyst for Crinetics Pharmaceuticals ($CRNX) is the closest, the FDA PDUFA decision on paltusotine on September 25, 2025. An approval in acromegaly would enable the immediate commercial launchwith estimated peak sales of US$ 1 billion within a global market of approximately 1.5 billion. This regulatory milestone is critical to CRNX's valuation, marking its move from a company without significant revenues to a potential leader in oral endocrine therapies.

$CRNX: Analysis of your Option Chain

Finally, in data mid-September 2025and taking into account the put/call ratio (OI)trading volume and expected movements until decemberI interpret as follows.

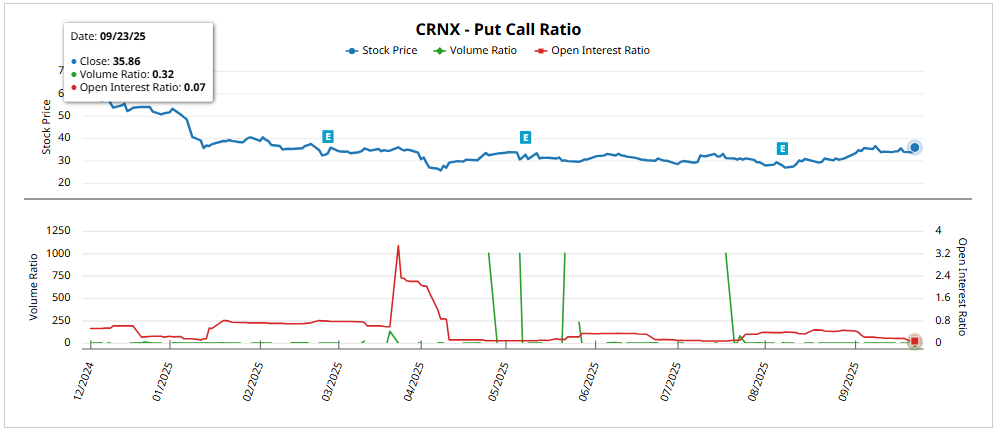

The total volume of options is moderatewith its average volumes highlighted in calls in each session, reflecting a sustained speculative interest in a large-cap biotech (~3.18B market cap) with imminent catalysts such as the paltusotine PDUFA. This volume generates a put/call volume ratio = 0.26 (below 0.7), which indicates a predominantly upward flowpossibly (more than likely, let's be clear) driven by expectations of regulatory approval.

The open interest (OI) confirms a strong upward bias: puts = 790 in the face of calls = 11,432with a put/call ratio of OI = 0.07 (well below 0.7). This asymmetry reflects long-term institutional positioning in callsanticipating significant upside of clinical and commercial milestoneswith limited downside exposure despite the proximity of the FDA decision.

The implied volatility (IV) is located in 83.60%with rank 92.44% y percentile 99%reflecting expectations of large movements at historical peakswell above the historical volatility (49.69%)in line with the pre-launch phase.

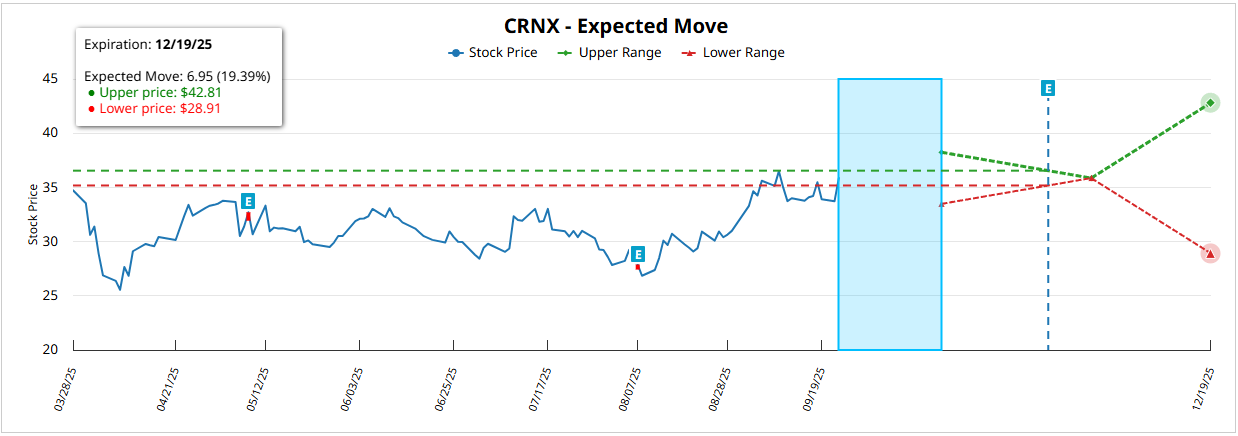

For the expiration December 19, 2025 (~87 DTE)the expected movement is ±6.95 $ (±19.37%) from the current price of 35.95 $with a superior rank of 42.84 $ and lower than 28.94 $. This implies a upside potential of 19,14% vs bearish from 19.50%supporting the bias in calls as the dominant strategy in the short-medium term.

$CRNX: Technical Analysis

And following the same structure that I am following, the technical analysis of Crinetics Pharmaceuticals ($CRNX)what it shows me is a transition from a phase of lateral consolidation towards a upward biasagain, based on the data from September 23, 2025. The current price around the 35.80 dollarsafter bouncing from key support at around 30.50 dollars.

The action remained for several weeks in a consolidation range between $30 and $35until it was confirmed a upward crossover of moving averages: the 50 EMA outperformed the 200 EMAvalidating a possible change of momentum. The immediate resistance zone is located at 38.00 dollarswhose breakup with volume >1.5M shares/day would open the way to a potential target in 45.00 dollars.

The RSI (14) is located at 61 pointsThe market is showing buying strength but is not yet overbought. The MACD exhibits a new positive crossoverreinforcing the hypothesis of bullish continuity after the recent correction.

This places us in a medium-term upward biasconditioned to the overcoming of the 38.00 dollarswith a risk of backward movement towards 32.50-33.00 dollars if the rupture is not confirmed.